The costliest global natural catastrophe for the insurance industry in 2015 was the series of winter storms that struck the northeast United States and Canada, according to Munich Reinsurance America, Inc. In the U.S., 2015 estimated natural catastrophe losses totaled $25 billion (in 2014, cat losses totaled $28 billion), of which an estimated $15 billion was insured. 2015 estimates exclude loss events that occurred during the last week of December.

Industry-wide losses from natural catastrophes in 2015 were lower than the previous year, due in part to El Niño climate conditions in the Pacific ocean which reduced hurricane activity in the North Atlantic.

“In terms of financial losses, the industry was somewhat fortunate in 2015,” said Tony Kuczinski, president and CEO, Munich Reinsurance America, Inc. “However, the comparatively low losses are no reason for complacency. Near misses and time between significant events tend to decrease perception of risk. We must continue to focus on creating resiliency and saving lives through stronger building codes, better land use and protective infrastructure.”

Natural catastrophes claimed 280 lives in the U.S. in 2015 (there were 270 deaths in 2014), below the annual average for the last 30 years (580).

“In 2015, strong tropical cyclones primarily hit sparsely populated areas or did not make landfall at all. In the North Atlantic, wind shear from the El Niño event helped to curtail the development of tropical cyclones, while measures to reduce loss susceptibility may have also had a positive effect,” said Peter Hoeppe, head of Munich Re’s Geo Risks Research Unit. “However, scientists believe that in the coming year the strong El Niño phase might be followed by a La Niña event. Both versions of the climate oscillation ENSO (El Niño Southern Oscillation) in the Pacific, influence weather extremes throughout the world. A La Niña phase would promote the development of hurricanes in the North Atlantic, for example.”

The costliest natural catastrophe for the insurance industry in 2015 was a series of winter storms that struck the northeast United States and Canada. Insured losses came to $2.1 billion; overall losses were $2.8 billion.

“North America is hit by dozens of winter storms annually, which cause a variety of hazards such as snow and sleet,” said Mark Bove, senior research meteorologist, Munich Reinsurance America, Inc. “But despite the frequency and size of winter storms, they do not usually have the same loss potential as tropical cyclones or earthquakes. Nevertheless, a large number of winter storms in rapid succession can lead to significant aggregate losses.”

While the direct overall losses due to the harsh winter of 2014/15, totaled $4.6 billion, only $3.4 billion of it was insured. Losses were higher the year before with direct overall losses totaling $4.4 billion and insured losses totaling $2.5 billion.

Two tornado outbreaks in late December 2015 across the southern states brought an unfortunately destructive and deadly end to what had been a relatively quiet year for severe thunderstorms. The December outbreaks included two EF4 tornadoes with wind speeds up to 200 mph. The first devastated several small towns in northern Mississippi and southern Tennessee, while the second carved a path through a densely populated suburb of Dallas, Texas. Both tornadoes took the lives of at least 10 people each; only ten tornado fatalities had been recorded nationally in 2015 before these events.

Earlier in 2015, two severe thunderstorm outbreaks each produced billion-dollar insured losses, though overall, the spring thunderstorm season in the U.S. was quieter than usual. Less than 1,200 tornadoes were recorded in 2015; the average figure is 1,360. The relatively inactive storm season still produced insured losses in excess of $ 9.4 billon (excluding industry-wide loss estimates from the late December storms which are not yet available). The current El Niño likely impacted conditions that led to a quieter overall thunderstorm season, as well as the late December storms that occurred close to the Gulf of Mexico coastline.

Drought conditions in California deteriorated further in 2015, following yet another winter without significant rainfall. Forests and brush land turned into tinder boxes, which fueled numerous wildfires across the state, including two that caused significant property losses in northern California. The Valley Fire ignited near the Napa Valley winemaking region and the Butte Fire in the foothills of the Sierra Nevada destroyed thousands of structures. The two fires caused losses totaling $1.6 billon, with $1.2 billion in insured damages. They were the costliest wildfires in California since the 2007 Witch Creek Fire in San Diego, and the costliest in northern California since the 1991 Oakland firestorm.

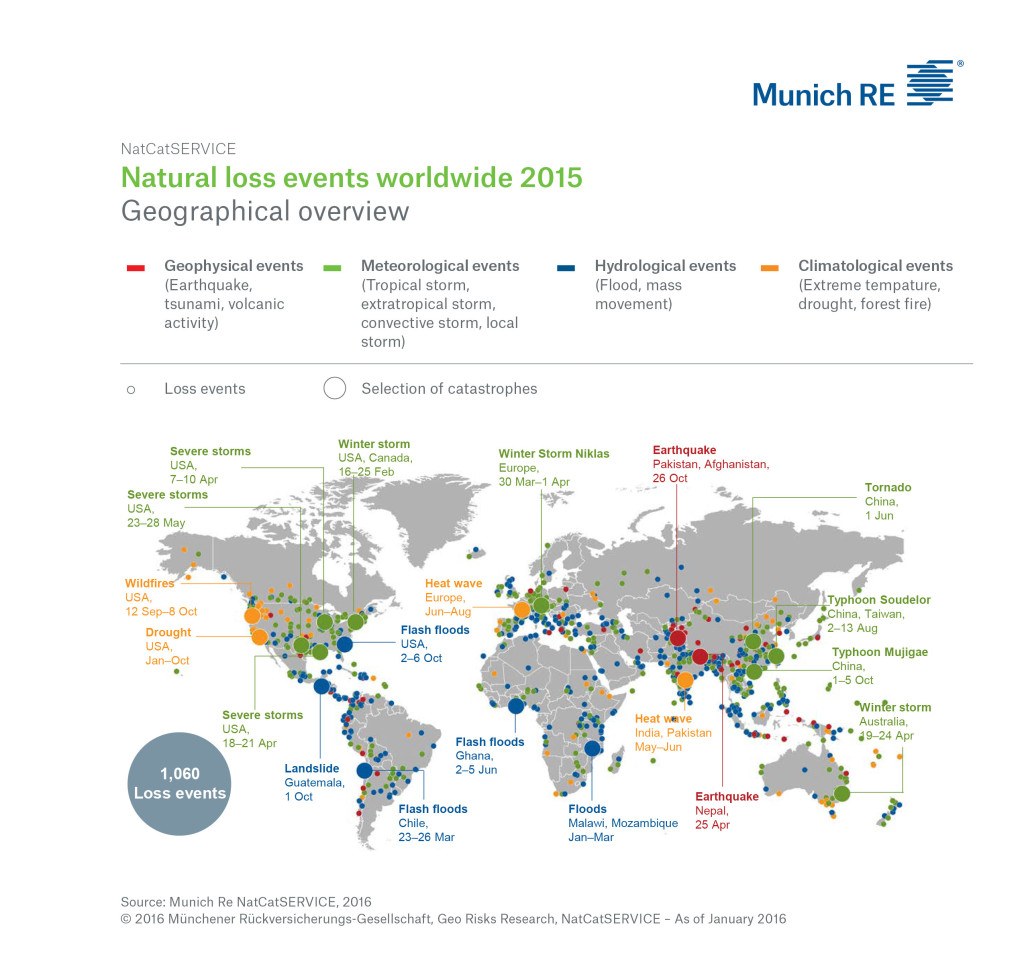

2015 Global Natural Catastrophes

Worldwide, 94 percent of loss-relevant natural catastrophes in 2015 were weather-related events. Due to the strong El Niño phase, the number of 11 tropical cyclones in the North Atlantic was below the basin average since 1995 (14.8). Of these cyclones, only four reached hurricane strength (average 7.6). Overall losses and insured losses came to just a fraction of the averages for previous years.

On the other hand, El Niño promoted the development of intense tropical cyclones in the northeast Pacific, partly due to the higher water temperatures it brings. A total of 26 cyclones (long-term average 15.6) developed there, 16 of which reached hurricane strength. Eleven (long-term average 4.1) grew to major hurricanes.

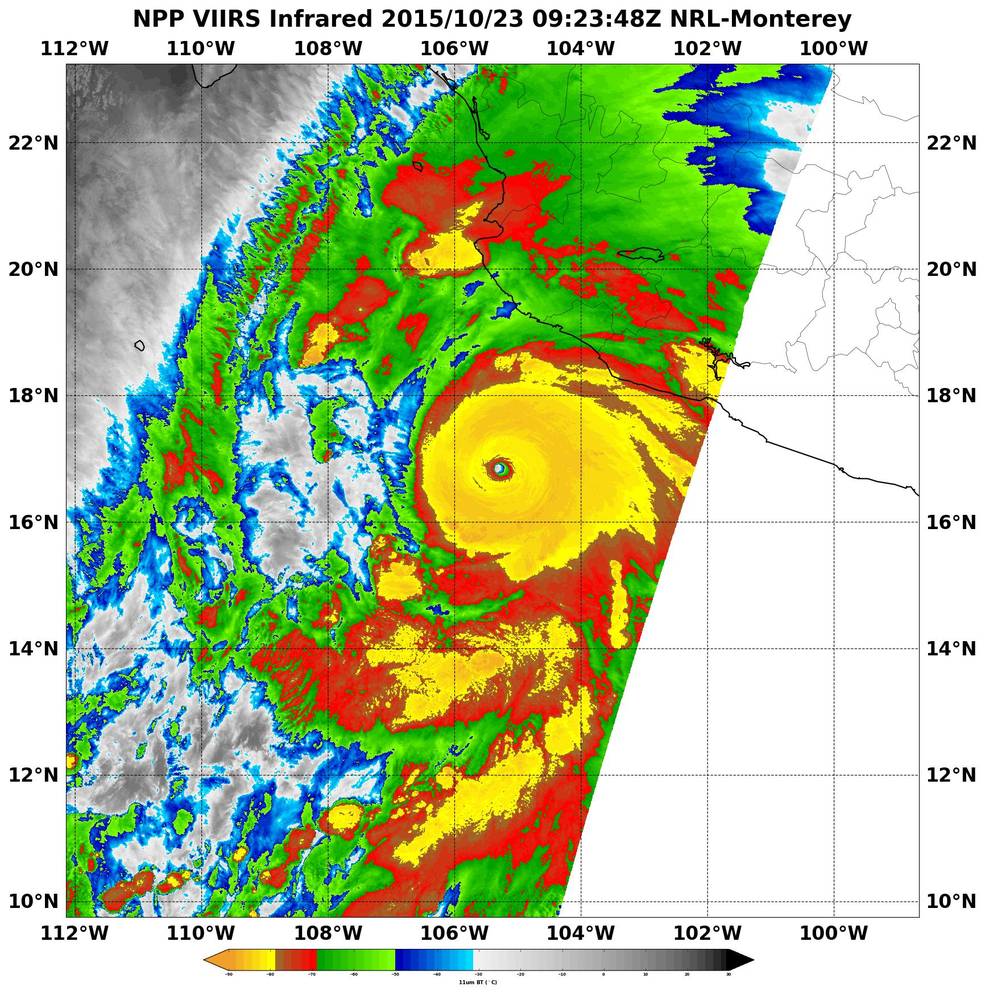

Although most storms in the northeast Pacific do not make landfall, one storm in 2015 did, and was particularly noteworthy: Hurricane Patricia became one of the strongest tropical cyclones on record globally and the most powerful in the northeast Pacific to make landfall. With sustained wind speeds of up to 200 mph, Patricia came ashore in late October close to Cuixmala in the Mexican state of Jalisco. Fortunately, this region contains the Chamela-Cuixmala Biosphere Reserve and is therefore sparsely populated. The storm was also relatively small in size and did not cause the level of damage that many less powerful but larger storms usually do.

Overall losses from Hurricane Patricia are estimated at $500 million, of which only a fraction was insured. Had the storm reached the nearby holiday resort of Puerto Vallarta, the damage and losses would have been much greater. “Besides this fortuitous set of circumstances, timely precautions and early warnings helped bring people to safety and prevented losses. One such measure was the prompt evacuation of affected areas ordered by the government,” explained Hoeppe.

The El Niño phase had a considerable effect on droughts and heatwaves, especially in South America, Africa and Southeast Asia. Overall losses worldwide from such events last year came to US$ 12bn, of which US$ 880m was insured. However, the highest losses from heatwave and drought – albeit not influenced by El Niño – were caused by the hot, dry summer in Europe. The overall loss totalled some US$ 2bn (€1.9bn); only about a tenth of this was insured.

Source: Munich Reinsurance America, Inc.

Was this article valuable?

Here are more articles you may enjoy.

Gas-Guzzler Revival Risks Dead-End Future for US Automakers

Gas-Guzzler Revival Risks Dead-End Future for US Automakers  Stellantis Weighs Using China EV Tech for Affordable Cars

Stellantis Weighs Using China EV Tech for Affordable Cars  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers