More auto glass claims are filed in Arizona than any state in the nation. The National Insurance Crime Bureau says there’s something fishy about that.

Howard Handler, government affairs director for NICB, said he doesn’t believe Arizona highways have that much more loose gravel than roads in other states.

“There is also a lot gravel in California, Texas and New Mexico,” Handler said. “Think of Texas. There’s a lot of gravel there and the state is four times larger than Arizona and there are fewer claims.”

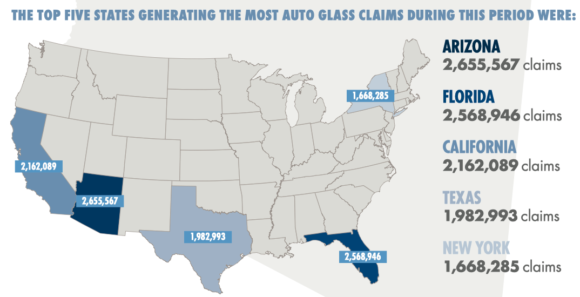

Arizona policyholders filed 2,655,567 auto glass claims from 2015 to 2019, the NICB says. That’s more than California, with 5.5 times the population, and No. 4 Texas, with four times more people. Annually, the number of Arizona auto glass claims climbed to 594,320 in 2019 from 470,136 in 2015.

The bureau issued a press release last week saying that the 26% increase in the past five years suggests that Arizona’s high number is being driven by fraud schemes. The organization supports legislation that would impose restrictions on businesses that use assignment of benefit forms to pursue claims against carriers.

“The problem is these companies are turning this into a lucrative business by inflating the insurance claim, and collecting the money for themselves,” Handler said.

The NCIB said fraudulent auto glass companies approach people at car washes and grocery store parking lots, or even by going door-to-door. They often offer free steak dinners or gift cards to policyholders who sign over their rights. Handler said he’s seen companies with advertisements that offer rebates of “up to $500” to consumers who sign AOB agreements.

Handler said Arizona statutes are part of the problem. Many states prohibit third parties from offering policyholders any inducements to sign assignment of benefit forms. Arizona does not.

House Bill 2441 by Rep. John Allen would change that by barring third parties from offering any “gift or compensation as an incentive to sign an assignment agreement.” The bill would also require parties to notify insurers of such agreements within three days, give notice of any litigation at least 15 days in advance, and imposes other limits and restrictions.

The bill was heard in the House of Representatives’ Judiciary Committee on Friday, but the bill was held over.

Handler said Arizona insurance statutes are also unique in that they require insurers to offer a policies with a zero deductible for safety devices, including auto glass. He said Florida has similar statutes and auto glass fraud is also a major issue there.

At least one major carrier is fighting auto glass claims in court. Berkshire Harthaway’s Geico last year filed several lawsuits against auto glass repair companies at the U.S. District Court in Phoenix.

A suit filed against Advantage Auto Glass says the company submitted thousands of fraudulent claims for windshields and related parts. Advantage submitted documents with forged signatures and invoices for work that wasn’t performed, Geico says.

The most recent was filed Wednesday against Auto Glass Express seeks to recover more than $950,000 for submitting bills for “illusory” windshield replacements.

Consumers have also complained about the tactics used by auto glass repairers, according to a report by 3 On Your Side, a Phoenix television program. The cited a complaint by Sara Perkins who alleges she was promised a $120 if she hired A & E Auto Glass to replace her cracked windshield, but the money never came. The TV station said nearly 100 other customers have lodged similar complaints.

A & E owner Eric Solheim told the TV station that he got behind on his payments to customers because he was defrauded by scammers who copied the account number and routing number on his company’s checks. He said 3 On My Side that he had paid nearly all of the money that he owed.

But Solheim may need to save some cash. Geico has filed a suit against him and his auto glass company, alleging that he submitted claims for work that was not performed.

Photo courtesy of NFIB.

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Explosive Wildfires Surge Through Oklahoma Panhandle and Kansas

Explosive Wildfires Surge Through Oklahoma Panhandle and Kansas  Bayer to Make $10.5 Billion Push to Settle Roundup Cases

Bayer to Make $10.5 Billion Push to Settle Roundup Cases  Walmart to Pay $100 Million to Settle FTC Case on Driver Wages

Walmart to Pay $100 Million to Settle FTC Case on Driver Wages