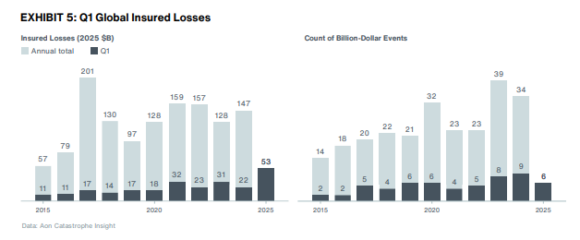

Global natural catastrophes had an insured price tag of more than $53 billion during the first quarter of 2025, with claims driven by the wildfires in Los Angeles adding roughly $38 billion to taht, or 71% of total insured losses across the globe, according to Aon’s Q1 Global Catastrophe Recap – April 2025.

Insured losses during the quarter ($53 billion) were far higher than the 21st century Q1 average of $17 billion, representing the second-highest total on record after the first quarter of 2011.

“At least six events, all of which occurred in the United States, surpassed $1 billion in insured losses,” the Aon report stated. “With an additional disaster activity expected in the rest of the year, 2025 may become another costly year for insurers/”

Q1 global economic losses were preliminarily estimated at $83 billion (Q1 2024: $54 billion), or 36% higher than the long-term 21st century Q1 average of $61 billion, Aon stated. Economic losses, which include the insurance price tag, were driven by the L.A. wildfires and other billion-dollar events, such as multiple severe convective storm (SCS) outbreaks across the U.S., and the earthquakes in Myanmar and China, according to the report.

U.S. economic losses accounted for roughly $71 billion of the economic loss total, the highest since 1994, when the Northridge Earthquake struck Southern California, and were significantly above the Q1 average since 2000 ($12 billion). By contrast, Q1 economic losses in all other regions were below their long-term Q1 averages, according to Aon.

The figures point to an insurance protection gap, the difference between total economic losses and the amount covered by insurers, of 36%. That’s the lowest Q1 value since 1990 (47%), which Aon attributed to high insurance penetration in the U.S., where most of the losses occurred.

Natural disasters killed more than 6,000 people in the first quarter of 2025, compared with 1,800 in the prior year period, with the vast majority (88%) of fatalities related to the Myanmar earthquake in March. All other events during the period caused roughly 700 fatalities in total.

Aon’s data, inflated to 2025, show that in 2024, global natural disaster events caused $374 billion (2023: $402 billion) in economic losses in 2024, driven by hurricanes and SCS in the U.S. This was 14% above the 21st century average and the ninth consecutive year of losses exceeding $300 billion.

Aon noted that U.S. SCS insured losses have averaged $33 billion annually since 2015–a 90% increase from the prior decade on a trended basis. SCS cost insurers $54 billion in 2024, Aon stated.

Costliest Events

High Q1 insured and economic losses were driven by destructive L.A. wildfires in January, when more than 18,000 structures were damaged or destroyed by the Palisades and Eaton Fires, with total insured losses estimated at $37.5 billion and an economic price tag of $52.5 billion. Another more than $10 billion in insured losses were generated by multiple SCS outbreaks across the U.S.

Outside the U.S. region, Windstorm Éowyn (which hit the UK and Ireland on Jan. 24) was the costliest event in Q1 2025, resulting in insured losses of roughly $690 million (€620 million) and economic lossses $890 million (€800 million). Éowyn became the costliest windstorm on record in Ireland, with insurance payouts reaching $335 million (€300 million).

In addition, Cyclone Alfred, which affected Australia’s Queensland in early March, had aggregated insured losses of roughly U.S.$750 million (A$1.2 billion), according to Aon’s report, which quotes statistics from the Insurance Council of Australia.

Top photo: A firefighter battles the Palisades Fire as it burns a structure in the Pacific Palisades neighborhood of Los Angeles, Jan. 7, 2025. (AP Photo/Ethan Swope, File)

Was this article valuable?

Here are more articles you may enjoy.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Claims Handling Breakdowns From LA Wildfires One Year on

Claims Handling Breakdowns From LA Wildfires One Year on  ‘Structural Shift’ Occurring in California Surplus Lines

‘Structural Shift’ Occurring in California Surplus Lines  When the Workplace Is Everywhere: The New Reality of Workers’ Comp Claims

When the Workplace Is Everywhere: The New Reality of Workers’ Comp Claims