Bayer AG Chief Executive Officer Bill Anderson said the wave of lawsuits over its Roundup weedkiller is an “existential” threat to the company and farmers, ratcheting up the stakes as it considers a controversial legal maneuver.

“The glyphosate litigation topic is an existential topic for our company because it does threaten to remove our ability to continue to innovate for farmers and for food security,” Anderson said in a speech at the Executives’ Club of Chicago on Thursday, referring to Roundup’s key ingredient.

Bayer is considering whether to use a legal tactic dubbed the Texas Two-Step bankruptcy, in an attempt to settle tens of thousands of US lawsuits claiming Roundup causes cancer, people familiar with the company’s thinking told Bloomberg in March. Bayer has vigorously defended its claim that glyphosate and glyphosate-based formulations are safe, and the chemical remains in widespread use across much of the world.

Related: Bayer’s $1.5 Billion Roundup Verdict Slashed to $600 Million

The CEO’s comments show that Bayer is trying to broaden its defense beyond the courtroom, where it has lost a number of US cases from users of the herbicide who claimed it caused cancer, which the company has steadfastly denied. The company argues that without such products, the world will be unable to feed a growing population.

Anderson’s predecessor, Werner Baumann, generally stopped short of warning that the company’s existence was threatened, even as the legal woes mounted. Bayer has set aside $16 billion to resolve Roundup suits. About $10 billion of that reserve has been spent so far, a company spokesman said.

What’s Bayer’s Roundup and Why Is It Controversial?: QuickTake

Texas Two-Step

The Texas Two-Step gets its name from the use of a state law that lets companies split their assets and liabilities into separate units, then place the part loaded with liabilities into bankruptcy to drive a global settlement.

Such a move, if successful, could permit other parts of Bayer, a major pharmaceutical and consumer health company, to keep operating normally. But courts have rejected the tactic by 3M Co. over suits targeting faulty hearing protection devices for US soldiers and by Johnson & Johnson in litigation tied to its talc-based baby powder.

Bayer agreed to transition from the glyphosate-based version of Roundup to new active weed-killing ingredients in the US consumer market by the end of last year. The company still sells glyphosate-based herbicides for agricultural markets, however, and the European Union late last year authorized sales for another decade.

Anderson in his speech called the glyphosate lawsuits without merit and bad for the company and the employees who have lost their jobs as a result.

The chemical conglomerate is spending more on lawsuits than the 2.4 billion euros ($2.6 billion) a year spent on R&D, the CEO said. He said Bayer is the largest R&D investor in agriculture, and the legal issues put at risk the progress needed to feed an exploding world population by mid-century with less water and land.

“This is actually something very serious for American agriculture,” Anderson said. “It’s been estimated that the cost of groceries for the average family of four in the US would go up by more than 40% if glyphosate were removed from the agriculture system.”

Crops genetically modified to withstand the application of glyphosate weedkiller account for almost all of the corn and soybean plantings in the US and Brazil.

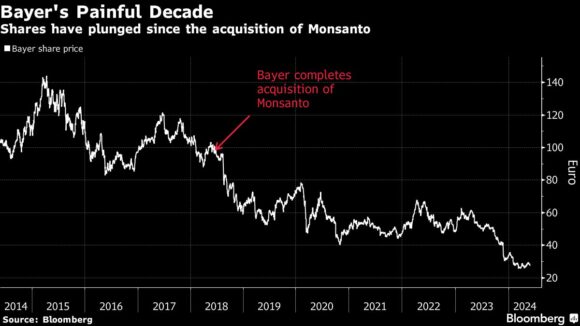

Anderson said that despite the US’s scientific and regulatory communities giving a green light to glyphosate, the company is still subject to billions of dollars every year in lawsuits. Bayer inherited the Roundup lawsuits through its 2018 purchase of agriculture behemoth Monsanto for $63 billion.

The German company’s shares have lost more than 70% of their value since the Monsanto purchase, and they were down a further 1.3% early on Friday in Frankfurt.

Investor concern has grown about Bayer’s liability, eventually leading to the departure of Baumann. In addition to the legal woes, the company has been grappling with other problems including a weak drug pipeline and high debt.

Was this article valuable?

Here are more articles you may enjoy.

Moody’s: LA Wildfires, US Catastrophes Drove Bulk of Global Insured Losses in 2025

Moody’s: LA Wildfires, US Catastrophes Drove Bulk of Global Insured Losses in 2025  Judge Upholds $243M Verdict Against Tesla Over Fatal Autopilot Crash

Judge Upholds $243M Verdict Against Tesla Over Fatal Autopilot Crash  When the Workplace Is Everywhere: The New Reality of Workers’ Comp Claims

When the Workplace Is Everywhere: The New Reality of Workers’ Comp Claims  Walmart to Pay $100 Million to Settle FTC Case on Driver Wages

Walmart to Pay $100 Million to Settle FTC Case on Driver Wages