When the Texas Panhandle went up in flames this winter, the news spread fast on Wall Street. An electric utility by the name of Xcel Energy Inc. was getting blamed for the massive blaze — a lawsuit pointed the finger at its dilapidated equipment — and this was making the company’s investors very nervous.

Throughout the morning of Feb. 29, investors unloaded shares. By early that afternoon, the stock was down nearly 10%. Bond prices were sinking too, triggering a spike in Xcel’s yields. For money managers who had long treated the utility’s bonds as an uber-safe asset — something almost akin to a US Treasury note — the rout, while brief, was jarring.

It sent the latest in a series of warnings on climate change to an investing community that’s plowed some $1.7 trillion into the stocks and bonds of power companies that trade on Wall Street. For years, these assets have been seen as safe bets for retirement and insurance funds for a simple reason: Selling electricity is about as steady, and crucial, an industry as there is. These businesses are regulated monopolies and, the thinking has gone, too important too fail.

But as climate change exacerbates droughts and wildfires, and utilities often take the blame for starting them, their assets are increasingly at risk. Few industries in America will be more directly impacted by fires — both physically and financially — than the power sector, experts say.

Already the financial pain is piling up. Over the past eight months, investors have driven down the value of Hawaiian Electric stock by 73% after the company was blamed for the deadly Maui blaze. Its bond due in 2045 is trading at 62 cents on the dollar. A few years earlier, shares of PG&E Corp. plunged after it caused wildfires in California that would eventually force it to declare bankruptcy. And fires have stuck PacifiCorp with such heavy losses that its parent company Berkshire Hathaway said it could wipe out all of its energy division’s profits. Warren Buffett, Berkshire’s chairman, admitted he made a “costly mistake” in not anticipating the surge in these expenses.

“Investors realize this is a big problem, but they don’t know how big of a problem it is for a particular utility,” says Michael Wara, a wildfire expert and director of the climate and energy policy program at Stanford University. They’re essentially “flying blind,” he says. “A bad September afternoon wildfire can cause the stock to fall by 80% or as a bond investor, you could land as an unsecured creditor in a bankruptcy proceeding.”

The losses have, so far at least, been more acute and lasted longer on the stocks side than the bond side. This makes a certain amount of sense. While soaring costs may erase profits — the lifeblood of any thriving stock — the too-important-to-fail element to these utilities means that in many cases state governments will prop them up enough to allow them to keep paying their debts. Still, to Andy DeVries, an analyst for CreditSights Inc., investors are shrugging off the “hidden risk” that wildfires and litigation pose to their portfolios.

“This risk is not a one-time thing,” says DeVries, who has covered debt markets for more than two decades. “It’s not a cyclical thing. It’s here to stay, and it’s going to get worse.”

Wildfires have been breaking out more frequently and burning more and longer as the climate changes — with blazes seen from the US west to Canada, Siberia and the Australian bush.

The Smokehouse Creek Fire erupted in northern Texas in late February. Over the course of almost three weeks, it charred more than one million acres and even spread into western Oklahoma. The blaze destroyed power lines, homes and cars and killed thousands of livestock animals and two people.

“These investors are looking to sleep at night — and now, all of sudden, they are waking up to wildfires,” says DeVries.

Xcel was promptly sued before investigators had officially determined the cause. In an unusually swift determination, a state probe found that a broken wooden pole owned by Xcel toppled in high winds and started the blaze. Kevin Coss, a representative for Xcel, says the company has and will continue to enhance its fire-risk mitigation efforts.

“We have already advanced a number of wildfire risk reduction initiatives,” Coss says. “Like all energy companies, we are navigating changes in weather and climate-induced impacts on our operations.”

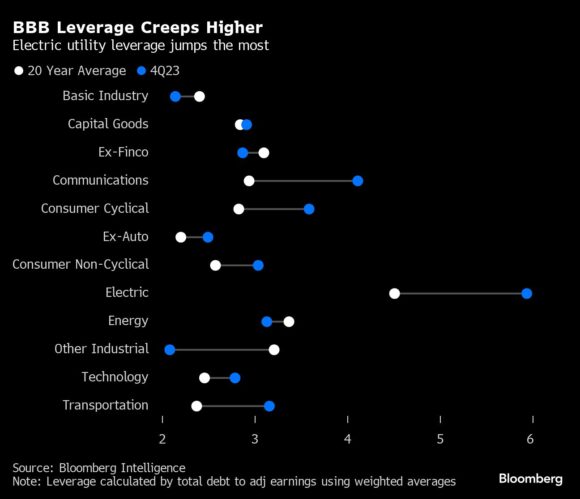

Many utilities are being forced to borrow more in corporate debt markets, straining their finances, to upgrade aging infrastructure and pay off claims. This has pushed sales of utility bonds up at a faster clip than those in other blue-chip industries, according to data compiled by Bloomberg.

Buffett’s PacifiCorp sold $3.8 billion of investment-grade bonds this year to, in part, help fund settlement claims related to fires that broke out in Oregon. Edison International’s Southern California Edison — which agreed in February to pay $80 million to resolve a lawsuit related to blazes in 2017 — issued $3.6 billion of bonds in the past six months, according to data compiled by Bloomberg.

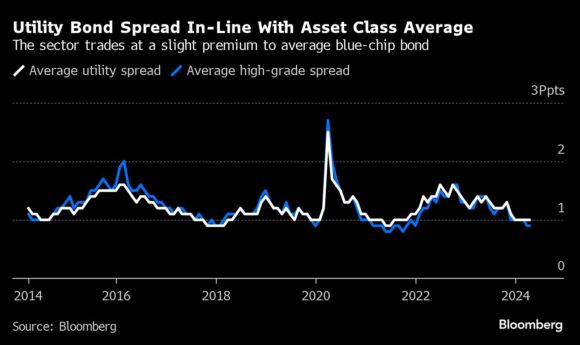

Even Xcel sold an $800 million note in February, only to see its yield over US Treasuries quickly balloon to a peak of 1.62 percentage points, from 1.25 points when it was issued. It’s the type of blowout in so-called risk premiums typically seen in riskier junk debt — not an investment-grade utility bond.

“You want to be very careful,” says Arvind Narayanan, co-head of investment-grade credit at Vanguard Group.

About a quarter of credit-rating downgrades in the industry over the past five years have been related to extreme weather events, according to Fitch Ratings. Xcel lost its A- credit rating when S&P Global Ratings cut the company to just three steps from junk. Its outlook remains negative, implying that further downgrades are possible.

“When we talk to the rating agencies and investors, they are right up front asking: ‘What does your wildfire mitigation plan look like?”‘ says Randy Howard, general manager of the Northern California Power Agency, which represents several locally-owned utilities. “It’s one of the first questions they ask today.”

Credit scores are crucially important to utilities, one of the most capital intensive industries in the US, says Emily Fisher, the general counsel for the Edison Electric Institute, the main industry group for investor-owned utilities. That’s because investment-grade companies can typically raise cash more cheaply in corporate debt markets than those with riskier scores.

Hence the effort by utilities to inform federal lawmakers about the issue and lobby for reforms at the state level. Utah, for example, has adopted legislation that caps utility wildfire liabilities, while California set up a wildfire insurance fund meant to backstop utilities involved in catastrophic blazes. That, a cap on shareholder utility liabilities and other regulatory reforms helped stabilize the finances of the state’s utilities after PG&E and Edison were blamed for multi-billion-dollar fires.

PG&E was recently upgraded by all three major credit assessors, leaving the company’s credit score just one notch below investment grade, says Jonathan Arnold, vice president of investor relations for PG&E. The protection afforded by the wildfire fund has allowed PG&E to make billions of dollars of investment in fortifying its grid against blazes, Arnold adds.

“Constant access to affordable capital, which is essential for a healthy utility and to keep customer rates low, is threatened by unchecked wildfire litigation,” says Tiffany Erickson, communications director at PacifiCorp. A spokesperson for Edison International also pointed to recent credit upgrades, which came alongside fire-risk reduction efforts and the state fire insurance fund. Hawaiian Electric declined to comment.

Recent fires have been “a wakeup call” to Portland General Electric Co.’s Chief Financial Officer Joe Trpik. In a 133-page wildfire mitigation plan, his company laid out projects that aim to minimize risk that the utility would ever be responsible for future wildfires. The company’s projected operating and maintenance costs for 2024 is more than $815 million.

The trick, for Trpik and other power executives, is financing for these projects while still transitioning toward greener energy — and without cranking up customer bills too much and fanning inflation.

“Here in Oregon, we are seeing, feeling and experiencing the impacts of climate change,” he says. “It’s a challenge. It’s not something anyone should take lightly.”

Stanford’s Wara says investors should do their due-diligence and press utilities about the precautions they’ve taken to reduce wildfire risk. Climate experts consistently warn that extreme weather events are going to happen more frequently and at higher intensities, and wildfires are notoriously challenging to predict.

“You’re always looking over your shoulder when something happens,” says Mike Sanders, head of fixed income at Madison Investments, which manages $25 billion. “There is enough to worry about in the investing world other than a fire in Texas.”

Top photo: A firefighter extinguishes hot spots following the Smokehouse Creek Fire in Texas in March.

Was this article valuable?

Here are more articles you may enjoy.

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Asbestos Lawsuits Prompt Vanderbilt Minerals to File Bankruptcy

Asbestos Lawsuits Prompt Vanderbilt Minerals to File Bankruptcy  Besieged Berkshire Utility Tries to Rewrite Who Pays for Wildfires

Besieged Berkshire Utility Tries to Rewrite Who Pays for Wildfires  Walmart to Pay $100 Million to Settle FTC Case on Driver Wages

Walmart to Pay $100 Million to Settle FTC Case on Driver Wages