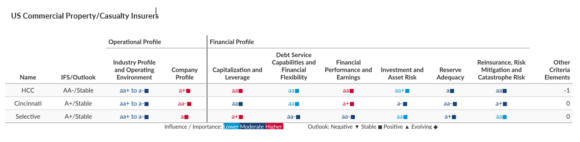

Inflation is bringing rising loss costs for US commercial property/casualty insurers, according to Fitch Ratings, which reviewed reports from three US insurers — Cincinnati Financial Corp., HCC Insurance Holdings Inc., and Selective Insurance Group Inc. — to gauge trends for the sector.

As financial performance is a highly weighted credit factor for this group of insurers, their ratings benefit from underwriting profitability, which in turn is reliant on premium rates keeping pace with claims cost trends, affirmed Fitch in a report titled “US Commercial Property/Casualty Insurers – Peer Review March 2024.”

Fitch explained that sources of earnings volatility for these three companies may be derived from catastrophe losses on property business and cyclical claims experience in casualty and liability lines.

Moderating Rates

“Commercial lines pricing increases are anticipated to moderate, but remain positive in most segments through 2024, with flat to declining premium rates in lines including workers compensation and directors & officers liability,” the report said.

In an emailed statement, Doug Pawlowski, senior director in Fitch’s U.S. insurance group, explained that the ratings agency reviews rated companies in similar peer groups.

“Admittedly, this is a small group, but [they represent] rated companies that have a concentration in commercial lines,” he added.

Conservative Reserving

The Fitch report said that the three insurers historically have strong reserve adequacy – a view that is supported by “a history of consistently favorable loss reserve development.”

While the group generally has limited net exposure to asbestos and environmental risk, the effects of inflation may diminish reserve adequacy, Fitch added.

“[The] potential for pricing errors that are manifest through inadequate initial loss estimates and upward development of accident-year loss ratios over time are heightened in an extended period of higher inflation.”

Fitch went on to discuss several other factors that are affecting the financial performance and credit ratings of these companies, including:

- Capitalization. Capitalization and leverage is a highly weighted credit factor for most companies in this group. Fitch said the capital adequacy of this peer group was all in the “Very Strong” category at year-end 2022, measured by Fitch’s Prism capital model. “Prism scores at YE 2023 will benefit from recent surplus growth, and a reduction in unrealized losses in fixed income portfolios as interest rates stabilize and new money is invested at higher rates.”

- Capital market access. Financial flexibility for the peer group is helped by stable access to capital markets. “Holding company financial leverage for this group is modest and consistent with rating guidelines.” Fitch expects greater statutory dividend outflows and share repurchases for 2024 relative to 2023, following surplus growth and reduced unrealized losses on bonds.

Source: Fitch Ratings

Was this article valuable?

Here are more articles you may enjoy.

Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud

Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Claims Handling Breakdowns From LA Wildfires One Year on

Claims Handling Breakdowns From LA Wildfires One Year on  Walmart to Pay $100 Million to Settle FTC Case on Driver Wages

Walmart to Pay $100 Million to Settle FTC Case on Driver Wages