Software enabled insurance provider to test process, technology and staffing changes without impacting customers

Effectively managing insurance claims is a complex business, especially for a carrier like Westfield Insurance. From the company’s rural roots in Ohio – formed in 1848 by a small group of farmers to protect their property – Westfield has grown into one of the nation’s 50 largest property and casualty insurance groups.

Today, about 2,500 people work for Westfield throughout the country. For nearly all of those employees, satisfying the customer is job one. That’s because the claims experience is a primary driver of policyholder satisfaction and loyalty.

Policy owners expect a prompt and accurate resolution to their claims. With so many steps and variations in the claims process, insurers often need to re-evaluate how they manage staffing, technology and systems integration. The ultimate goal: provide an easy and efficient claims service experience for policy owners in the most cost-effective manner.

Challenge

In 2011, Westfield began a three-year process to replace its existing claims management system that had been in use for more than 20 years. The upgrade provided management with an opportunity to look at operational improvements, including the claims First Notice of Loss (FNOL) process. The FNOL process starts when Westfield is notified of a claim and ends when the claim is assigned to the correct adjuster.

Claims are reported different ways, including faxes and phone calls. Faxes are sent by agents, representing customers, to a claims entry vendor where they are entered and forwarded for assignment to an adjuster. Phone calls arrive direct from customers in Westfield’s Customer Care Center (CCC) where they are entered and forwarded for assignment to an adjuster.

Westfield leadership wanted to shift the majority of claims reporting from faxes to phones, thus providing greater and more accurate detail about the claim and an opportunity for direct and positive interaction between the customer and company. In order to accomplish the shift, leadership needed to better understand this change and how many representatives would be needed to handle the additional calls.

Two of the most common inquiries to representatives in Westfield’s CCC were callers asking about the status of their claim and for the name of their adjuster. Leadership believed that reducing the FNOL cycle time would also reduce the volume of these types of calls.

Also, previous studies have shown that this time indirectly correlates with the claims customer experience rating. To improve the FNOL cycle time, Westfield was considering numerous scenarios, including automating the adjuster-assignment process, adding staff to handle additional calls and bringing the data-entry step in-house.

Lastly, Westfield leadership wanted to add triage services in the CCC, so service representatives would be able to set up a rental car or provide information on car repair shops as part of the claims process. Making this change to the claims process would improve the customer’s experience and reduce the overall cycle time for the claim, but it would add time to the calls in the CCC. CCC management needed to make adjustments to how it staffed the center in order to maintain its high service level and low percentage of abandoned calls, or callers who hang up because their call has gone unanswered.

Westfield needed a way to evaluate potential changes to staffing and the claims process without adversely impacting the customer experience – and it wanted to have all changes in place before the new claims-management system went live.

Solution

To better understand the effects any organizational changes would have on customer service, leadership turned to the company’s internal analytics department, the Analytics Resource Center (ARC).

The ARC investigated several advanced analytics techniques and recognized that the most effective way to test potential changes and their impact across variables would be to use a discrete event simulation model. They chose Rockwell Software Arena simulation software based on the recommendation of a consultant they had worked with on a previous project.

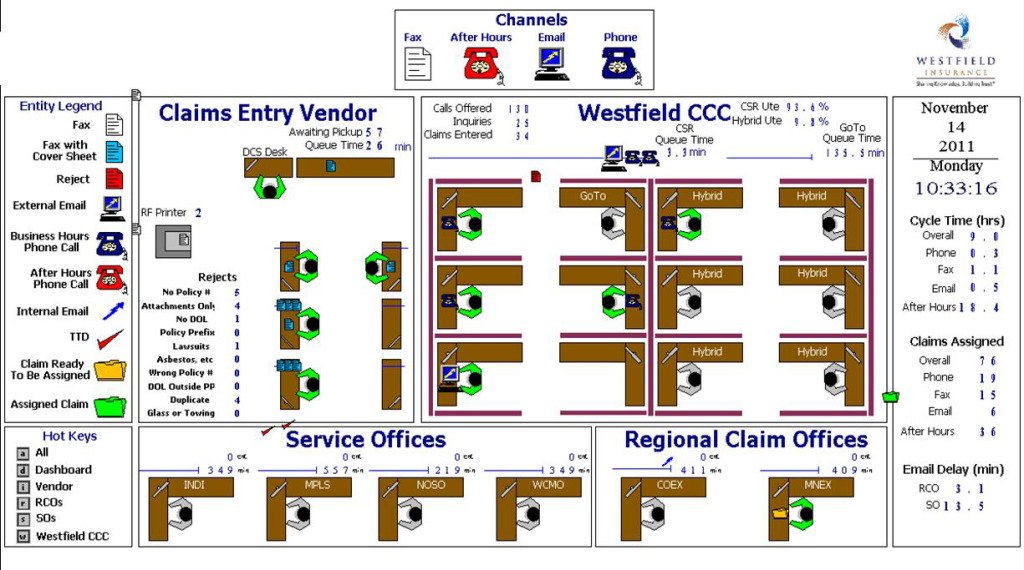

Arena software allowed Westfield to experiment with various scenarios in a risk-free environment. Using current data, the software’s discrete event simulation shows how changes to one or multiple variables will affect all others.

“The ability to test sweeping changes without jeopardizing customer service was huge for Westfield,” said Quinn Conley, analytics professional for Westfield. “We needed to be prepared for the impact any modifications – small or large – would have on our customers and the company, and the Arena software enabled us to do that.”

The Westfield ARC began by mapping out the claims and billing processes, incorporating all business standards, staffing parameters and timing.

Next, the team worked with the CCC and claims management to gather all data needed to populate the model. Data included staffing hours and schedules, call times and lengths, percentage of abandoned calls, and number and time of claim arrivals per channel. Sources included system data, call records, and self-reports by staff and management.

All data was entered into the software. The analysts then coded the process and verified the simulation model over six weeks, which they then validated.

Once the model was finalized, the ARC tested a range of options. Through biweekly meetings with the CCC and claims management, they prioritized potential changes to be tested and confirmed. The animated visuals of the model proved to be crucial in communicating potential effects to management as scenarios were tested.

Results

Through repeated testing and experimentation within the simulation software, the Westfield ARC compiled recommended changes to processes and staffing. The first recommendation – and the one most surprising to executives – would decrease FNOL times.

Allocation specialists are responsible for assigning newly entered claims to individual adjusters. Previously they were working typical business hours and leaving after 4 p.m. However, the third-party data-entry vendor, used for faxed-in claims, was sending claims in the evening as well. This led to a bottleneck in claims processing.

Based on the software outcomes, management changed the hours of some specialists, shifting them to evening claims processing. Per the analytics team recommendations, the company also plans to bring data entry in-house. The team is testing ideal staffing and schedules.

Automating the adjuster-assignment process became another high priority when the software models showed it would provide the largest reduction in FNOL time. Once the new claims management system is in place, the assignment process will be automated. All customers calling the center will know who their adjuster is and have his or her contact information by the end of the call. This change will also reduce the number of repeat calls from customers who have not heard from their adjusters.

Within the call center, the analytics team found that representatives who were trained to handle both billing and claims calls helped decrease call abandonment significantly. So Westfield made that change, and the company now trains all representatives to handle both.

Based on the models tested, the company is also prepared to staff accordingly as calls to the center increase over faxes, and as the company begins to offer triage services.

The Westfield ARC has completed five major projects for the company using the Arena simulation software, and began its sixth in June 2014. The company has already seen the FNOL time reduced by over 50 percent, and expects to see additional reductions as further changes are implemented.

“Throughout the process, we could experiment with different requests almost immediately,” said Conley. “As further changes are made, we can update our existing models and continue experimenting with ways to improve our customers’ experience.”

The results mentioned above are specific to Westfield Insurance’s use of Rockwell Automation products and services in conjunction with other products. Specific results may vary for other customers.

Was this article valuable?

Here are more articles you may enjoy.

Tesla’s Austin Robotaxis Report 14 Crashes in First Eight Months

Tesla’s Austin Robotaxis Report 14 Crashes in First Eight Months  Asbestos Lawsuits Prompt Vanderbilt Minerals to File Bankruptcy

Asbestos Lawsuits Prompt Vanderbilt Minerals to File Bankruptcy  Claims Handling Breakdowns From LA Wildfires One Year on

Claims Handling Breakdowns From LA Wildfires One Year on  Moody’s: LA Wildfires, US Catastrophes Drove Bulk of Global Insured Losses in 2025

Moody’s: LA Wildfires, US Catastrophes Drove Bulk of Global Insured Losses in 2025