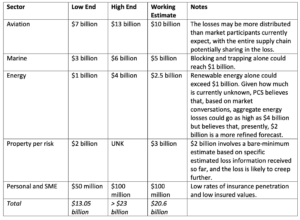

The conflict in Ukraine has already had a significant impact on the specialty lines re/insurance market. Although it could take months after any cessation of hostilities for loss adjusters to begin to understand the insurance industry impact, information on losses has begun to pass through the global re/insurance market, making it possible for many in the industry to assemble a view on the possible industry-wide insured loss for the event. PCS believes that aggregate industry-wide insured losses could exceed approximately US$20 billion based on market intelligence available to date. It’s still early in the conflict, though, and the flow of information is but a trickle compared to what will likely come through when loss adjusters eventually gain access to affected sites. As a result, the conflict in Ukraine has the potential to become the largest industry-wide insured loss, across all classes of business, in history, even exceeding that of the terror attacks of Sept. 11, 2001.

1. Aviation: The conflict in Ukraine has led to intense focus on the global aviation re/insurance market, specifically the potential insured losses from policies associated with the aircraft leasing market. Publicly reported estimates have tended to range from US$5-10 billion, with even the low end potentially making this the largest aviation insured loss event in the market’s history. As the participants closest to the risk understand, though, the ultimate loss to the market will be far more nuanced.

The potential for a US$5-10 billion industry-wide insured loss event based on factors related to leased aircraft seems realistic, but the losses may span segments of the aviation market, rather than involving binary outcomes specific to all-risk or war-hull, PCS has learned from our worldwide re/insurance client base. There is the potential for some loss to be borne in the air carrier market and potentially by manufacturers, through the financing arrangements in place with aircraft leasing companies. The overall insured loss, simply, could wind up distributed across the supply chain, rather than concentrated on one particular link.

The lack of mobility is among several factors that could exacerbate aircraft-related losses. Takeoff and landing restrictions caused by sanctions curtail even the theoretical possibility of returning aircraft. Required maintenance is likely to be impeded by sanctions as well, with both parts and labor shortages poised to impair aircraft values over time. Further, the sense that leases could wind up being settled in rubles later this year could influence how aviation claims are interpreted (to include quantum).

Losses from airports have largely slipped the industry-wide radar so far, and PCS has learned through dozens of client conversations that such losses could lift the overall industry-wide insured loss estimate from the conflict by 20-40 percent. For now, a realistic potential range for industry-wide aviation insured losses related to the conflict in Ukraine may be US$7-13 billion, with a working estimate of US $10 billion.

2. Marine: The designation of the Black Sea and Sea of Azov as war areas for marine by the Joint War Committee has led some marine market professionals to expect relatively low insured losses from the conflict, even with a reported six vessels affected so far. There is still the possibility for insured losses to accumulate to multiple billions of dollars, though. Blocking and trapping losses, for example, take time to materialize, but if the time conditions are met, PCS clients have indicated that the inability of vessels to move freely and safely in the region makes trapping and blocking a real concern. Waiting periods tend to range from six months to a year, which leaves room for some amount of uncertainty. PCS believes that such losses could go as high as US $1 billion.

A number of ports have ceased operation, although exposure to physical damage seems to vary with proximity to fighting. Insured losses could accumulate quickly, as a result. While there aren’t any firm estimated ranges in the market yet, PCS clients have suggested that losses could range from US$2-5 billion, although there’s a considerable amount of uncertainty in that range, still. Additionally, we have had discussions with some about cargo losses in the market. Some see it as contributing minimally to the industry-wide insured marine loss, while a differing perspective notes the volumes of grain that used to move through the affected ports and the potential for spoilage. Market estimates have yet to be circulated, but expectations seem to be that aggregate cargo losses will be small in relation to those from blocking and trapping and ports and terminals.

Overall, PCS believes the industry-wide insured marine loss could range from US$3-6 billion, with US$5 billion a working estimate. Given that much of the loss is time-related, it will be a while before reliable estimates come into the market.

3. Energy: According to PCS market sources, most insured energy losses are expected to come from the onshore sector, with windfarms alone likely sustaining as much as US$850 million in industry-wide insured losses. And of course, there are several nuclear facilities that have sustained damage or other disruption that could result in insured losses in the future, including Zaporizhzhia and potentially Chernobyl, according to public reports. Nuclear losses tend to be expensive, as a result of the specialized labor and material needed for even the most seemingly mundane tasks, a situation exacerbated by security requirements.

While we have not discussed much else with others with that degree of specificity, it appears that plenty of exposure remains, including public reports of other power plants being damaged. Ukraine produces domestically 65 percent of the energy it consumes, according to the International Energy Agency (IEA), but the country imports more than 80 percent of the oil it consumes and half of the coal it consumes. Reliance on nuclear power accounts for a considerable amount of domestic energy production. The implications of Ukraine’s being a transit country for fossil fuels exported from Russia do not appear to have manifested, although the possibility remains.

Onshore energy projected industry-wide insured losses, generally, may be difficult to ascertain this early in the conflict. Being able to get loss adjusters on the ground is crucial to understanding onshore energy insured loss estimates from political violence, as PCS saw in producing estimates for PCS Turkey Catastrophe 1613, a political violence event in the southeastern part of the country in which approximately 10 percent of the industry loss came from large energy programs.

For now, it is difficult to forecast a potential industry-wide impact for this sector, but client conversations suggest that industry-wide insured losses of above US$2 billion seem likely, particularly with windfarms and nuclear facilities potentially accounting for half that.

4. Property per risk: Property per risk losses could take the longest to accumulate, given that a large number of companies could be affected, limits could be high, and business interruption could contribute significantly to any industry-wide insured loss total for this class of business. This class of business, after aviation, could be the greatest contributor to the overall industry-wide insured loss in Ukraine. Forty percent of the country’s gross domestic product (GDP) comes from steel and grain, with reports of several such insureds already coming through the global re/insurance community.

PCS has become aware of one such loss so far and has learned of as much as US$4 billion in limit (for named companies) that are exposed to the conflict, with the understanding that many more exposures remain. Specific sectors on that list include manufacturing, mining, technology/media/telecommunications, financial services, and consumer business. It is extremely difficult to forecast the ultimate industry-wide insured loss from property per risk in the Ukraine conflict, and it will take some time for even a wide range to emerge. So far, it seems likely to exceed US$2 billion, based on intelligence received by PCS, but as with the energy sector estimate above, it’s tough to determine more than that.

5. Personal and small commercial property: This category is not expected to comprise a significant portion of the industry loss, and sources suggest a likely result of US$100 million. Ukraine’s low rates of insurance penetration and lower insured values should keep the industry-wide insured loss for this sector manageable. Further, recent political violence catastrophe events have shown that a disproportionate amount of the industry-wide insured loss tends to come from commercial (especially large commercial) insureds, as evidenced by the riots over the past three years: 2019 in Chile, 2020 in the United States, and 2021 in South Africa.

Early Estimates of Potential Industry-Wide Insured Losses from the Conflict in Ukraine

Sources: PCS Global Aviation, PCS Global Marine and Energy, PCS Global Large Loss, PCS internal research

A Note on Cyber

Expectations about cyber activity have varied since the earliest days of the conflict. Some expected a much greater role for cyber, while others believe that impact from attempted cyber operations was at least dulled by preparations made in 2021. International relations research suggests that cyber operations do not feature significantly in armed conflict because its impact would be far smaller in scale than that of kinetic activity (physical fighting). Because of this, PCS believes there’s a risk of post-kinetic cyber operations. Essentially, insured losses from cyber would be more likely to begin and accumulate after a cessation of the conflict.

Further, there is a possibility that such cyber activity would not be focused exclusively (or even predominately) on Ukraine. Ransomware actors would benefit from state accommodation (rather than state sponsorship or direction) in pursuing worldwide targets, particularly those in western nations. While the actions of ransomware gangs would advance an agenda involving the destabilization of western countries, the benefits of destabilization to the accommodating state would result from an alignment of interests rather than coordination or direction.

Was this article valuable?

Here are more articles you may enjoy.

Iran War Threatens Supply Disruptions for Agriculture Markets

Iran War Threatens Supply Disruptions for Agriculture Markets  Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud

Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud  Claims Handling Breakdowns From LA Wildfires One Year on

Claims Handling Breakdowns From LA Wildfires One Year on  NYC Travel Snarled by Snow as Central Park Gets 15 Inches

NYC Travel Snarled by Snow as Central Park Gets 15 Inches