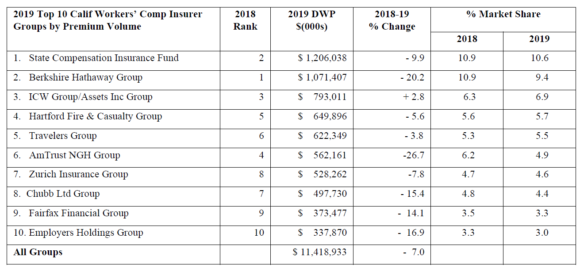

California workers’ compensation total direct written premium continued to decline in 2019, falling 7.0% to a five-year low of $11.42 billion, as nine out of the state’s 10 largest insurer groups wrote less premium in 2019 than in 2018, a new report shows.

A California Worker’s Compensation Institute analysis of the latest market share report issued by the National Association of Insurance Commissioners shows that despite last year’s booming economy and rising payroll, California workers’ comp Insurers’ total direct written premium fell by nearly $863 million between 2018 and 2019 as premium rates continued to decline.

The Workers’ Compensation Insurance Rating Bureau’s April 23 report on insured experience through the end of last year that insurers’ average charged rate per $100 of covered payroll for California workers’ comp policies incepting in 2019 fell to $2.00, down 11.5% from $2.26 in 2018, and 32.7% below the 2014 peak of $2.97, the CWCI report shows.

Charged rates have continued to decline since enactment of the 2012 reform package (Senate Bill 863), and the WCIRB governing board has recommended a string of reductions in the advisory pure premium rates used by insurers as a benchmark in setting their rates.

This year the WCIRB governing committee voted against recommending that California Insurance Commissioner Ricardo Lara make any mid-year change in the advisory rates, and with the state’s economy impacted COVID-19 and the sudden loss of thousands of jobs, both covered payroll and total DWP are expected to drop sharply this year, the CWCI report states.

The WCIRB in June published estimated costs of allowing state workers to receive benefits for COVID-19 claims without proving virus exposure at work, dropping a prior mid-range estimate by $10 billion.

The report also shows that State Compensation Insurance Fund, which except for the last two years has traditionally been the state’s largest workers’ comp Insurer, regained the top spot in 2019, even though its total premium fell by $133 million. Berkshire Hathaway Group, which topped the list in 2017 and 2018, reduced its total premium volume by nearly $272 million, cutting its market share from 10.9% to 9.4%, the report shows.

Was this article valuable?

Here are more articles you may enjoy.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Asbestos Lawsuits Prompt Vanderbilt Minerals to File Bankruptcy

Asbestos Lawsuits Prompt Vanderbilt Minerals to File Bankruptcy  Bayer to Make $10.5 Billion Push to Settle Roundup Cases

Bayer to Make $10.5 Billion Push to Settle Roundup Cases  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard