The Florida Supreme Court’s call for an additional appellate court and six – now seven – new judges in the state has met with mixed reviews, with some attorneys welcoming the idea, while others, including a few judges, have said the caseload does not warrant the expense.

One insurance attorney said that in at least some parts of the state, the redrawing of appeal court district lines could have an impact on the types of decisions that have resulted in large plaintiffs’ attorneys’ fees and large judgments against insurers

“The fifth district has been very plaintiff-friendly in the last few years,” said Katie Koener, an insurance defense attorney with the Kelley Kronenberg firm in Tampa. “And the second has been more favorable to insurance companies.”

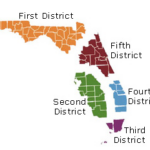

The addition of a sixth appeals court district court would mean redrawing most district lines in the state. If approved by the Florida Legislature, which meets next week, the plan would move two heavily populated counties surrounding Orlando from the fifth district to the more-rural second district, based in Lakeland.

The Supreme Court’s recommendation would also fold four Tampa-area counties into the new sixth district. Three northeast counties would move from the first district to the fifth, with court offices in Daytona Beach. And four of the seven proposed new judgeship positions would go to the fifth district, which could significantly alter the demeanor of the bench there.

Koener cited a number of appeals court decisions handed down by the 5th District Court of Appeals in recent years, which have driven insurers crazy. In one of those, Hugh Hicks vs. American Integrity Insurance Co., the court agreed with the plaintiff that a policy that excluded damage from water leaks “over a period of 14 or more days” provided coverage for the first 13 days of the leak.

Insurance attorneys found that line of reasoning to be very difficult to swallow, partly because it’s impossible to know exactly when the leak occurred.

By contrast, the Lakeland-based 2nd District Court of Appeals has made some significant rulings in insurers’ favor, Koener said. In other districts, insurers also appear to be on something of a winning streak in recent months. An informal count of appeals decisions shows that insurance companies have prevailed in at least seven cases handed down since September.

The Supreme Court said an additional court is needed, not only for an expected increase in overall caseload, but also to re-balance the number of judges in districts. One district now has 10 judges while another has 16, the court explained in its opinion. In the 1st DCA, covering the northern part of the state, about a third of the appeals filings come from the Jacksonville area, but only 13% of the appeal court’s judges hail from that part of the state, the court said.

“The configuration proposed in the committee’s plurality plan would help address this geographical anomaly existing in the current district court system,” Chief Justice Charles Canady wrote in the court’s opinion.

Some lawyers were not sure of the need or what the impact of a new court might be.

“I was surprised when I read the opinion. I’m not sure what to think about it, frankly,” said Elaine Walter, a Miami attorney and a director of the Florida Defense Lawyers Association.

The court is required by the Florida Constitution to annually certify if there’s a need for more or fewer courts and judges in the state. In its opinion posted in November, the court for the first time in more than four decades called for an additional appeals court and a total of 70 appellate judges, statewide. In December, the court revised its opinion and said that due to recent changes in the residency of some judges, the state now needs an additional spot, for a total of 71 judges.

Justice Canady also noted in the November opinion that the court expects a significant increase in cases and appeals as the COVID-19 pandemic winds down and businesses and courtrooms fully reopen.

“Those operational impacts at the trial court level have a direct bearing on the number of appeals filed in the district courts,” Canady wrote. “An increase in district court workload is anticipated as the trial courts fully return to normal operations.”

It’s now up to the Florida Legislature to decide if it will approve and fund the plan. An additional court could cost at least $1 million per year, just to cover six new judges’ salaries. Judges are paid almost $170,000 per year. And a new courthouse could prove expensive with the increase in the cost of building materials and labor.

“Do they need another building, with clerks and security and all that?” asked David Langham, the chief workers’ compensation judge for Florida. He noted that one court building could cost $40 million to construct and furnish.

It’s uncertain if a new court and more judges will help solve one of Florida’s biggest problems – the flood of litigation that has arisen from property insurance claims disputes.

Insurance industry advocates have repeatedly pointed out that litigated insurance claims in the state have exploded in recent years, leading to huge financial losses in the industry and higher premiums for policyholders, along with a chilling effect on the number of carriers in the state.

Insurance industry advocates have repeatedly pointed out that litigated insurance claims in the state have exploded in recent years, leading to huge financial losses in the industry and higher premiums for policyholders, along with a chilling effect on the number of carriers in the state.

But it’s not obvious that those types of cases are driving the need for another appeals court.

Data compiled by CaseGlide, a litigation management software maker that tracks insurance litigation, show that litigated insurance claims have increased dramatically at the trial court level, from 16,300 in 2014 to 52,209 in 2020. Assignment-of-benefits cases make up 22% of those, up from 17% in 2014.

The firm does not collect data on insurance claims appeals. But the Supreme Court’s committee that recommended the additional court district reported that the overall number of appeals of all types has dropped significantly in that time. Appeals court filings in Florida have gone from 23,730 in 2016 to 17,785 in 2020 – a 21% decrease.

On one hand, more judges could mean faster resolution of cases, which could have the effect of encouraging more litigation, some have said. Others said that faster resolutions would help insurers as much as plaintiffs.

“It could help remove a bottleneck and move cases through faster,” said Julie Nevins, who handles insurance coverage and bad faith cases in Miami.

Justice Ricky Polston dissented from the court’s certification of the need for more judges.

“As I explained in my dissent to the majority’s November 24, 2021 opinion, no additional district court of appeal judges are needed. None. Not six. Not seven,” Polston wrote. “This revised certification makes my point. It is based on where current judges live, not any objective basis of a need for more judges to do the work.”

The court recommended no more circuit judges and only one additional county court judges in the state.

One idea that’s been discussed is to set up one appeals court to handle insurance claims cases, much like Florida’s 1st District Court of Appeals handles all workers’ compensation case appeals.

“I think there’s merit in that thought process,” said Langham, the comp judge. “We ask an awful lot of judges” who must hear a wide variety of cases, he added. But having one court that specializes in insurance matters “might make things move more expeditiously.”

Others said such a plan may prove to be impractical and may not help that much. The litigation overload is found more at the trial court level, particularly in South Florida, not at the appeal courts, said David Henry, an insurance defense and third-party litigation lawyer in Fort Lauderdale.

Appeals court decisions are often considered to be quite important, because some cases are not appealed to the state Supreme Court, and the high court declines to hear others, leaving the appellate court ruling as the law of the land. One of the most significant Florida workers’ compensation cases, the Miles vs. City of Edgewater decision by the 1st District Court of Appeals in 2016 allowed claimants to contract with their lawyers to set attorney fees. The case was not reviewed by the high court and continues to have an impact on fees.

Florida appears to have more appellate courts and judges than some large states, less than others. Texas, with a similar population, for example, has 14 appeals courts and 80 judges. New York has some 60 judges. California has more than 100 appellate judges.

Was this article valuable?

Here are more articles you may enjoy.

Stellantis Weighs Using China EV Tech for Affordable Cars

Stellantis Weighs Using China EV Tech for Affordable Cars  Tesla’s Austin Robotaxis Report 14 Crashes in First Eight Months

Tesla’s Austin Robotaxis Report 14 Crashes in First Eight Months  Bayer to Make $10.5 Billion Push to Settle Roundup Cases

Bayer to Make $10.5 Billion Push to Settle Roundup Cases  Explosive Wildfires Surge Through Oklahoma Panhandle and Kansas

Explosive Wildfires Surge Through Oklahoma Panhandle and Kansas