Consumers expecting big savings from a National Association of Realtors’ class-action settlement over agent commissions may instead be in for a letdown.

The agreement drew cheers from President Joe Biden, who said it “could save homebuyers and home sellers as much as $10,000” in one example, and former Treasury Secretary Larry Summers, who said that breaking the “Realtor cartel” could save US households $100 billion over time. But the true benefits remain unclear, especially for first-time buyers who need help the most.

Never miss an episode. Follow the Big Take podcast on iHeart, Apple Podcasts, Spotify or wherever you listen. Read the transcript.

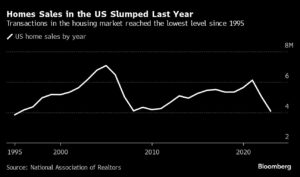

It comes at a precarious time for the housing market, with higher mortgage rates pushing sales last year to the lowest level in nearly three decades. It’s especially tough for first-time buyers looking to jump into one of the most unaffordable markets in history. In theory, the settlement could translate into lower home prices by pushing commissions down. But experts say that’s not a given, especially in the short run.

“No seller I’ve encountered will lower the price just because their transaction cost went down,” said Steve Murray, senior adviser to data provider and consultant Real Trends. “That will not happen.”

“No seller I’ve encountered will lower the price just because their transaction cost went down,” said Steve Murray, senior adviser to data provider and consultant Real Trends. “That will not happen.”

The NAR said in a statement responding to Biden’s remarks that commissions were already negotiable before the settlement agreement and will continue to be.

“Real estate agent commissions are driven by the market and are not the cause of the affordability crisis,” the NAR said.

How the changes ripple out and impact the market is a subject of heated debate, in part because nobody really knows.

The decades-old system for how US agents are compensated has long been controversial. Sellers typically pay a commission to their agent of 5% or 6%. The listing agent then splits the money with the buyer’s representative. Critics argue that the structure inflates costs and creates bad incentives.

In October, a Missouri jury handed down a $1.8 billion verdict that found the NAR and others liable of colluding to keep prices high. To settle that case and others, the NAR agreed earlier this month to pay sellers roughly $418 million and said it would change some of its rules. In the most important shift, the trade group would bar sellers from including compensation details on the multiple-listing service, which has long been the most important tool for marketing homes.

That change, to take effect this summer subject to a court’s approval, could encourage sellers to negotiate lower commissions. But the industry is rife with speculation that agents will find ways to discuss commission splits through other methods, for example, on brokerage websites.

“I expect commissions to get bid down to 4% to 5% over time with variation by home price and geography,” Moody’s Analytics Chief Economist Mark Zandi said. “It’s a significant change but will likely be gradual. I expect most of the gain to be captured by the seller, so the impact on home prices will be small.”

Possible Outcomes

The settlement was a hot topic at the American Real Estate Society’s annual gathering of academics in Orlando this week. Ken H. Johnson, a real estate professor at Florida Atlantic University and a former broker, was in attendance, gaming out the possible outcomes with colleagues.

Even the question of who is getting the benefit from lower commissions — buyer or seller — doesn’t have a simple answer, he said. In theory, the seller should pass on some savings to the buyer, but maybe not as much in a seller’s market.

And it may encourage more first-time homebuyers, who sometimes lack the cash to pay brokers upfront, to go it alone, according to Johnson. More buyers are likely to go directly to listing agents to avoid having to shell out for commission costs. But that might result in more agents with potential conflicts of interest, representing buyers and also the sellers who pay them.

“Now some buyers are going to have to pay out of pocket, or maybe buy less expensive homes,” Johnson said.

Another huge question looms over the industry. The Department of Justice has taken aim at commission sharing, arguing for a full decoupling of compensation for sellers’ and buyers’ representatives. It remains to be seen if the NAR settlement satisfies regulators.

New Rules

Agents are already adapting to the new rules under the proposed settlement. In New York, broker Keith Burkhardt is working on a new flat-rate service to provide help valuing properties, negotiating deals, and navigating the city’s co-op and condo boards. He figures pricing will be critical and estimates charging buyers between $5,000 and $7,500.

Meanwhile, buyers’ agents will also have to work harder to explain how they’ll add value to any deal, according to Iain Phillips, a real estate agent in California.

The settlement is a start, said Larry Summers, a paid contributor to Bloomberg Television, on Wall Street Week with David Westin. But most observers don’t expect huge changes to happen overnight.

“Right now, everyone is turning this ruling into what they want it to be,” said Mike DelPrete, who teaches courses on real estate technology at the University of Colorado Boulder. “Some people are saying not much is going to change. Others want the story to be that it’s a seismic shift for the industry. The whole thing is being driven by fear and uncertainty.”

Top photo: Single family homes in a residential neighborhood in San Marcos, Texas, US, on Tuesday, March 12, 2024. The National Association of Realtors is scheduled to release existing homes sales figures on March 21.

Was this article valuable?

Here are more articles you may enjoy.

Judge Upholds $243M Verdict Against Tesla Over Fatal Autopilot Crash

Judge Upholds $243M Verdict Against Tesla Over Fatal Autopilot Crash  Bayer to Make $10.5 Billion Push to Settle Roundup Cases

Bayer to Make $10.5 Billion Push to Settle Roundup Cases  Asbestos Lawsuits Prompt Vanderbilt Minerals to File Bankruptcy

Asbestos Lawsuits Prompt Vanderbilt Minerals to File Bankruptcy  When the Workplace Is Everywhere: The New Reality of Workers’ Comp Claims

When the Workplace Is Everywhere: The New Reality of Workers’ Comp Claims