The property/casualty insurance industry is confronting challenging claims dynamics, with rising frequency and severity of claims despite decreases in economic inflation, according to Swiss Re.

The pace of claims growth in the liability line of business challenges the insurability of those risks, said Swiss Re’s sigma report titled “Risks on the rise as headwinds blow stronger: global economic and insurance market outlook 2024‒25.”

Macroeconomic factors, particularly inflation, remain top concerns for P/C insurers’ claims development, despite progress on economic disinflation, said Swiss Re.

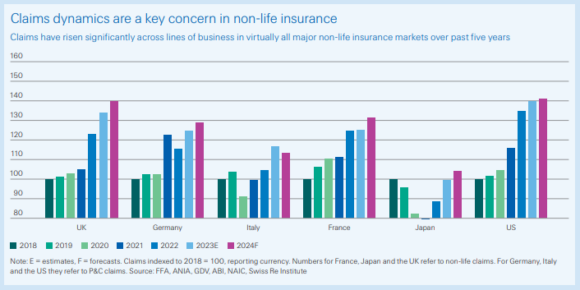

Claims have risen significantly across lines of business in virtually all major non-life insurance markets over the past five years, said the report. While the impact of economic inflation on claims growth is easing in 2023 from the highs of 2022, it remains elevated, Swiss Re continued.

“The shift of inflation into wages and healthcare costs this year is seen in increasing claims costs in casualty lines,” the report said, citing the 2023 Allianz risk barometer, which found that macroeconomic risks such as “inflation, financial market volatility and a looming recession” moved up to number 3 from number 10 year-on-year, behind cyber risks and business interruption.

“We expect the impact of economic inflation on claims to ease further over the course of 2024 and 2025.” Swiss Re said, noting as the impact of inflation on claims eases, “more structural trends such as social inflation and increasing natural catastrophe exposure are likely to return to the heart of claims dynamics.”

Motor and Property Insurance

Claims in motor insurance, which is the second-largest non-life line of business globally, have risen swiftly in major markets in 2023, leading to higher claims frequency and severity in motor liability insurance, the report said.

“This differs from the initial post-pandemic claims surge, which was driven principally by surging repair costs for motor-own damage claims (spare parts, replacement cars, repair costs),” it explained.

In the German motor market, for example, liability claims went up by more than 20% over the last two years and the combined ratio is expected to reach 101.2%, up from 96.5% in 2022, the report said. “In the US, the personal auto combined ratio reached 112% in 2022, the highest since 1975. Loss costs have decelerated somewhat recently, but the combined ratio may well remain above 100% in the coming years.”

Property insurance is still seeing a strong upward trend in claims, fueled by much higher replacement costs today than two years ago, the report continued. “While cost pressure from construction materials has generally eased, higher wages and higher financing costs as a result of tighter monetary policy [from higher interest rates] keep construction costs elevated.”

Natural Catastrophe Claims

Swiss Re said the global loss burden from natural catastrophes is also continuing to grow, with nat cat insured losses on track to total US$100 billion in the full year 2023 – for a fourth consecutive year and the sixth year since 2017 (on an inflation-adjusted basis).

Swiss Re estimates the long-term growth rate for natural catastrophes is 5%-7% in inflation-adjusted terms since 1992.

“The growth in exposure values, driven primarily by continued construction in high-hazard areas, and rising replacement costs – largely due to inflation – are the most significant factors responsible for increasing catastrophe losses in the recent years.”

Nat cat losses this year have been driven by severe convective storms (SCS) in the US, with global SCS insured losses surpassing US$50 billion for the first time ever during the first nine months. Globally, SCS losses are rising by about 7% annually in the last 30 years and have surpassed US$30 billion every year since 2020, the report confirmed.

Swiss Re described these storms as bringing a range of hazards such as tornadic and straight-line winds, intense rainfall, lightning, and most damaging of all, large hailstones.

While the US accounts for most of the insured losses due to its SCS-prone geography, claims from this composite peril are also rising elsewhere, said Swiss Re, explaining that July’s storms in northern Italy were the largest insured loss event for this peril outside the US and caused a record loss for both that peril and weather-related losses in Italy.

In addition, devastating earthquakes have added to this year’s nat cat price tag. The February 2023 earthquake in Turkey and Syria is the costliest insured loss event this year so far at US$6 billion in estimated insured claims.

Strikes, Riots and Civil Commotion

Strikes, protest movements and civil unrest are on the rise, and have caused insurance claims of more than US$10 billion since 2015, said the report, quoting Howden. (The Howden report, published in April 2023, is called “A world of trouble.”)

The strikes, riots and civil commotion (SRCC) risk is traditionally covered by all risks property damage insurance and business interruption policies, Swiss Re explained.

“As claims rise, property coverage is being tightened to limit accumulation risks and avoid surprise losses. However, more severe scenarios such as the strikes turning into social unrest, are risks to watch, though destruction to property from strikes (or other ‘social perils’) are often subject to lower indemnity sub-limits. Covers responding to limitations of access or cancellation, such as travel and event cancellation, could also be impacted.”

Growing economic and political tensions could lead to more civil unrest, “although compared with the 1970s, the number of working days lost to strikes is still very low,” Swiss Re said.

“This challenging post-pandemic claims backdrop for non-life insurance is likely to continue in 2024 and 2025. We anticipate that the industry may need to consider strategies to restore profitability and commercial sustainability. This includes setting appropriate and commensurate rates and being disciplined in underwriting policies.”

Geopolitical Tensions

Geopolitical tensions are elevated – from heightened US-China strategic rivalry to the Russia-Ukraine war and now the Middle East conflict – which generate uncertainty and risks for the insurance industry and may put short-term pressure on marine, aviation, travel and property insurance losses, said the report.

“Even if the [Israel-Hamas] conflict remains localised, continued geopolitical risk may lead to tighter underwriting terms and conditions, particularly in lines such as cargo, hull, war, piracy, terrorism and construction,” it said. “In some cases, war exclusions have already been widened.”

If the conflicts escalate, energy price shocks are a key risk to the global economy and could lead to claims inflation in the non-life sector, Swiss Re said, explaining that an adverse scenario in which the conflict expands to include major regional oil producers could add 2.4 percentage points to Swiss Re’s global inflation forecast.

Further, more volatile financial markets could affect investment returns. “Careful monitoring for potential escalation that could precipitate an alternative tail risk scenario, in particular a so-called 1970s-style stagflation scenario that would stress underwriting performance is key,” the report said.

Additional findings from the report include:

- Swiss Re forecasts a global growth slowdown in 2024 following 2023, which was more resilient than anticipated.

- Swiss Re forecasts 2.2% global real GDP growth in 2024 before a rebound to 2.7% in 2025, supported by lower inflation and central bank interest rates. “Major economies are diverging: the US continues to grow, while Europe is stagnating, if not already in recession in some countries, and China is grappling with structural domestic growth challenges.”

- Inflation and interest rates in developed markets expected to stay higher in the next decade with global inflation forecast to moderate to 5.1% in 2024 and 3.4% in 2025, but price pressures likely will continue to be volatile.

- The long-term positives of high interest rates outweigh the negatives for life insurance.

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Gas-Guzzler Revival Risks Dead-End Future for US Automakers

Gas-Guzzler Revival Risks Dead-End Future for US Automakers  Moody’s: LA Wildfires, US Catastrophes Drove Bulk of Global Insured Losses in 2025

Moody’s: LA Wildfires, US Catastrophes Drove Bulk of Global Insured Losses in 2025  Judge Upholds $243M Verdict Against Tesla Over Fatal Autopilot Crash

Judge Upholds $243M Verdict Against Tesla Over Fatal Autopilot Crash