The Vermont Supreme Court has denied a bid by a manufacturer of asbestos products to bypass Vermont law in determining the allocation of losses for insurance purposes.

In so doing, the Vermont court sided with Ambassador Insurance Co., which has been under liquidation in the state since 1987, and against Atlanta-based Georgia Pacific Corp.’s Bestwall Gypsum Co., which produced and sold products containing asbestos for decades

Under Vermont’s approach to losses, Ambassador will likely not have to pay any; whereas under Georgia law preferred by Bestwall, the insurer might have to pay millions.

Ambassador’s 1983 excess policy for Bestwall was in place for only a short period of time— 44 days. Under the Vermont pro-rata approach, Bestwall’s total losses would be allocated to Ambassador based on the 44-day period that the policy was in place, which Bestwall contends would not be enough to trigger Ambassador’s policy and thus it could receive nothing from Ambassador.

Bestwall had reason to believe that it stood a better chance of obtaining payment under an all-sums, or joint-and-several liability, allocation rather than a pro-rata and it thought Georgia courts would likely oblige. If the all-sums approach were used, Bestwall might receive the policy limit of $10 million from Ambassador.

However, in affirming opinions by both a special master and a superior court, the Vermont high court ruled that Vermont’s approach applies in the matter. It noted that the only reason Georgia law might apply is if there were a conflict between the laws of the two states. It found that, in fact, Vermont law is very clear on what allocation formula should be used while Georgia has never addressed the loss allocation question and thus there is no conflict.

From 1965 to 1986, Georgia Pacific (GP) maintained commercial general liability insurance with multiple layers of primary and excess coverage from multiple insurers. GP’s insurers included Ambassador, which was incorporated in Vermont in 1965 and had an office in Berlin, Vermont. Ambassador was also licensed in New Hampshire, Arizona, and Nevada, and had offices in several states, including New Jersey. Ambassador was not licensed to sell insurance in Georgia, where GP was headquartered, but acted as a surplus lines insurer.

In 1983, GP negotiated an excess liability policy with Ambassador’s Georgia-based surplus lines broker. Under the policy, Ambassador agreed to provide up to $10 million as a portion of GP’s total excess liability coverage of $75 million. But GP’s losses needed to exhaust the $100 million of GP’s underlying coverage to trigger Ambassador’s excess coverage.

Ambassador’s coverage followed that of the underlying policies, and at least one underlying policy limited coverage to bodily injury “which occurs during the policy period.” Although the Ambassador policy was written to be effective from April 1, 1983, to April 1, 1984, GP cancelled the policy on May 15, 1983, after it decided to replace its entire insurance program. Ultimately, the policy was in effect for only 44 days, for which Ambassador collected a net premium of $605.

In November 1983, Ambassador was placed into receivership due to its “hazardous financial condition.” In 1987, the Vermont superior court ordered Ambassador into liquidation.

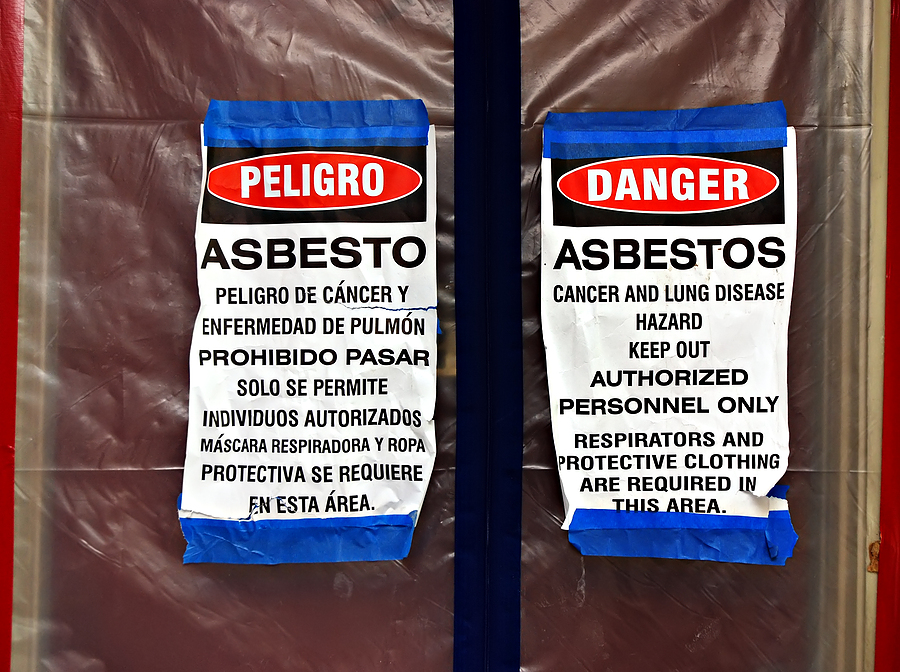

Since the early 1980s, GP has faced many lawsuits across the country alleging personal injury and death resulting from exposure to GP’s asbestos-containing products. GP has incurred approximately $2.9 billion in losses. GP’s insurers have covered approximately $850 million of GP’s losses. In 2017, GP was restructured, and Bestwall acquired its asbestos liabilities.

Bestwall filed a claim with the liquidator for coverage under the Ambassador policy but the liquidator denied the claim. Bestwall appealed that denial to the Vermont superior court, which appointed a special master to hear the claim. The special master divided the proceedings into two tracks: the first to determine threshold legal questions, including choice of law and the method of loss allocation, and the second to allocate loss under the applicable law.

Bestwall and Ambassador each filed for partial summary judgment on the issues of choice of law and method of loss allocation. At this point, Bestwall argued that New Jersey law should apply since New Jersey was the state where Ambassador’s main office was located at the time it issued the policy. Alternatively, Bestwall argued that Georgia law could apply as it was the state of Bestwall’s incorporation and headquarters when the policy was issued. Ambassador argued that Vermont law applied.

Special Master

The special master granted partial summary judgment to Ambassador, rejecting Bestwall’s argument that New Jersey law should apply and reasoning that either Vermont or Georgia law could apply to the claim. The special master then considered whether Georgia law conflicted with Vermont law regarding allocation of loss. He explained that while Vermont law clearly applies pro-rata (or time-on-the-risk) allocation, no appellate court in Georgia had considered this issue. After considering a Georgia state trial court decision and federal district court decision adopting the pro-rata method under Georgia law, the special master also predicted that Georgia courts would adopt the pro-rata method.

Because Georgia law did not conflict with Vermont law, the special master concluded that Vermont law applied. He further noted that even if the laws conflicted, Vermont law would still apply under a choice-of-law analysis, given Vermont’s interest in Ambassador’s liquidation and the clarity in Vermont’s allocation law.

Bestwall filed an objection with the superior court, which also rejected Bestwall’s arguments. Bestwall then moved for interlocutory appeal. Bestwall again pleaded that if Bestwall’s losses were allocated to the policy by time under the Vermont pro-rata method, the loss would not exceed the underlying coverage necessary to trigger Ambassador’s policy and its claim would fail. Bestwall offered that the Supreme Court of Georgia and Georgi law would not support this outcome where the policy language does not specifically require pro- rata allocation.

The Supreme Court found Bestwall’s arguments and evidence supporting Georgia law unpersuasive:

“We conclude that in the face of unsettled law, Bestwall must show with reasonable certainty that Georgia law plainly and materially conflicts with Vermont law. Although Bestwall has set forth the Georgia law that exists, Bestwall has not pointed us to a precedential state decision or other clearly established law determining how Georgia courts allocate loss in the same or similar circumstances. Without such proof, Bestwall has not shown, nor can it show with reasonable certainty, that Georgia courts would reject pro-rata allocation and instead apply all-sums allocation. For the reasons set forth in greater detail below, we conclude that Vermont law applies.”

The Ambassador liquidation order dates back 35 years to 1987, following state regulators’ discovery that the company was insolvent by at least $43 million. In addition to collecting reinsurance balances and other debts owed to Ambassador, the liquidator obtained a final judgment against Ambassador’s former accountants Coopers and Lybrand for $205 million in 2008. The funds paid under that judgment, along with Ambassador’s other assets, enabled the liquidator to pay all court-approved highest priority claims against Ambassador insurance policies with interest— a total of more than $352 million.

In 2015, the Vermont Supreme Court denied an order setting a final date to file claims, noting that many asbestos claims tend to be long-tail and Ambassador had the resources to pay lower priority claims, which totaled an estimated $32 million at the time.

Was this article valuable?

Here are more articles you may enjoy.

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions  Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads  US Will Test Infant Formula to See If Botulism Is Wider Risk

US Will Test Infant Formula to See If Botulism Is Wider Risk  Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case

Navigators Can’t Parse ‘Additional Insured’ Policy Wording in Georgia Explosion Case