“I don’t know how to put this, but I’m kind of a big deal.” – Ron Burgundy, Anchorman: The Legend of Ron Burgundy

Houses are getting older; the median age of a home in the U.S. is steadily increasing, with more than half of the homes being 40 years old. A majority of homes still have their original roof, which makes them particularly susceptible to damage—older roofs are more likely to fail in storms than newer roofs and older roofs are more likely to be built with less resilient materials than newer roofs. This all adds up to substantial roof-related losses.

In an effort to address this issue, many carriers now consider roof age in their products. We see carriers using two leading methods for doing this:

- Pricing (rating or discount/surcharge), and

- Actual Cash Value (ACV) over a certain age.

Both of these strategies are dependent upon roof age, which is usually supplied by the homeowner or agent and is assumed to be accurate. However, research shows that homeowner- and agent-supplied roof age is consistently underestimated. But is this underestimation really a problem? How much are these underestimations really affecting current carrier solutions? Many think that the assumption of roof age accuracy is not a big deal, taking a “close enough” mindset. Don’t be so sure… it’s kind of a big deal. In this research paper BuildFax takes an in-depth look at the impact of underestimated roof age and how relying on assumed accuracy is costing the industry billions each year.

The Underestimation Problem: A Brief History

Why Roof Age is Underestimated: Unreliable roof age sources, like homeowner- and agent-supplied roof age, are systematically underestimated. But why?

- Poor Estimating: It’s natural for us to be overly optimistic in our estimations—we are not sure, so we guess, and we don’t realize how much time has passed, therefore we underestimate. Time seems to go by so quickly; has it really been fifty years since Sean Connery played 007 in Gold Finger?!

- Lack of Knowledge: Simple lack of knowledge also fuels an inaccurate guess. Properties change hands, often times without reports of roof updates or replacements, and agents and homeowners are left to fill in the unknowns the best they can.

- Incentives to Underestimate: It does not help that often times there is underlying incentive to claiming a newer roof. Homeowners often don’t know when a roof was replaced but intuitively know that their rates will be lower if their roof is newer. Agents want to offer the best rates to their customers and may suggest an age based on their past experience with rates.

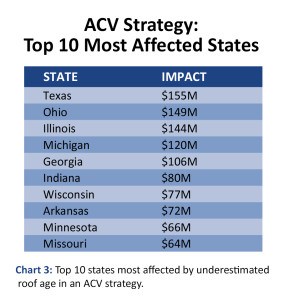

- It Adds Up: Based on BuildFax analysis of over 35 million policies, the median roof age is around 16 years old. The expectation would be to find half of the roofs on a carrier’s book to be younger than 16 and half of the roofs to be older; however, BuildFax research finds that the distribution of roof ages across a typical carrier’s book of business is skewed downward, with far too many roofs being categorized as younger than they actually are.

Calculating the Impact

In order to find the total financial impact of underestimated roof age, BuildFax evaluated over 35 million policies nationwide taking the following steps:

Step 1: Count the difference between accurate roof age and misclassified homeowner- and agent-supplied roof age; and

Step 2: Quantify the difference in loss frequency between younger roofs and older roofs and how much each misclassified roof is costing carriers.

BuildFax then used the results of these analyses as to answer the following questions:

- What is the financial impact of utilizing underestimated roof age when rating on roof, providing discounts for newer roofs, and/or surcharges for old roofs?

- What is the financial impact of improperly giving replacement cost coverage to roofs that don’t qualify and should have ACV coverage?

The Result: It’s Kind of a Big Deal

Pricing Strategy: BuildFax found that 284 out of 1,000 roofs are (net) misclassified as being younger than 15 years old.

How much does this miscategorization cost? Based upon roof age/roof material factor tables in rate filings across many states, BuildFax found that each miscategorization across the 15 year line costs a carrier around $50 per premium.

Annually, miscategorized roof age in a pricing strategy is costing carriers $1.14 billion nationally.

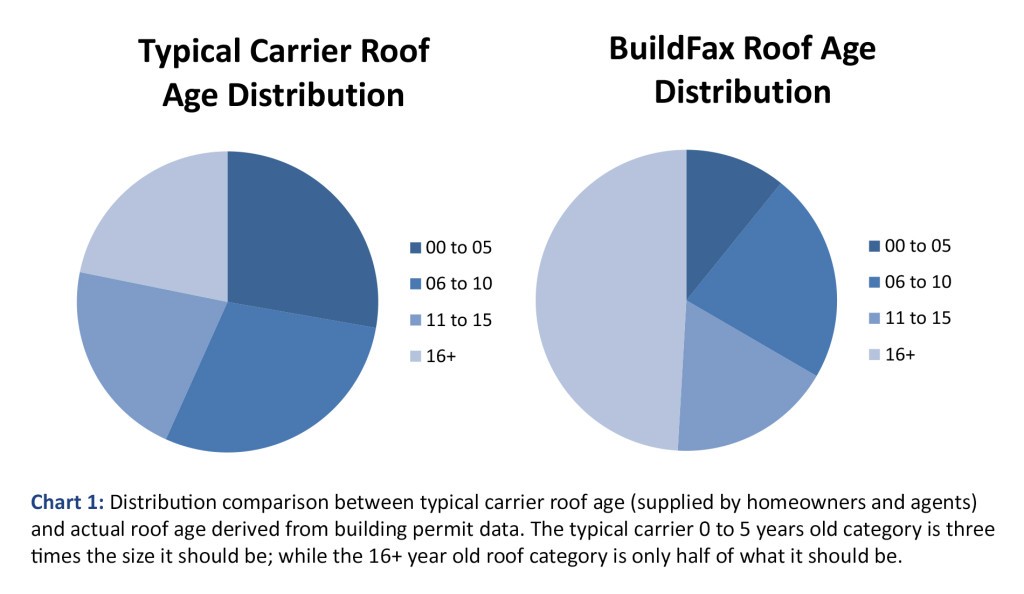

ACV Strategy: BuildFax found that 372 out of 1,000 roofs are (net) misclassified as being younger than 10 years old.

ACV Strategy: BuildFax found that 372 out of 1,000 roofs are (net) misclassified as being younger than 10 years old.

How much does this miscategorization cost? Based on roof loss frequency, the average roof replacement cost, and the average actual cash value roof cost, each miscategorization in an ACV strategy costs a carrier $103 per policy.

Annually, miscategorized roof age in an ACV strategy is costing carriers $1.34 billion nationally.

This loss may be smaller in states where some carriers do not use, or narrowly deploy, an ACV strategy (such as California). However, in wind/hail states, where ACV strategy is more aggressively used, losses will be greater.

Combined Impact: BuildFax found that the total financial impact of underestimated roof age across both strategies is $2.48 billion per year, nationally. Like we said, it’s kind of a big deal.

Key Takeaways

Industry-standard solutions to the roof problem involve pricing (rating or discount/surcharge) and ACV over a certain age. These solutions are based on assumed accurate roof age, which research shows is systematically underestimated. Loss analysis shows that the impact of risk-mitigation solutions that rely on assumed accuracy is costing the industry billions.

- 1 in 4 roofs is miscategorized as under 15 years old;

- 1 in 3 roofs is miscategorized as under 10 years old;

- $30,449 impact per 1,000 policies each year (nationally, based on pricing and ACV).

A research paper by BuildFax co-founders, Joe Emison, CTO and Holly Tachovsky, CEO. BuildFax collects and organizes construction records on millions of U.S. properties.

Emison oversees BuildFax’ cloud architecture and frequently speaks on cloud architecture, scaling in the cloud and cutting costs in the cloud.

Emison oversees BuildFax’ cloud architecture and frequently speaks on cloud architecture, scaling in the cloud and cutting costs in the cloud.

Data industry thought leader Tachovsky has led her pioneering team to take BuildFax from “a cool idea” to its current industry-changing trajectory.

Data industry thought leader Tachovsky has led her pioneering team to take BuildFax from “a cool idea” to its current industry-changing trajectory.

Was this article valuable?

Here are more articles you may enjoy.

US Will Test Infant Formula to See If Botulism Is Wider Risk

US Will Test Infant Formula to See If Botulism Is Wider Risk  Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads  One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand

One out of 10 Cars Sold in Europe Is Now Made by a Chinese Brand  Hackers Hit Sensitive Targets in 37 Nations in Spying Plot

Hackers Hit Sensitive Targets in 37 Nations in Spying Plot