Auto claims frequency and severity dipped considerably during the economic downturn that began in 2008. As the economy recovers it...

premium leakage News

One definitive method can show misrepresented commercial use well before a claim ever arises. Pulling the wool over the insurance...

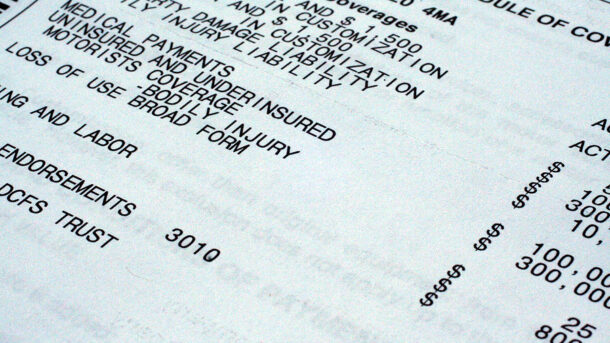

Verisk Analytics estimates that personal lines automobile insurers face at least a $29 billion annual problem from premium leakage—omitted or...

Property/casualty insurance information company Verisk Insurance Solutions is teaming with a technology firm to provide insurance companies with the ability...

Verisk Insurance Solutions – Underwriting, a unit of Verisk Analytics, announced the availability of automated screening for fraud and premium...