Property data provider CoreLogic is rebranding itself to Cotality. The rebrand includes a new name, logo and brand identity. “The...

CoreLogic News

Roughly 170,000 properties were potentially impacted by the outbreak of severe storms across the Midwest and Mississippi Valley, in addition...

Convective storms added to a year of extreme weather events that will put pressure on property insurance rates, particularly in...

Estimates released on Wednesday from CoreLogic show that insured wind and flood losses from Hurricane Milton are expected to be...

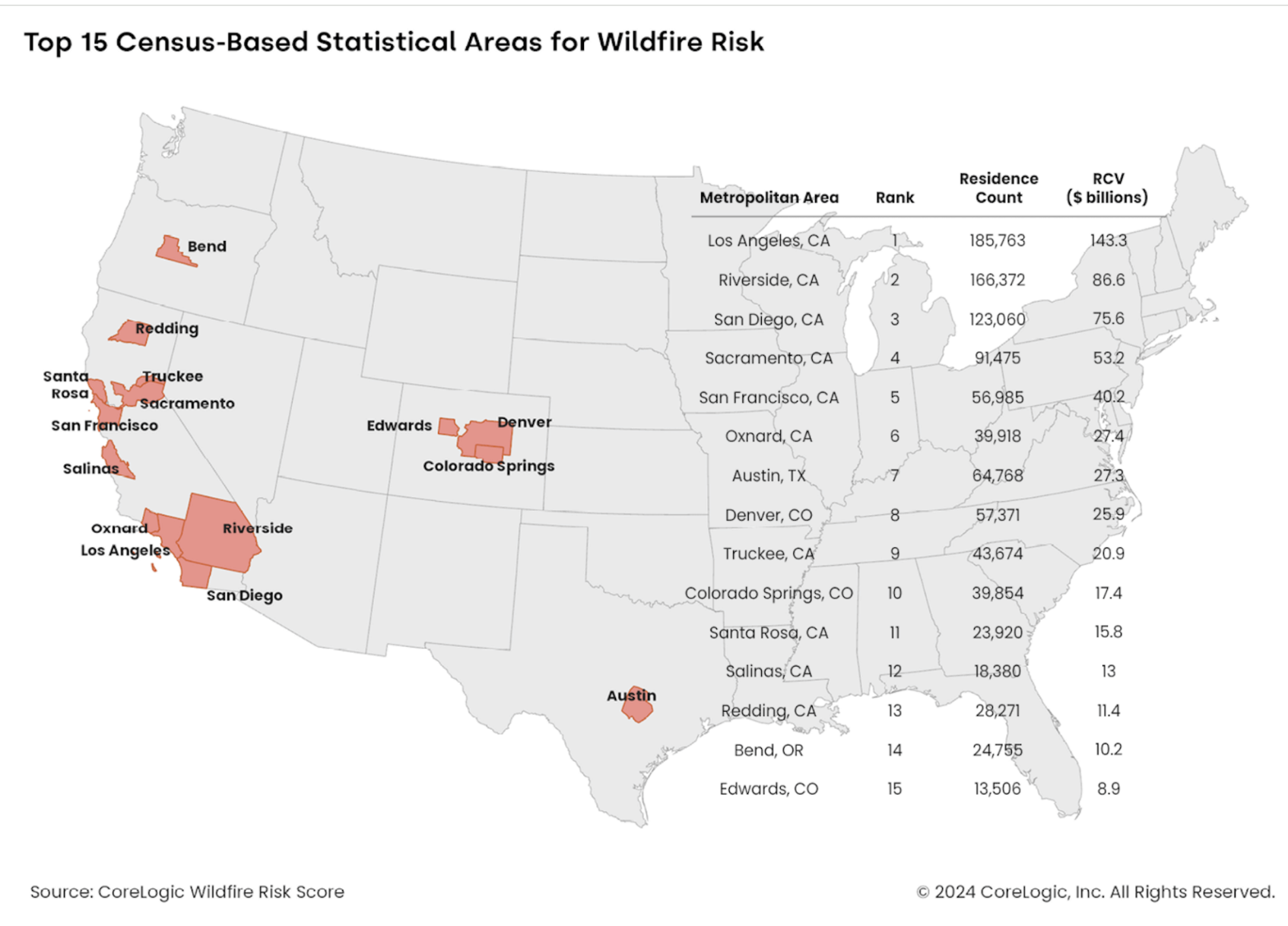

More than 2.6 million homes across 14 states with a total reconstruction cost of $1.3 trillion are at moderate to...

While the official start to California’s wildfire season is still a ways off, the best forecast of what’s ahead may...

More than 1,000 residential properties in New Mexico may have been damaged or destroyed by wildfires in New Mexico, according...

Atlantic hurricane risk in the U.S. continues to increase “substantially as oceanic and atmospheric conditions reach a point where tropical...

More than 32.7 million residential properties are at risk of moderate or severe damage sustained from hurricane-force winds from Texas...

The number of wildfires per year is going down, but the increasing size and intensity of the fires is creating...