Have insurers and defendants been overpaying for asbestos liability claims? Are there other ongoing toxic torts where that might be true today?

The questions arise as a result of a revolution that’s now underway in genomic analysis and its application in civil litigation.

Genomic analyses of molecular data can allow medical scientists to identify an individual’s genetic propensity to develop cancers like mesothelioma and other conditions. Beyond that, the frequency with which genomic analyses have been used in personal injury cases—by both plaintiffs and defendants—is increasing rapidly.

How It Started

An early, impressive use of genomic analysis was in Bowen v. E.I. DuPont de Nemours & Co., 906 A.2d 787 (2006). There, children were born with heart-rending deformities, including malformed eyes. The claim was that fungicide exposure caused the deformities.

Shortly before trial, newly published, peer reviewed research showed that a pathogenic mutation to a particular gene (CHD7) could be the cause of the deformities, independent of any exposure to the fungicide. Genetic testing revealed the children at issue in fact carried pathogenic mutations to the CHD7 gene.

Ultimately, the genetic testing results caused plaintiff’s experts to withdraw their prior opinions on causation, and so summary judgment was entered for the defendant fungicide maker.

Since then, there have been numerous orders around the country requiring some amount of genetic testing in a wide range of cases; the orders usually are in cases involving claims of medical malpractice, product liability and negligence. There have been some state-to-state variations and some denials of genetic testing, mainly when counsel did not make a detailed record. And some plaintiff lawyers undertake their own genetic testing before investing heavily in a case or make arguments based on the results of genetic tests.

The Asbestos Question

Many insurance claims professionals have been conditioned to think that virtually anyone who encountered asbestos in their career or life, and subsequently developed mesothelioma, probably had their disease caused by that exposure. Advances in genomics now reveal, however, that this is not necessarily true.

In fact, genomic analyses have scientifically established that a meaningful percentage of mesotheliomas are caused solely by genetic mutations, a fact that holds true for virtually all cancers. Those scientific findings are now reshaping expert testimony in mesothelioma litigation. In very recent deposition testimony (May and June of 2022) a genetic expert often called by plaintiffs (Dr. Joseph Testa) finally acknowledged that, in fact, some mesotheliomas are caused solely by genetic abnormalities.

That overdue acknowledgement arose from multiple factors:

- One factor was an April 2022 peer reviewed article by an international group of 52 doctors and researchers; the article shows that nearly 100 percent of people who inherited highly pathogenic mutations in the BAP1 gene will develop mesotheliomas and other cancers, independent of any asbestos exposure.

- Another factor was Dr. Testa’s review and acknowledgement of detailed, very recent expert reports by Dr. Len van Zyl of ToxicoGenomica, a PhD geneticist (and colleague of one of the co-authors of this article). As explained by Dr. van Zyl, also key are recent scientific articles showing that particular types of genomic abnormalities cause particular effects in particular types of tissue, thus explaining why particular cancers arise (e.g., mesotheliomas), independent of exposure to asbestos or other substances.

- Another factor was that two defense counsel invested time in being coached on genetics and then asked excellent, detailed questions during four deposition sessions that totaled over 14 hours.

But have insurers been overpaying on asbestos liability claims?

The answer is complicated by group settlements and the fact that there are so many “repeat players” in mesothelioma cases, thereby inducing trade-offs between cases. In short, yes, settlement payments have been made in some cases where asbestos causation was highly dubious or implausible. And importantly, there soon may well be bad faith claims against insurers who fail to fund genomic defenses in appropriate cases.

Genomic analyses can be highly effective in both mass tort and individual cases. Genomic analysis reports are unique to each person, and so costs are higher than costs for generic reports that have been used hundreds of times over many years and that include only a few paragraphs specific to the person. The costs for genomic analyses, however, are relatively small when compared to the potential jury verdicts in cases involving a person under 60 who has a terminal, painful cancer, especially in view of today’s so-called “nuclear verdicts.” Logically, this potential for outsized verdicts compared to the cost of genomic defenses could fuel “bad faith” claims against insurers going forward.

The Economics: When to Use Genomic Analyses

Still, the question of precisely when it becomes economical to pursue genomic analysis as part of a defense doesn’t have a clear-cut answer.

Genomic defenses are credible and appropriate only in some cases. An initial step is to look for the presence or absence of “red flags” (a term of art in the genetics literature) that suggest the likely or possible presence of pathogenic hereditary mutations—for example, personal and family histories of cancer. For defendants, the presence of red flags can suggest investing in genomic analyses for high-value cases or to send a message to plaintiff’s counsel to discourage suits against a defendant that does not belong in the case. Consider the math when the plaintiff has targeted only one or two defendants, the plaintiff is relatively young and successful, and counsel is seriously demanding eight-figures to settle the case.

Tsunamis Ahead

Hundreds of thousands of whole genome sequences, linked to anonymized medical data, are on the cusp of arriving at researchers’ doorsteps with the prospect of transforming both the scientific and legal systems.

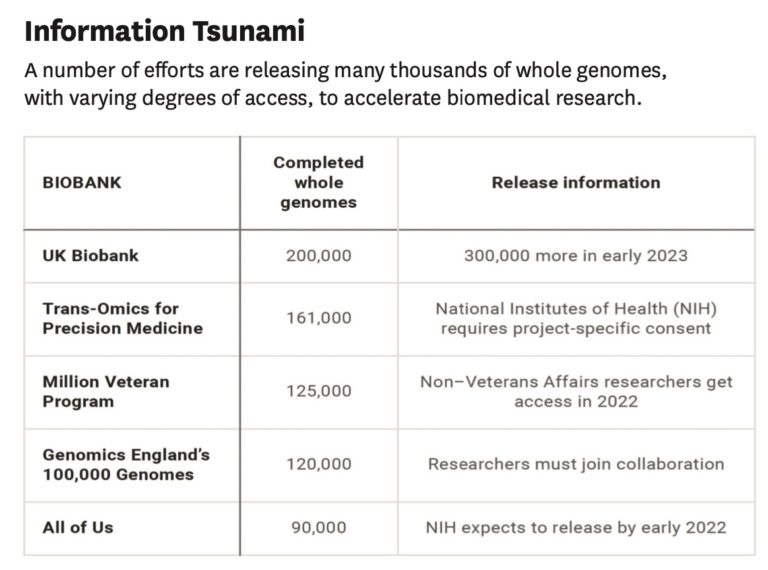

Insurers need to understand the speed and scale of advances in this genomic knowledge. The next 10 years will bring multiple tsunami waves of genomic information. The first tsunami arrived last year with a UK group’s release of 200,000 whole genome analyses, accompanied by anonymized medical records. Another tsunami will arrive in 2023 with the same group’s release of an additional 300,000 whole genomes and anonymized medical records.

The tsunamis will continue as more whole genomes and medical records are released from government programs or other databases (see the chart for examples).

The medical records and genomes are now being mined, and disease-specific papers are now being released that far more reliably link specific genes to specific diseases, while other papers show gene/environment interaction. These “genomic epidemiology” papers in some instances will exonerate defendants and other times will support plaintiffs. Both outcomes create risks of major surprises for stakeholders who are not tracking genomic science as it advances. Stakeholders and lawyers need to start thinking about how they are going to cope with so much risk of a rapid change, and the fact that new knowledge will 1) effect pending claims, 2) may stimulate new claims, and 3) will influence underwriting considerations.

Even though the use of genomics could work for, or against, the defense (e.g., maybe it shows that a toxin was highly likely to have caused the plaintiff’s disease), the best move for insurers is to engage early and intelligently in order to avoid extreme surprises. Simply put, the availability of massive amounts of anonymized medical records and matched genomic data is a “never before” event, and so existing actuarial models simply cannot be as reliable as they are for many other risks. The arrival of genomic epidemiology will not impose surprises and changes as fast or as broadly as did the arrival of COVID. But it seems realistic to suggest the need to manage change and the new data, perhaps by analogizing to the recent development of new forms of extreme weather models based on data and analytic methods that were not available 10 or even five years ago.

The volume of data truly will arrive in tsunamis, and the impact will be highly material for some toxicants. Actuaries simply will not find workable prior models; new methods and models are needed to better manage the changes that will arrive with hundreds of thousands and then millions of anonymized medical records and associated genomic data.

We can’t predict the path or exact ramifications of the tsunami of genomic/medical data to be released over the upcoming decade. But, with great confidence, we can predict that insurers sticking their head in the sand take the risk of surprises and outcomes that could have been avoided.

The time has arrived to invest resources and, yes, money in understanding this scientific revolution and its ramifications for the liability landscape.

The accompanying article has been adapted from a Aug. 16, 2022 research note titled “Liability Insurance: Invest in Genomics Now, the Future is Arriving,” published by Assured Research. Wells Media is publishing with permission from the authors.

Was this article valuable?

Here are more articles you may enjoy.

Red Flags Adjusters Should Look for in Truck Accident Claims Investigations

Red Flags Adjusters Should Look for in Truck Accident Claims Investigations  Insurance Clubs to Halt Ship War-Risk Cover in Persian Gulf

Insurance Clubs to Halt Ship War-Risk Cover in Persian Gulf  Live Nation’s Settlement Efforts Stalled Ahead of DOJ Trial

Live Nation’s Settlement Efforts Stalled Ahead of DOJ Trial  Bayer Wins Court Nod for $7.25 Billion Roundup Settlement

Bayer Wins Court Nod for $7.25 Billion Roundup Settlement