J.D. Power says frustration with slower claim cycle times and a rough transition to digital channels contributed to the lowest customer satisfaction score for property claims in five years.

Overall customer satisfaction with homeowner insurance property claims dropped to 871 on a 1,000-point scale, down from 883 in 2021. J.D. Power said almost all insurers saw a decrease in their score. The 12-point drop in the industry average broke a string of steady increases in customer satisfaction scores during the previous five years.

“Insurers really struggled last year, partly due to circumstances beyond their control,” said Mark Garrett, director of insurance intelligence for J.D. Power. “Longer cycle times, material shortages and personnel availability put added pressure on insurers to keep customers informed and expectations managed. Digital tools were a pivotal part of the process as customers increasingly turned to digital channels by submitting photos to assist in the estimation process and were far more willing to use the tools for status updates. Unfortunately, these digital tools are not always meeting expectations, resulting in support staff needing to get involved. That disconnect creates a major drag on customer satisfaction.”

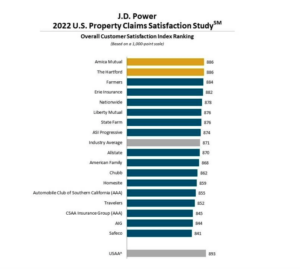

Amica Mutual and The Hartford ranked highest in a tie in property insurance claims experience, each with a score of 886. Farmers ranked third with a score of 884.

J.D. Power said on average, insurers took 17.8 days to complete repairs, up from 2.9 days in 2020. Customers who adopted a fully digital channel experience were rewarded with shorter cycle times, but customers whose experience was only partially digital were less satisfied with the experience.

J.D. Power said on average, insurers took 17.8 days to complete repairs, up from 2.9 days in 2020. Customers who adopted a fully digital channel experience were rewarded with shorter cycle times, but customers whose experience was only partially digital were less satisfied with the experience.

USAA has even higher customer satisfaction — with a score of 893 — but the insurer was not included in the index because it serves only military families.

On the other end of the spectrum, Safeco had the lowest satisfaction rating, 841. American International Group ranked slightly higher at 844.

J.D. Power said satisfaction scores were 47 points lower when customers submitted photos electronically, but still needed to arrange for an in-person inspection. Such “hybrid digital limbo” slowed down the process and made customers more likely to say that the process was more complicated than expected.

Digital claims show huge promise when customers fully use available tools, the company said. Usage of mobile apps increased 19 percentage points from last year’s survey. Also, the latest survey marked the first time that a digital channel —email — overtook phone calls as the most frequently used communication method.

However, only 11% of customers fully used digital channels for all major steps of the claim process: First notice of loss, digital estimation, and status updates.

Customers who used digital tools throughout the claim process saw their repairs get started nine days sooner and rated their satisfaction 33 points higher than customers use did not use digital tools, J.D. Power said.

The U.S. Property Claims Satisfaction Study measures satisfaction with the claims experience among insurance customers who have filed a claim for damages by examining five factors: settlement; claim servicing; FNOL; estimation process; and repair process. The study is based on responses from 5,724 homeowner insurance customers who filed a claim within the previous nine months. The study was fielded from April through December 2021.

Was this article valuable?

Here are more articles you may enjoy.

Live Nation’s Settlement Efforts Stalled Ahead of DOJ Trial

Live Nation’s Settlement Efforts Stalled Ahead of DOJ Trial  Red Flags Adjusters Should Look for in Truck Accident Claims Investigations

Red Flags Adjusters Should Look for in Truck Accident Claims Investigations  Bayer Wins Court Nod for $7.25 Billion Roundup Settlement

Bayer Wins Court Nod for $7.25 Billion Roundup Settlement  Trump Says US Will Escort, Insure Oil Tankers Amid the Iran War

Trump Says US Will Escort, Insure Oil Tankers Amid the Iran War