A sharp decline in claim frequency helped the commercial auto line achieve its best underwriting performance in a decade last year, but rising claim severity threatens to erode profits as traffic returns to US roadways, according to a report released by Fitch ratings this week.

The combined ratio for commercial auto dropped to 101.6 in 2020 from 109.4 in 2019 and may reach a “break-even level” in 2021, Fitch said. That hasn’t happened since 2010.

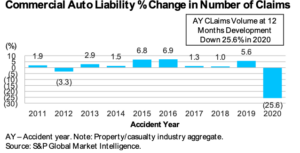

The improvement was driven by year-after-year rate increases and a 25.6% decrease in claims frequency in 2020, the report says. Fitch said the reduction was driven by the sharp decline in driving activity because of the COVID-19 pandemic.

“Claims volume is positioned to rebound in 2021 as driving activity and economic activity continue to increase since late 2020, though current-year performance will still likely benefit from a gradual return to past frequency patterns,” the report says.

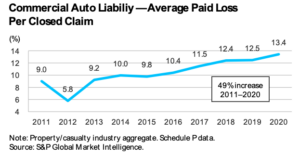

Claim severity is another matter. Fitch said the average paid loss per closed claim jumped 13.4% in 2020, the largest annual uptick in a series of hikes that resulted in a cumulative 49% increase in claim severity since 2011.

Claim severity is another matter. Fitch said the average paid loss per closed claim jumped 13.4% in 2020, the largest annual uptick in a series of hikes that resulted in a cumulative 49% increase in claim severity since 2011.

Fitch said loss costs tend to trend higher over time because of general inflation alone. Increased use of technology by commercial trucking fleets added to that pressure by making repairs and replacement more expensive.

More importantly, Fitch said litigation costs and legal settlements are putting pressure on claims costs. The report cites research by the American Transportation Research Institute, released in June, that found a substantial increase in jury verdicts for transportation claims that exceeded $1 million and $10 million.

The ATRI report says the average size of verdict from 2010 to 2018 increased from $2,305,736 to $22,288,000.

“The evolution of the litigation finance market that provides capital investment for commercial auto claims litigation further expands insurers’ exposure to high severity losses,” Fitch said.

Insurers may not be prepared. Fitch said carriers incurred losses developed unfavorably for each accident year from 2010 to 2019. Fitch said it believes 2019 reserves are still deficient, but the conservative approach taken by actuaries may not have recognized the sharp drop in claims frequency in 202, meaning the 2020 loss ratio is likely overstated.

“Longer term, a return to an adequate reserve position in commercial auto will hinge on insurers maintaining a conservative approach to reporting losses and the ability to recognize shifts in claims trends,” the report said.

Insurers may have to be conservative because there are indications that a decade of steady rate increases in commercial auto may be moderating, the report says. Fitch noted a report by Willis Towers Watson that predicted “decelerating” rate increases in casualty lines, including commercial auto.

Insurers may have to be conservative because there are indications that a decade of steady rate increases in commercial auto may be moderating, the report says. Fitch noted a report by Willis Towers Watson that predicted “decelerating” rate increases in casualty lines, including commercial auto.

Technology offers some hope. Fitch said developments in global positioning systems, sensor technology and telematics allow trucking companies to better monitor driver behavior and vehicle use. Electronic logging devices required by the Federal Motor Carrier Safety Administration adds to an abundance of data.

“Advances in data analytics and predictive modeling give commercial auto insurers tremendous opportunities in claims,” Fitch said. “Scoring models provide a tool to quickly identify incidents that correspond with large losses or have a strong propensity for litigation. More sophisticated analytics and artificial intelligence provide tools for the identification and prevention of fraudulent claims.”

Clearly, some carriers have been able to control costs better than others. The report says Progressive Corp. — the nation’s largest commercial auto carrier with a 13.1% market share — posted combined loss ratios that averaged 86% over the past three years. Among the top 15 carriers, only Chubb Limited, Erie Insurance and Tokio Marine US also posted combined loss ratios at or below the break-even point of 100%, the report says.

Liberty Mutual (122%), State Farm Mutual Group (121%), Nationwide (118%), and Travelers (112%) had combined ratios that exceeded the industry average.

A summary of the report is available on the Fitch Ratings website.

Was this article valuable?

Here are more articles you may enjoy.

Claims Handling Breakdowns From LA Wildfires One Year on

Claims Handling Breakdowns From LA Wildfires One Year on  UK Floods Raise Specter of ‘Mortgage Prisoners’ Across Banks

UK Floods Raise Specter of ‘Mortgage Prisoners’ Across Banks  Moody’s: LA Wildfires, US Catastrophes Drove Bulk of Global Insured Losses in 2025

Moody’s: LA Wildfires, US Catastrophes Drove Bulk of Global Insured Losses in 2025  Building Fortification And The Role of The Insurance Industry

Building Fortification And The Role of The Insurance Industry