An instinct for self-preservation has carriers dipping their toes into the smart home technology space, but no U.S. insurer has taken a full plunge so far.

The industry hasn’t settled on how it should get devices such as water-leak detectors and upgraded fire-prevention sensors into their customers’ homes. Carriers have only just begun to collect the data thats needed to show how effective smart home technology can be for loss control.

“They at least conceptually realize that these devices have significant potential to mitigate risks and reduce claims,” said Brad Russell an analyst for Parks Associates, a market research firm based in Dallas that focuses on the internet of things.

But without hard data, what amount of premium discount is that worth?

“It’s kind of a chicken or egg conundrum for the insurance industry,” Russell said. “They have to put these devices in 100,000 homes to quantity the savings.”

Russell said he is aware of only one carrier that offers an insurance product fully coupled with smart-home technology: Neos, a startup carrier that launched in the United Kingdom in 2016.

Neos sends its customers an array of sensors designed to reduce risks from fires, water damage and break-ins that are installed by the policyholder. Alerts go to a 24-hour response center that can dispatch contractors if needed. The price is included in the policy premium.

In the United States, by contrast, insurers have launched a variety of pilot products. For example:

- On Tuesday, Farmers Protective Mutual Insurance Co. announced a partnership with Roost, a home telematics provider based in Sunnyvale, California. Policyholders will be offered sensors to detect water leaks connected to home wi-fi systems.

- In February, Berkshire Hathaway’s Guard Insurance Cos. announced that it has teamed up with Triple+ to offer its policyholders water-leak detection sensors at discounted prices. The equipment will shut off the main water supply if it detects flooding, the companies said.

- Last October, Travelers announced that it had teamed up with Amazon to offer policyholders in participating states discounts on smart home kits, including security cameras and water-leak detectors.

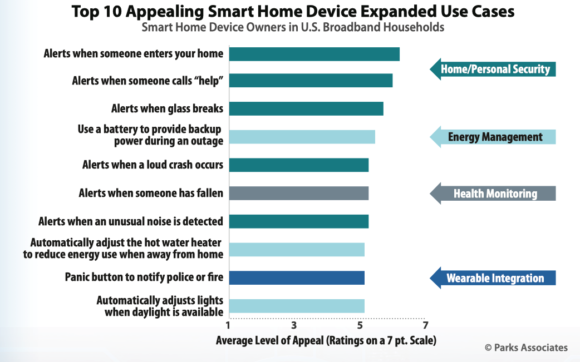

Russell said the enormous popularity of video doorbells should be a signal to insurers that their involvement can’t be limited to offering discounts on products. According to Parks Associates’ research, 25% of U.S. households with broadband internet access plan to install a video doorbell in 2019. What’s more, 40% of U.S. households with broadband would switch insurance carriers in order to obtain smart home products, the company said in a white paper.

Smart home technology also offers insurers an opportunity to differentiate themselves from competitors, Russell said. Consumers often view insurance like a commodity; that is, there’s not much difference among providers other than the cost. By offering a superior level of service, insurers can gain market share, he said, which means carriers that don’t will steadily lose customers.

It doesn’t hurt that market research has shown consumers trust insurance companies more than any other type of service provider, Russell said.

“It’s part of the model that the insurance company is there to protect,” he said. “It’s in the very nature of the customer relationship.”

Russell said the true value of smart home technology, as far as insurers are concerned, is data collection. The question is, how to best obtain access to that data?

For American Family Insurance, the answer is a partnership with Neos, the U.K. property insurer that has gone full bore into smart home technology. American Family has formed a partnership with Neos to offer smart home technology to policyholders.

Andy Kearns, state product director for American Family, said the contract allows his company to essentially borrow Neos’ business model for U.S. customers. Kearns said American Family will offer its policyholders access to the same array of smart home products that Neos provides to its customers.

The carrier is starting with a pilot project for customers in Arizona and Washington that will be rolled out in August.Kearns said the pricing structure has not yet been worked out.

Kearns said American Family picked Arizona and Washington for its pilot because both have adopted rules that specifically encourage the use of smart home technology. He said insurance regulations can be an obstacle because carriers are generally prohibited from offering rebates that are not disclosed in rate filings.

American Family has been dabbling in smart home projects for awhile. In 2015, it announced apartnership with Nest to offer policy discounts to customers in Minnesota who installed the Nest smoke and carbon monoxide detector. Also in 2015, American Family teamed up with Ring to offer policyholders $30 discounts on video doorbells.

Kearns said the purpose of all of the partnerships is to collect information on what customers want, while at the same time gathering data on how smart technology devices impact insurers losses. He said if American Family is going to offer discounts for smart home technology, it needs to first work with regulators to provide data that can withstand “actuarial rigor.”

A white paper written by American Family in conjunction with the Internet of Things Insurance Observatory outlines the carrier’s reasoning for investing in smart home technology. Citing Insurance Information Institute data, the paper says damage caused by water and freezing is the second-most common cause of loss for property insurers, with 2.05 claims for 100 policy years, behind only wind and hail damage in claim frequency. The average water and freezing damage claim costs $10,234.

“For customers who have not experienced water loss, water damage prevention is not top of mind,” the white paper states. “However, customers are highly receptive to avoiding such loss after a recent incident.”

Crawford & Co., the Atlanta-based third-party administrator, is offering another route to get smart home technology to policyholders.

In April, Crawford & Co. launched a subscription service for insurance carriers that links policyholders to water-leak detection sensors. Michael Beverly, property product manager for the company said customers install the devices on their own. Once they are hooked up, they are connected to both the homeowner’s smart phone and a 24-hour call center. If any leak is detected, the water-detection device will shut off the flow of water and sent an alert. Crawford & Co. will dispatch a contractor who will be on site within an hour, he said.

“We are all about servicing,” Beverly said. “A lot of the carriers are getting the the alert level. The rapid alert is great, but you still have to have some quick intervention.”

Was this article valuable?

Here are more articles you may enjoy.

Red Flags Adjusters Should Look for in Truck Accident Claims Investigations

Red Flags Adjusters Should Look for in Truck Accident Claims Investigations  Bayer to Make $10.5 Billion Push to Settle Roundup Cases

Bayer to Make $10.5 Billion Push to Settle Roundup Cases  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  When the Workplace Is Everywhere: The New Reality of Workers’ Comp Claims

When the Workplace Is Everywhere: The New Reality of Workers’ Comp Claims