Claims cost per injured vehicle are still increasing in the United States, even though better vehicle safety has helped reduce claims frequency, the Insurance Research Council found in a new report.

The IRC, a division of the American Institute For Chartered Property Casualty Underwriters (The Institutes), said the results point to a need for further scrutiny of what is driving those costs.

“Documenting the specific drivers of cost in the states where cost growth is greatest will be a priority for the IRC in the years ahead,” Elizabeth Sprinkel, an IRC senior vice president, said in prepared remarks.

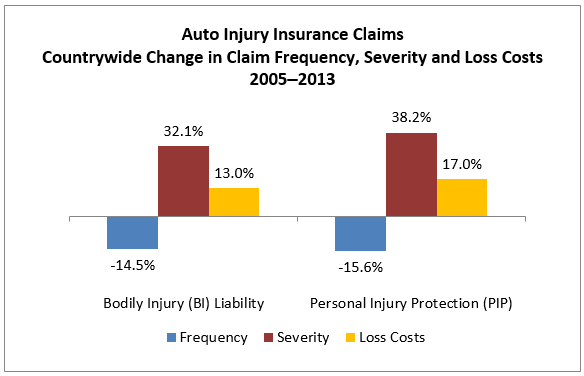

Bodily injury liability claims frequency fell nationally by 14.5 percent from 2005 to 2013, the IRC determined in “Trends in Auto Injury Claims, 2015 Edition.” That translates to a dip from 0.94 paid claims per 100 insured vehicles to 0.81 paid claim. At the same time, however, the average cost per paid liability claim grew from $11,738 to $15,506, a jump of 32.1 percent.

Bodily injury liability claims frequency fell nationally by 14.5 percent from 2005 to 2013, the IRC determined in “Trends in Auto Injury Claims, 2015 Edition.” That translates to a dip from 0.94 paid claims per 100 insured vehicles to 0.81 paid claim. At the same time, however, the average cost per paid liability claim grew from $11,738 to $15,506, a jump of 32.1 percent.

The same thing happened with personal injury protection (no fault) claims, which dropped in frequency from 1.49 to 1.25 paid claims per 100 insured vehicles over the same period. But the average cost per claim jumped in this category from $5,802 to $8,017, according to the IRC, a 38.2 percent hike.

The IRC said that every state except for Florida, Kansas, Kentucky and Maryland saw a decline in bodily injury claim frequency from 2005 through 2015. Also, every state with personal injury protection coverage (PIP) except for South Carolina had a drop in PIP claim frequency.

Meanwhile, every state except for West Virginia experienced a jump in bodily injury claim severity from 2005 to 2013. All U.S. states save for Pennsylvania experienced an increase in PIP claim severity.

Some states saw jumps that were worse than others. Michigan, for example, had the average payment per personal injury protection claim soar from $25,997 to $44,756 over the studied period, a 72.2 percent jump. Other jurisdictions with substantial increases in PIP claim severity are New York (40.2 percent), Washington (40.1 percent), Oregon (42.3 percent) and the District of Columbia (55.8 percent).

The IRC suggested that reports of a jump in traffic deaths could signify “a change in the beneficial long-term trend of declining claim frequency,” something that could make costs trends more severe.

Source: Insurance Research Council

Was this article valuable?

Here are more articles you may enjoy.

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says

Credit Suisse Nazi Probe Reveals Fresh SS Ties, Senator Says  Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims

Why 2026 Is The Tipping Point for The Evolving Role of AI in Law and Claims  Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms

Cape Cod Faces Highest Snow Risk as New Coastal Storm Forms  Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo

Canceled FEMA Review Council Vote Leaves Flood Insurance Reforms in Limbo