By this point, we have all likely seen and read at least a handful of articles centered around millennials and their effect on nearly every facet of life. This is not surprising as millennials are currently the largest generation, at nearly 80 million in the United States, according to Pew Research Center. The property/casualty insurance industry, and specifically total loss claims management, is no different. In an industry where high-tech is not typically the first word that comes to mind, the millennial effect is helping to change that to everyone’s benefit – consumers and insurers alike. One of the major high-tech trends that millennials are embracing is on-demand services. There are many reasons why millennials have been a driving force in the adoption of on-demand services in the last few years — smartphone adoption, mobile payment platforms and social authentication, to name a few. Millennials seek out and have come to expect products and services that meet their needs – on their terms and in their timeframe – and in doing so have caused the rest of us to have similar expectations. When insurers understand the on-demand trend and are capable of adopting these technologies into the claims management process, they have the opportunity to more successfully attract and retain customers in what is a very competitive field.

In the decade preceding the recession, CCC Information Services reported that new vehicle sales averaged 16.7 million units per year. That figure plummeted in 2008, which found droves of recently graduated millennials without the buying power that previous generations possessed. CCC also reported that the consumer slowdown in new vehicle sales resulted in approximately 22 million fewer new vehicles hitting the road during that time. With consumers delaying new vehicle purchases, the average age of the vehicle population naturally increased. This metric currently sits at 11.5 years, and IHS Automotive predicts that it will continue to increase to 11.7 years by 2018. This data is significant because, according to CCC, the percentage of claims deemed a total loss increases as the vehicle population ages. From 2011 through 2015, more than 70 percentage of all total loss valuations were attributed to vehicles older than seven years. During that span, the percentage of all claims declared a total loss increased from 14.7 percent in 2011 to 15.4 percent in 2015. And as the pool of total loss claims increases, so does the need for keeping customers satisfied at a level they’ve come to expect.

Given the rise in total loss percentage, it is also no surprise that average length of rental (LOR) – a proxy for average length of repair – has increased as well. According to Enterprise Holdings Inc., average LOR rose to 11.5 days in the fourth quarter of 2015, up 0.3 days year-over-year. Assuming a daily rental charge of $31.00, this would equate to approximately $356.50 per claim. A higher average LOR is certainly unwelcome news, with claims departments facing constant pressure to reduce cycle times and costs in order to attract and retain customers.

According to Capgemini’s World Insurance Report 2015, throughout the insurance lifecycle, claims servicing has the lowest percentage of customers with a positive experience. The report also found that customers who file an insurance claim tend to have lower positive customer experience levels than those who do not. In North America in 2014, 37 percent of the customers surveyed by Capgemini reported a positive experience with auto insurance if they made a claim in the past year, versus 46 percent of customers who made no claim during that same period. This is natural given the stressful nature of an auto insurance claim, but with claims servicing being arguably the most important factor for customer retention, it still indicates a problem area where p/c carriers need to constantly access options for improvement.

Even under the best circumstances, managing an insurance claim can be a trying experience for policyholders. Communicating with the necessary parties, properly submitting paperwork, and managing and understanding claim status are just a few of the challenges they face. These setbacks make the whole process seem daunting to anyone, not only to millennials who often are still fairly new to the world of managing their own auto insurance. When you couple these challenges with the desire for instant access to information or customer service, and the ability to problem solve through multiple devices and platforms, the application of on-demand technology is highly desirable and tremendously beneficial.

By offering a web-based, self-service tool, carriers can give policyholders the freedom to track claims from any internet-connected device without ever having to call and connect with the claim agent or adjuster. From downloading and submitting paperwork or photos of damage, to facilitating efficient communication, the self-service approach provides better access to information, visibility to real-time status updates, and a reduction in documentation issues. Using on-demand technology to significantly transform customer experience can have a significant positive impact on customer satisfaction and ultimately retention.

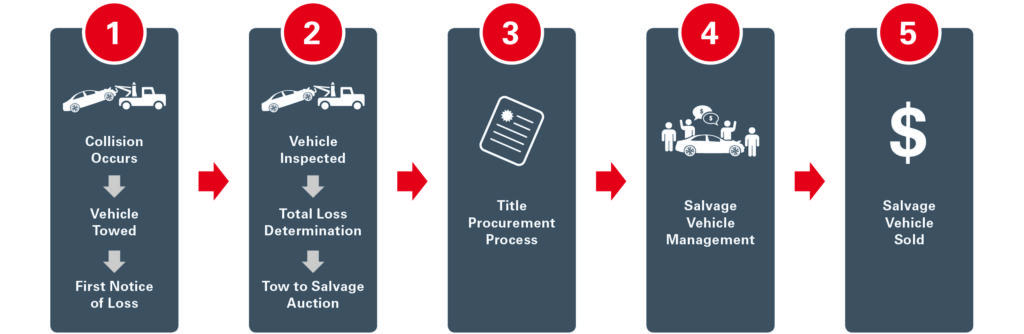

Now that customers have instant access to claims information, it is equally important to maintain the accuracy and visibility of a claim’s status to ensure customer satisfaction. This begins with identifying redundancies throughout every step of the claims process, and anyone involved with the auto insurance industry knows that there are plenty to choose from. Although the process varies by insurance carrier, an average industry process will help us identify the seemingly minor delays that can become major bottlenecks (see Figure 1).

The inevitable first step for a collision claim is the occurrence of an accident, which causes the vehicle to be towed to a designated location. This is the point in the process where the first notice of loss is communicated, and a claims representative is deployed to inspect the vehicle. If it is determined that the vehicle is a total loss, it is assigned and towed to a salvage auction. P/c insurers also want on-demand technology that provides them with the flexibility to make this process more efficient to simultaneously reduce costs and save time. An auto auction partner can provide a solution that manages the entire inspections process, which can also integrate a carrier’s existing data or current appraisal partners to ensure a seamless operation.

This solution also can provide direct towing to an auction yard to eliminate multiple tows, high-resolution imagery to match the carrier’s specifications, and a condition report to save the expense of sending an appraiser to inspect the vehicle. Providing the carrier with a technology-based platform that manages the entire inspections process can enable fast and accurate desk appraisals that not only reduce cycle times, but also digitize the progress for their customers to track online

It may be a surprise to some, but as many claims managers know all too well, the title procurement process is a major influencer of customer satisfaction, as well as employee engagement. From a cycle time perspective, title procurement often has the greatest influence on overall efficiency. One of the most formidable barriers to reducing cycle times has been securing power of attorney (POA) from the claimant, a process which can also drive customer experience. According to a case study done by IAA of over 100,000 salvage vehicles, the power of attorney (POA) paperwork for 10-20 percent of claims is submitted incorrectly. This adds time to the total process in the form of follow-up communications that frustrate customers and tie up employees in hours of avoidable paperwork.

While this is occurring, claims departments are also managing the auction process – assigning vehicles, monitoring inventory and more – through a separate system. This lack of alignment points to an obvious solution: combine the title procurement and auction management functions into one cohesive system. With all of the necessary information in one location, carriers can avoid costly errors and more effectively manage their claims. Once the vehicle is declared a total loss, every step of the process could be managed through one platform, allowing claims departments to focus on value-adding tasks. And with talent representing the most important investment a p/c company can make, freeing up employees for more engaging work they and their companies value directly appeals to millennials who, according to Pew Research Center, now represent more than one-in-three American workers.

Since millennials are not only your customers, but also your employees, it is no surprise that our largest generation, who grew up with rapidly-changing technology, is helping drive innovation and available technologies for the industry. By focusing on technologies that ultimately impact customer experience at every level, p/c carriers can put processes and tools in place that will satisfy customer expectations, maximize employee engagement and manage costs. Understanding where the industry is headed and implementing against that is a wise decision which could pay tremendous dividends for everyone all around – companies, employees and consumers.

Pat Walsh is a senior vice president for Insurance Auto Auctions, Inc. He recently launched IAA Total Loss Solutions, and leads IAA’s acquisition efforts, as well as several other growth-related and product development activities, including diversified claims services for insurance company clients. Pat can be reached at PWalsh@IAAI.com, (708) 492-7000, www.IAA-Auctions.com. To learn more about IAA Total Loss Solutions, please visit https://iaa-auctions.com/services/sell-vehicles.

Pat Walsh is a senior vice president for Insurance Auto Auctions, Inc. He recently launched IAA Total Loss Solutions, and leads IAA’s acquisition efforts, as well as several other growth-related and product development activities, including diversified claims services for insurance company clients. Pat can be reached at PWalsh@IAAI.com, (708) 492-7000, www.IAA-Auctions.com. To learn more about IAA Total Loss Solutions, please visit https://iaa-auctions.com/services/sell-vehicles.