The property/casualty (P&C) industry has the opportunity to dramatically improve operational efficiencies and increase productivity by deploying electronic data interchange (EDI) methodologies to handle medical billing and payments. For most claims operations, billing and payments account for the highest volume of paper interactions between providers and payers.

Today, 73 percent of consumers who access the Internet at least once a week now pay at least one bill online each month. The P&C industry however has lagged behind when it comes to streamlining traditional billing and payment processes, instead relying on paper-centric methods. Nationally, healthcare providers and payers have been sending electronic bills for quite some time, yet it is only in the last five years that the P&C industry has recognized the advantages of electronic billing (eBilling), and now electronic payment (ePayment).

The Patient Protection and Affordable Care Act (ACA) of 2010, in addition to the 1996 Health Insurance Portability and Accountability Act (HIPAA), have been the major drivers in establishing requirements for administrative transactions that improve the effectiveness of medical information exchange and reduce administrative costs. Recently, a set of operating rules – the Attachment Operating Rules and the National Operating Rules – were established by the Council for Affordable Quality Healthcare (CAQH) / Committee on Operating Rules for Information Exchange (CORE), not only to address eligibility and claims status, but also attachments, Electronic Funds Transfer (EFT) and Electronic Remittance Advice (ERA) standards. The Attachment Operating Rules are effective June 1, 2014 with an implementation date of January 1, 2016. The EFT and ERA effective date of implementation of the National Operating Rules is January 1, 2014. Today, according to HIPAA, the P&C industry is exempt from these rules. However, more and more states are enacting requirements that incorporate eBilling and EFT technologies as the means to interact between providers and payers.

eBilling and ePayment: State-Specific Drivers

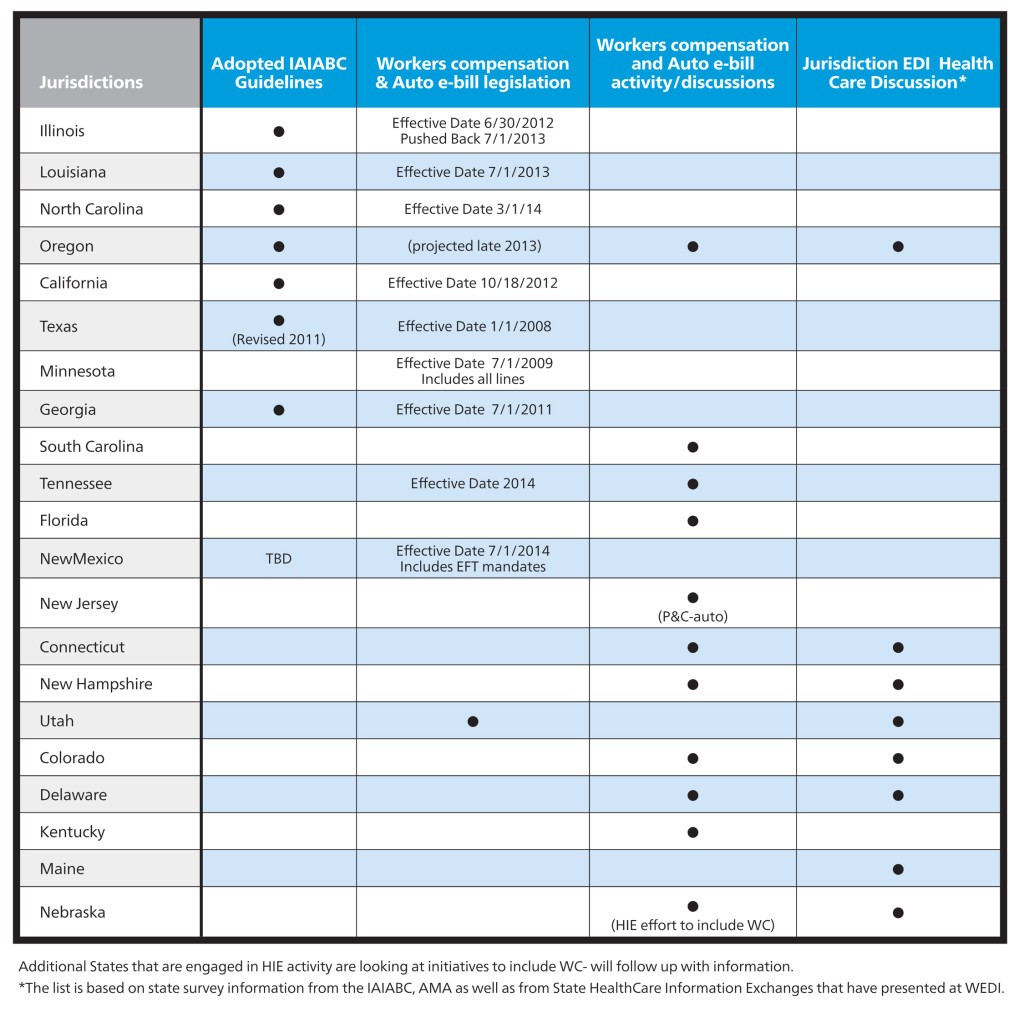

In 2008 the State of Texas adopted HIPAA ASCX12 electronic transaction sets and mandated eBilling for both payers and providers in the workers’ compensation industry. Shortly thereafter, in 2009, Minnesota adopted eBilling rules requiring payers and provider to exchange medical billing transactions electronically for all lines of business. Georgia implemented voluntary eBilling rules in 2011. California’s eBilling requirements became effective in October of 2012. Louisiana’s eBilling rules are effective July 1, 2013.The standard model is that payers have the ability to accept electronic bills and attachments. North Carolina and New Mexico have adopted rules that are effective in 2014, including EFT. Oregon and Tennessee have target dates in 2014 as well, and additional states are contemplating adoption of eBilling rules as part of their workers’ compensation reform initiatives according to the International Association of Industrial Accident Boards and Commissions (IAIABC) & the American Medical Association (AMA).

Increase in eBilling Adoption: What Has Changed?

Increase in eBilling Adoption: What Has Changed?

There are several key industry factors driving the adoption of eBilling and ePayment for the P&C market.

As part of their workers’ compensation reform initiatives, many states are adopting eBilling as a strategy to gain administrative simplification, automating workflow processes to improve the integrity and accuracy of data collection. As part of the eBilling state mandates, states are aligning with the national HIPAA rules and standards, as applicable, to facilitate stakeholder adoption.

Industry collaboration has played a major role in eBilling adoption. The National Standard Development Organizations (WEDI, IAIABC, ASC X12) along with the states adopting eBilling and the AMA have collaborated to address the P&C industry’s business needs. As a result of this effort, the IAIABC published the 2010 National Workers’ Compensation Electronic Medical Billing and Payment Guides based on the National HIPAA X12 Standards and NCPDP D.0. Today, heath care providers can use the same EDI transactions they use for Medicare and commercial claims for workers’ compensation and auto claim processing. Also, there have been many innovations that assist providers in managing attachments, which is a required component for most P&C medical billing transactions, and a key point of differentiation between the P&C industry and group / commercial claims. Also, the IAIABC as part of the industry’s collaboration effort, developed an eBilling model rule template to provide states guidance when developing their eBilling workers’ compensation regulations. The key factor accentuating the need for eBilling has been the AMA’s response to the provider community’s demands for a single workflow process for all lines of business. The AMA’s participation in the industry collaboration efforts to enable providers to use the same EDI transactions for workers’ compensation and auto processing has significantly enhanced the rate of adoption of eBilling for healthcare providers. In addition, the AMA has been a major advocate of eBilling and ePayment legislation for workers’ compensation and the auto industry. To assist their members and other stakeholders at large, the AMA developed a national eBilling Workers’ Compensation and Auto Educational Toolkit to help facilitate adoption www.ama-assn.org/go/workerscomp

Another important game-changer is that provider technology solutions (practice management systems, clearinghouses and billing services) are now offering P&C connectivity capabilities, including supporting attachments. Vendors in the past have not embraced P&C eBilling due to the lack of existing industry standards. With P&C eBilling standards now aligning with the National EDI Standards, this barrier has been removed, allowing providers to be able to use their existing technology vendors to send their workers’ compensation, auto bills and attachments.

Benefits of eBilling: What Payers and Providers are Reporting

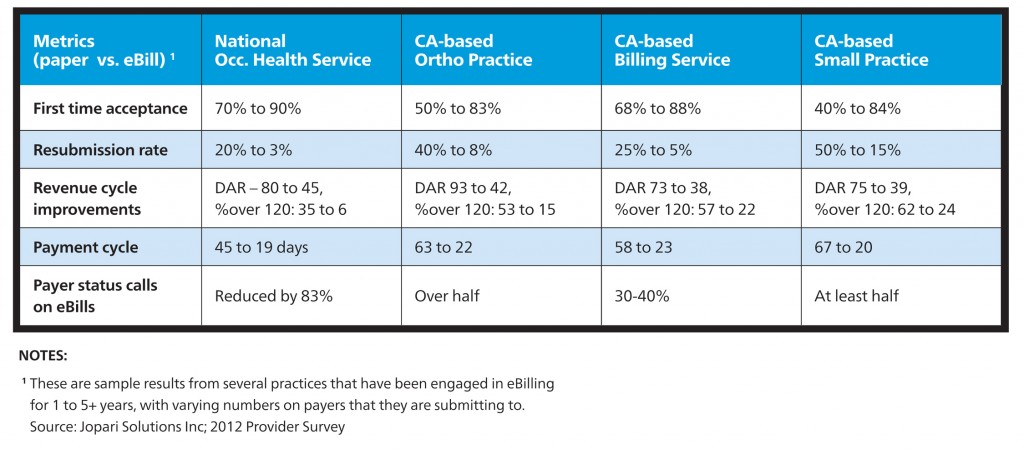

Providers and payers countrywide are exchanging bills and attachments electronically, even without a state-specific regulations based on return on investment results and the need for administrative simplification. Handling paper is expensive, creating timeliness and accuracy issues. The following are eBilling payer reported metrics from a 2012 survey conducted by Jopari Solutions Inc., a national payer and provider eBilling clearinghouse:

- Sixty-three percent of first round of bills submitted successfully

- Seventy percent reduction in duplicate billing

- Use of CARC / RARC vs. proprietary codes resulted in a reduction in requests for Appeals / Reconsiderations

- 64 percent reduction in bill status inquiries

- Reduced “lost bills” due to acknowledgement process

- Improved data quality

– Upfront edits ensure complete and proper data

– Improved auto-adjudication rates – “end to end” processing

– Information for medical management available more quickly

- Better data which leads to better analytics

- Improved provider relations through timely and accurate payment

Provider eBill Reported Metrics based on 2012 California Provider Survey  eBilling, ePayment and EFT Opportunities

eBilling, ePayment and EFT Opportunities

For almost two decades, HIPAA covered entities, such as commercial and governmental payers and their trading partners, have been required to send and receive HIPAA standard transactions, such as claims, claim status, electronic remittance advices and EFT. The infrastructure is in place for the widespread adoption of eBilling and ePayment. Now, P&C organizations and stakeholders can take advantage of these opportunities and streamline their administrative process. By doing so, they should experience the following benefits:

- Cleaner, more timely data that can be adjudicated by the payer faster;

- Expedited information delivery to enhance the creation of claims, initiation of case management and lower indemnity / medical costs;

- Significant reduction in claim status calls and improved customer and provider satisfaction;

- Improved payment cycles to exceed provider expectations;

- True workflow automation to aid in the streamlining of operational costs and maximize resource management opportunities;

- Ability for providers to utilize the same national transaction sets as group / commercial claims;

- EDI standardization will facilitate cost effective implementation of eBilling;

- Stakeholders can adopt eBilling as a standard operating method, regardless of current state legislation .

In summary, the P&C industry has access to tools and processes that will make a serious impact on the historically paper and labor intensive approach to claims management. When integrated with workflow and other sophisticated claims decision tools, these tools can transform an organization’s operations, improve their interactions with the medical community, reducing overall claims and expense costs. If not fully engaged with these methods, organizations in the P&C industry must establish a plan. Whether the motivation is to be compliant, or to genuinely embrace change, eBilling will soon be the standard. The overall climate to achieve administrative simplification has tremendous momentum, one that is much larger than the P&C industry alone. Now is the time to get involved.

![don-st-jacques2[1]](https://www.claimsjournal.com/app/uploads/2013/06/don-st-jacques21-150x150.jpg) By Don St. Jacques, SVP, Business Development and Client Services for Jopari Solutions, a nationwide supplier of eBilling and ePayment solutions for the workers’ compensation/auto medical industries.

By Don St. Jacques, SVP, Business Development and Client Services for Jopari Solutions, a nationwide supplier of eBilling and ePayment solutions for the workers’ compensation/auto medical industries.

By Sherry Hoefel, director of Regulatory & Compliance for Mitchell International.She is responsible for monitoring legislative and administrative rules, automation of compliance pricing and rules, and collaborating with state and federal organizations to develop alliances and provide up to date information and insights on compliance news and trends.

By Sherry Hoefel, director of Regulatory & Compliance for Mitchell International.She is responsible for monitoring legislative and administrative rules, automation of compliance pricing and rules, and collaborating with state and federal organizations to develop alliances and provide up to date information and insights on compliance news and trends.

Was this article valuable?

Here are more articles you may enjoy.

Elon Musk Alone Can’t Explain Tesla’s Owner Exodus

Elon Musk Alone Can’t Explain Tesla’s Owner Exodus  Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver

Tesla Sued Over Crash That Trapped, Killed Massachusetts Driver  FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings

FM Using AI to Elevate Claims to Deliver More Than Just Cost Savings  Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads

Portugal Rolls Out $2.9 Billion Aid as Deadly Flooding Spreads