In its annual look at questionable claims (QC) in the United States, the analysis released today by the National Insurance Crime Bureau (NICB) reports that in the three-year period from January 1, 2010 through December 31, 2012, there was a 16 percent increase in QCs from 2011 to 2012 (100,201 to 116,171) and a 27 percent increase over the past three years (91,652 to 116,171).

California was home to the most QCs generating 58,415 over the three-year period. It was followed by Florida (29,086), Texas (27,107), New York (23,402) and Maryland (10,315).

The report further breaks down the QCs by city and by Core-Based Statistical Area (CBSA). The top five cities for QCs were New York (13,564), Los Angeles (7,779), Miami (5,503), Houston (5,464) and Baltimore (3,690). The top five CBSAs generating the most QCs were Los Angeles-Long Beach-Santa Ana, CA (25,939), New York-Northern New Jersey-Long Island, NY-NJ (20,849), Miami-Fort Lauderdale-Pompano Beach, FL (12,068), Dallas-Ft. Worth-Arlington, TX (6,719) and Chicago-Naperville-Joliet, IL-IN-WI (7,702).

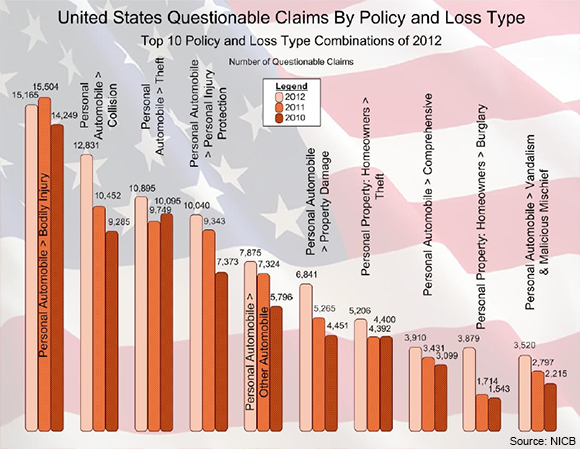

Of the various insurance policy types, the top five identified in the report were personal automobile (209,724), personal property/homeowners (40,747), workers’ compensation/employers’ liability (11,151), commercial automobile (9,512) and commercial liability/general liability (7,519).

A single QC can contain up to seven referral reasons. The top five referral reasons reflected in this report were casualty-faked/exaggerated injury (50,472), vehicle-questionable auto/boat/heavy equipment theft (35,508), miscellaneous-prior loss/damage (29,646), miscellaneous-fictitious loss (29,017) and property-suspicious theft/loss non-vehicle (24,867).

Source: NICB

Was this article valuable?

Here are more articles you may enjoy.

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims

LA County Told to Pause $4B in Abuse Payouts as DA Probes Fraud Claims  Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions

Founder of Auto Parts Maker Charged With Fraud That Wiped Out Billions  China Bans Hidden Car Door Handles in World-First Safety Policy

China Bans Hidden Car Door Handles in World-First Safety Policy  Danone Infant Formula Recalls Expand in UK, Ireland

Danone Infant Formula Recalls Expand in UK, Ireland