California workers had filed 5,093 COVID-19 workers’ compensation claims as of Tuesday, according to the state Department of Industrial Relations, a pace that might lead to a lower impact on costs than projected by actuaries.

The potential cost of the novel coronavirus on the California workers’ compensation system looms large because Gov. Gavin Newsom on May 6 issued an executive order that eases the path toward benefits for workers who contract the disease. Newsom created a presumption that any coronavirus infection claimed by employees who did not work at home is a compensable occupational disease, but only if the claimant submits a positive test or diagnosis within 14 days.

At least 13 other states have similarly expanded workers’ comp coverage for first responders or medical workers through legislation and executive orders. Kentucky Gov. Andy Beshear included “essential workers” to his order.

In California — which has the nation’s biggest work comp system — the Workers’ Compensation Insurance Rating Bureau examined Newsom’s order to estimate how much it might cost. The bureau provided a “mid-range” estimate of 31,100 COVID-19 claims during 2020, at a cost of $1.2 billion — an amount equal to 7% of the prior year’s total costs.

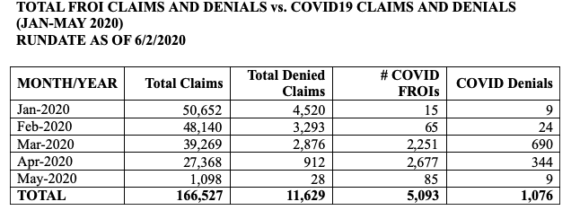

The 5,093 COVID-19 first report of injury submissions so far make up 3 percent of the total 166,527 workers’ compensation claims filed from Jan. 1 to June 2, according to figures provided by the Department of Industrial Relations in response to a request by the Claims Journal. Of course, the cost of those claims will not be known until those claims are resolved and all benefits paid.

To reach WCIRB’s projected total, at least 2,592 claims must be filed in each of the 12 months. In the first five months of the year, that number was met only in April.

The WCIRB estimated that COVID-19 claims will cost an average of $29,100 each. But the 82 percent of cases that require no hospitalization were projected to cost an average of just $2,100. In contrast, the 3 percent of cases that require critical care were projected to cost $191,100 each.

The DWC data shows California workers filed 15 claims in January, 65 in February, 2,251 in March, 2,677 in April and 85 in May.

Alex Swedlow, president of the California Workers’ Compensation, said the May numbers are likely a preliminary count; more claims may be added for the month later.

Swedlow said he found it interesting that 1,076 claims were denied. He said when CWCI examined a sample of about 1,100 claims filed in February, March and April, researchers found that about 35 percent had been denied. The DWC numbers include claim counts through early June and show a lower denial rate of 21 percent.

“It is still a demonstrably higher denial rate than the general population of reported claims,” Swedlow said. “COVID-19 is much more complicated to investigate due to the lack of testing and the wait for test results.

Swedlow said CWCI’s research shows that reasons for denying a COVID claim were consistent with the governor’s executive order. The institute’s study states that “seven out of 10 workers whose claims were denied tested negative for the virus, with the balance of the denials made after it was found that the employee had not been exposed at work, or for other reasons including the lack of a diagnosis, lack of symptoms, or that the employee had been working at home or had refused to take a COVID-19 test.”

Swedlow said each of those reasons are consistent with the executive order.

Any increase in costs caused by COVID-19 claims will likely be offset by a corresponding reduction in the California claims rate overall. The WCIRB in another analysis released last month noted that 4.3 million unemployment claims were filed in the state during the first 10 weeks of the pandemic — 20 percent of the state’s workforce.

Typically, fewer claims are filed during economic downturns. WCIRB projected a 14 percent decline in claim frequency.

But the bureau said lower frequency may be offset by an increase in post-post-termination claims by laid off workers who say they suffered cumulative injuries. According to the report, since 2012, about 25 post-termination claims are filed for each 1,000 jobs lost.

“It is possible and perhaps likely that growth in these types of claims will more than offset the impact of the economic slowdown on claim frequency,” the WCIRB report says.

Jill Dulich, executive director of the California Self Insurers Association, said workers’ compensation claims by employees who contracted COVID-19 seems to have had a minimal impact on most members of the organization, but not all.

“The majority of the board members have had very few COVID claims filed,” she said. “One member has had a higher number and advised that while most of the claims are minimal with no lost pay due to C19 sick pay, there are a handful of claims that are going to be very costly for them given the expenses of ICU, nurse case managers and rehab.”

About the photo: Kreation Organic manager Frank D’Andrea, left, measures a required six-feet distance between tables as his staff gets ready for customers to sit outdoors in Los Angeles, Friday, May 29, 2020. Populous Los Angeles County won approval Friday to reopen restaurants and hair-cutting businesses to customers. At the same time, remote Lassen County, the first California jurisdiction to backpedal on a reopening plan, reversed itself again and decided to allow in-person dining and shopping in stores after determining it mitigated its first small outbreak of coronavirus cases. (AP Photo/Damian Dovarganes)

Was this article valuable?

Here are more articles you may enjoy.

Texas Among Several States Facing New Fire Risks: Weather Watch

Texas Among Several States Facing New Fire Risks: Weather Watch  Justice Department Preparing Ticketmaster Antitrust Lawsuit

Justice Department Preparing Ticketmaster Antitrust Lawsuit  SC High Court Strikes ‘Troubling’ Denial of Comp Claim, Says Can’t Be Based on Stats

SC High Court Strikes ‘Troubling’ Denial of Comp Claim, Says Can’t Be Based on Stats  Travelers Survey: Distracted Drivers Making US Roads More Dangerous

Travelers Survey: Distracted Drivers Making US Roads More Dangerous