Specialty insurance products sold to classic car collectors must include coverage for damages caused by uninsured motorists — even if the owner is driving a vehicle not covered by the policy, the Florida Supreme Court ruled.

All five justices who participated concurred with the ruling, but two wrote a separate opinion that called on the state legislature to clear up a murky statute that requires auto insurers to include uninsured motorist coverage without defining exactly what that means.

“The legislature has never defined ‘uninsured motor vehicle coverage,’ and our attempts to explain what it means have been based on a 50-year-old case that analyzed an older version of section 627.727 and relied on a questionable reading of the statutory text,” stated Justice Carlos G. Muñiz in a concurring opinion. He was joined by Justice Alan Lawson.

The decision handed down by the Florida Supreme Court on Tuesday resolves a split between two appellate districts. The case was an appeal from a 2017 Fifth District Court of Appeal ruling that the statute requires insurers to provide uninsured motorist coverage for all auto liability policies unless the policyholder explicitly declines coverage by signing a form.

But in 1996 the Second District Court of Appeal ruled that uninsured motorist coverage was not included in a policy that contained a restriction that stated the coverage was only available for accidents that involved the policyholder’s vehicle.

The Supreme Court affirmed the 5th District’s ruling in Lentini v. American Southern Home Insurance Co. The decision overturns the precedent set by the Second District in Martin v. St. Paul Fire & Marine Insurance Co.

Tampa attorney Anthony T. Martino represented the estate of Louis Philip Lentini at trial. He said it is not uncommon in Florida for insurers to wrongly deny uninsured motorist coverage for damages caused by accidents that did not involve the policy owner’s vehicle, as well as numerous other legal theories.

“For the past 40 years we’ve had uninsured motorist benefits mandated by law and we’ve had insurance companies refuse to pay for one reason or another,” Martino said. “Many times I’m dealing with out-of-state adjusters who don’t know Florida law.”

Martino said despite the Martin v. St. Paul case, he finds section 627.727 quite clear. If an auto insurer wants to exclude or restrict uninsured motorist coverage, the policyholder must sign specific form issued by the Office of Insurance Regulation. Otherwise, the insurance coverage applies to damages caused by uninsured motorists no matter what vehicle the policyholder is driving, or even if the policyholder is a pedestrian, he said.

As the Supreme Court decided Tuesday, that requirement includes policies for collector cars.

Michael Lentini purchased a policy from American Southern Home for his 1992 Chevrolet Corvette. In 2015, Lentini was killed when a motorist struck his motorcycle. All parties agreed that Lentini was not at fault, Martino said. There was also no disagreement that Lentini had not signed a form to waive the coverage.

Lentini’s estate filed an uninsured motorist claim, which Southern Home rejected because the policy was limited to accidents involving the insured vehicle. The trial court ruled in favor of the insurer, but the 5th District reversed.

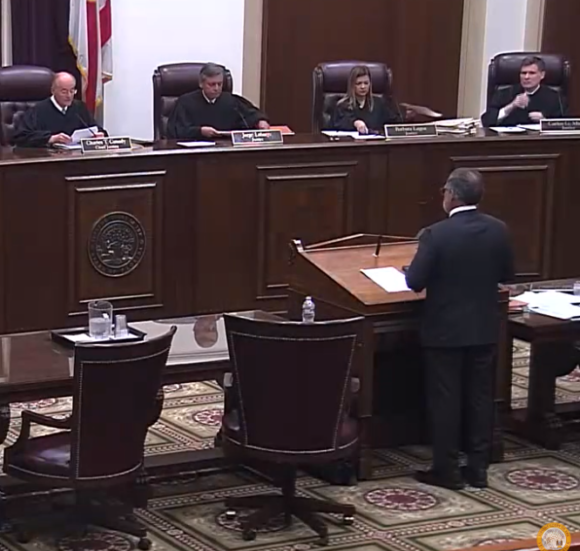

In oral arguments on March 19, Coral Gables attorney Raoul G. Cantero told the justices that Lentini had purchased a highly specialized policy. It did not allow Lentini to use his Corvette as his primary vehicle and required him to store the car inside a permanent enclosed structure. Cantero argued that while the statute requires auto insurance policies to include uninsured motorist coverage, “it does not say that that coverage has to include other vehicles.”

Justice Robert J. Luck responded that the case turns on whether the definition of uninsured motorist coverage includes coverage for accidents that don’t involve the insured vehicle. He noted that nothing in the statute states what uninsured motorist coverage must include. A subsection, however, names several types of limits that can be imposed if the policyholder signs a consent form. Accidents that do not involve the insured vehicle are included on that list.

The Supreme Court concluded that the list of exclusions provides at minimum the circumstances that must be covered by an uninsured motorist policy unless the required waiver is signed. Because he had not signed a waiver, Lentini had opted for uninsured motorist coverage in all forms, without limits, the court decided.

Martino said the Southern Home policy had a policy limit of $300,000, but he has not yet conferred with his clients and can’t say whether the high court’s decision entitles the Lentini estate to the entire amount.

About the photo: Attorney Raoul G. Cantero argues the Lentini case before the Florida Supreme Court on March 19. The photo is a screen shot of a YouTube video provided by the court.

Was this article valuable?

Here are more articles you may enjoy.

Report Using Aerial Imagery Keys in on Hailstorm Risks to Colorado Homes

Report Using Aerial Imagery Keys in on Hailstorm Risks to Colorado Homes  Hawaiian Electric Hits 40-Year Low Ahead of Maui Fire Report

Hawaiian Electric Hits 40-Year Low Ahead of Maui Fire Report  CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape

CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape  California Chiropractor Sentenced to 54 Years for $150M Workers’ Comp Scheme

California Chiropractor Sentenced to 54 Years for $150M Workers’ Comp Scheme