The Seibels Bruce Group Inc. of Columbia, S.C., announced financial results for the quarter that ended June 30, 2003, noting that the company posted a net profit of $759,000, or $0.08 per share (basic and diluted). This is compared with a net profit of $1.0 million, or $0.11 per share (basic and diluted), for the same period last year.

“We have worked closely with our regulators over the past few quarters, culminating with the South Carolina Department of Insurance lifting its Order Imposing Administrative Supervision (Order) in May 2003,” said Seibels Bruce president, Michael A. Culbertson. “The company is working to completely restore the insurance writing authorities that existed prior to the August 2002 Order. With the approval of the South Carolina Department of Insurance, we have also introduced new risk-bearing homeowners and nonstandard automobile programs in South Carolina.”

The automobile segment, which includes the company’s continuing nonstandard operations in North and South Carolina, as well as several runoff operations, reported a loss of $603,000 for the quarter. “The expenses and adverse reserve development associated with the automobile segment’s runoff programs played a major role in its results of operations,” stated Culbertson. “Decreased premium volumes in our North Carolina nonstandard automobile operations, written through Universal Insurance Company, as well as the start-up costs associated with the company’s recently introduced South Carolina nonstandard automobile operations further impacted the profitability of the company’s automobile segment.”

Culbertson concluded, “Our North Carolina nonstandard automobile program will continue to be the foundation of our automobile segment, but we are also excited about the potential of our new South Carolina program once it becomes established.”

The flood segment reported a net profit of $1.8 million for the quarter, while the company’s commercial operations reported a net loss of $282,000 for the quarter.

The adjusting services segment, Insurance Network Services Inc. (INS), reported a profit of $102,000 for the quarter. The all-other segment reported a loss of $249,000

Culbertson noted that the company is “pleased to be out from under administrative supervision and happy with the progress we have made in restoring our pre- supervision insurance writing authority. In addition, we believe our recently introduced homeowners and nonstandard automobile products in South Carolina are competitive and provide an opportunity for us to become a stronger company in the future.”

Was this article valuable?

Here are more articles you may enjoy.

California Chiropractor Sentenced to 54 Years for $150M Workers’ Comp Scheme

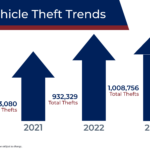

California Chiropractor Sentenced to 54 Years for $150M Workers’ Comp Scheme  National Crime Report Shows Vehicle Thefts Surged to More than 1 Million in 2023

National Crime Report Shows Vehicle Thefts Surged to More than 1 Million in 2023  Synopsys Sued by Private Equity Firm for Shopping $3 Billion Unit

Synopsys Sued by Private Equity Firm for Shopping $3 Billion Unit  Tesla Settles Over Fatal Autopilot Crash on Eve of Trial

Tesla Settles Over Fatal Autopilot Crash on Eve of Trial