Customer use of digital interactions in the claims process has increased 18% since 2017 and the vast majority of policyholders are pleased with the process, J.D. Power said in its first U.S. Claims Digital Experience Study.

“Personal interaction continues to be a critical part of any claims operation,” stated Tom Super, head of property and casualty insurance and intelligence. “However, 84% of claimants say they’ve used digital at some point during their claim, placing insurers on notice of the evolving expectations of today’s insurance customers.”

For customers who scheduled vehicle repairs through an insurer’s mobile app, the customer satisfaction score was 909, higher than any other method, J.D. Power said.

J.D. Power said satisfaction scores among claimants who used digital channels at any point in the claims process is one point higher than among those who do not use digital channels, 872 vs. 871 on a 1,000 point-scale.

The study is based on 2,224 evaluations by auto and home insurance customers who filed a claim in the past 12 months. Customers were surveyed from July through September of this year.

The study was conducted in partnership with Corporate Insight, a provider of competitive intelligence and user experience research to the financial services and healthcare industries.

“Digital interaction—particularly via a mobile device—is becoming the most important battleground for the insurance customer experience,” stated Michael Ellison, president of Corporate Insight. “Increasingly, the experience customers have scheduling a repair, getting updates on the progress of their claim and even reporting a new claim is occurring on an app or website, and insurers need to be able to convey their values and their unique brand attributes through those digital interactions.”

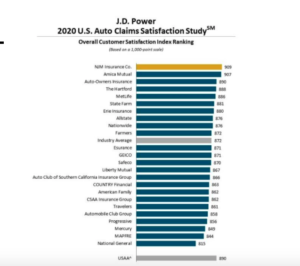

The report on digital claims follows the release of J.D. Power’s annual Auto Claims Satisfaction Study. The company said a slowdown in auto claims during the pandemic has allowed insurer claims departments to focus on quality of service and reduce cycle times.

J.D. Power said overall satisfaction with auto claims department reached a record high of 872, up four points from 2019. This is the third consecutive year that auto claims satisfaction has increased over the previous year, the company said.

NJM Insurance Co. had the highest satisfaction rate, with a score of 909. Amica Mutual finished a close second, with 907.

J.D. Power said performance improved in nearly every factor measured in the study: claim servicing; estimation process; repair process; rental experience; and settlement. The only factor that that did not improve from last year was first notice of loss, which remained flat.

The decrease in claim frequency led to an increase in the speed of processing claims. Overall cycle time for claimants with repairable vehicles dropped to 10.3 days, down from 12.6 days last year.

Th use of direct repair program shops increased customer satisfaction, J.D. Powder said. Affiliate repair shops had an overall satisfaction score of 888, compared to 844 for independent shops.

The survey insurance customers was conducted in four waves from November 2019 to September 2020.