New Jersey was the first state to propose a bill that would mandate insurers cover COVID-19-related losses under their business interruption policies, and the insurance industry was quick to express its concern. But that hasn’t stopped some states from rolling out similar proposed legislation.

New York and Pennsylvania have recently proposed their own COVID-19 business interruption bills, bringing the total to seven states that have introduced legislation like this. Similar to New Jersey, New York and Pennsylvania is legislation that has been floated in Louisiana, Ohio, Massachusetts and South Carolina. None of the proposed bills have yet passed.

The concern among the insurance industry is that legislation like this could place too much financial strain on insurers that didn’t price for virus-related losses, which were initially excluded from policies nearly 15 years ago through an Insurance Services Office (ISO) exclusion for loss due to virus or bacteria. The ISO exclusion was introduced in July 2006 and later approved by regulators. Similar exclusions exist in forms issued by other insurance organizations or in insurer-drafted forms, Insurance Journal previously reported.

“I think in layman’s terms, it would implode the industry,” Doug Jones, managing director of JAG Insurance Group, told Insurance Journal in a March webinar on business interruption and the coronavirus. “At the end of the day, the ripple effect of what that would cause down the road, and I’m talking short-term, not long-term; I’m talking about months from now, not years from now. It would be difficult for anybody to buy any type of insurance.”

Additional concerns among the insurance industry about this type of legislation surround The Contracts Clause in the U.S. Constitution, which places limitations on states’ ability to interfere with private contracts.

“It’s just not constitutional,” Don Hayden, co-founder and partner of Mark Migdal & Hayden, added. “I mean, what you’re essentially doing is creating insurance where there is nothing. You’re essentially throwing out the underwriting and the risk evaluation that insurance companies have done before writing a policy and saying, ‘You have to cover this. Even though you had expressly said that you would not cover it in your exclusion and in your insurance agreement.'”

Proposed Bills in Pennsylvania, New York

In Pennsylvania, HB 2372 – or An Act Providing For Insurance Coverage For Business Interruption – has been introduced. While the bill has not yet seen a vote, it calls for any insurance policy that covers loss or damage to property, including the loss of use and occupancy and business interruption, to cover business interruption losses due to global virus transmission or pandemic. If enacted, the legislation would be retroactive for policies in force on March 6, 2020, when a Proclamation of Disaster Emergency was first declared in the state regarding this pandemic.

The proposed bill applies to insurance policies that have been issued to insureds with fewer than 100 eligible employees in Pennsylvania, meaning full-time employees who work a normal week of at least 25 hours, according to the proposed legislation. The bill also states insurers that pay claims related to business interruption stemming from the coronavirus pandemic can apply to the Pennsylvania Insurance Commissioner for relief and reimbursement.

“As a general matter, business interruption insurance will only pay when there has been a physical loss (such as a fire) to the premises of the building,” Pennsylvania Insurance Commissioner Jessica Altman said in an emailed statement regarding the proposed legislation. “The product generally was not designed or priced to cover communicable diseases, such as COVID-19, and generally policies that we have seen in mediating complaints contain clear exclusions.”

This is an issue that has garnered attention in Washington, D.C., as U.S. Congress considers strategies to assist business owners, Altman’s statement continued.

“The industry argues that proposals to retroactively apply coverage to policies that excluded benefits in such policies, though beneficial to the policyholder, are unconstitutional and threaten the viability of the broader industry,” Altman said. “We understand those concerns and recognize the need for a national solution to this growing challenge confronting businesses across the nation.”

Similarly, New York has proposed A 10226 in the State Assembly and S 8178 in the State Senate, which would require certain perils to be covered under business interruption insurance during the COVID-19 pandemic. The Senate bill is being sponsored by State Senator Shelley B. Mayer, while the bill in the Assembly was introduced by State Assemblyman Robert Carroll. Neither bill has yet been voted on.

The proposed New York bills read similarly to the Pennsylvania legislation, applying to policies issued to insureds with fewer than 100 eligible employees, meaning full-time employees who work a normal week of 25 or more hours, according to the bills. The legislation would be retroactive for policies issued on or after March 7, 2020. If enacted, insurers required to pay business interruption claims related to the coronavirus would be eligible for reimbursement with the New York Department of Financial Services. A spokesperson for DFS said it does not comment on proposed or pending legislation.

Industry Opposition

Insurance industry associations have continually expressed opposition regarding such legislation. In an April 13 letter to Pennsylvania Representative Tina Pickett, Chair of the Pennsylvania House of Representatives’ Insurance Committee, The Wholesale & Specialty Insurance Association (WSIA) stated it believes HB 2372 in Pennsylvania, as proposed, would have “far-reaching, significant negative impacts to all consumers and businesses relying on the insurance market to protect them now and in the future.”

“Any action to fundamentally alter business interruption provisions specifically, or property insurance generally, to retroactively mandate insurance coverage for viruses by voiding those exclusions, would immediately subject insurers to claim payment liability that threatens solvency and the ability to make good on the actual promises made in existing insurance policies,” the letter stated.

In a statement released by the National Association of Mutual Insurance Companies (NAMIC), President and CEO Charles M. Chamness said calls for the insurance industry to provide coverage for perils that are excluded in a business interruption policy are misguided, Insurance Journal previously reported.

“If elected officials require payment for perils that were excluded, never underwritten for, and for which no premium was ever collected, catastrophic results will occur and we may deal with a second crisis: insurance insolvencies and impairments. There will also be irreparable harm done to contract law, and the impact of this will be felt by every business in America,” Chamness said.

Seeking Relief for Small Businesses

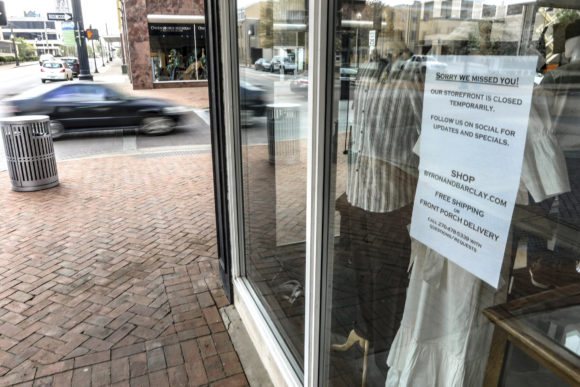

In a previous interview with Insurance Journal, however, Massachusetts State Senator James Eldridge – who introduced Bill SD.2888 regarding business interruption insurance and the coronavirus in Massachusetts – said legislation like this is important because it comes on the back of a big push about relief for small businesses amidst the coronavirus crisis.

“I personally think this kind of pandemic should be covered by insurance companies,” he said.

The challenge is, unlike big businesses, many small businesses may not have the financial ability to fund coverage litigation or to absorb the loss of income they are facing, Alexandra Roje, partner in Lathrop GPM’s insurance recovery practice, previously told Insurance Journal.

“It remains to be seen how long big business can absorb losses in the current environment, but it is clear that if small businesses do not get help from their representatives, they and their employees will face dire consequences,” she said.

Jones stated he is sympathetic to the concerns of small businesses being impacted by COVID-19 right now. Although he said he believes legislation like what has been proposed in several states would result in great consequences for the insurance industry, he is optimistic relief for businesses hurting due to this pandemic is on the horizon.

“I think keeping hope alive is human nature,” Jones said. “I don’t blame any one of my clients that calls me expecting for this to be covered by their policy, because they may or may not understand the terms of the contract. I’m not mad at those people for thinking that or for being optimistic that legislation may pass. I think that ultimately, there will be other avenues for small businesses like the stimulus package and whatever else is going to follow-up with the payroll protection program – things of that nature. That is where you’re going to get or have the ability to get the funds that you need to stay open.”

Was this article valuable?

Here are more articles you may enjoy.

CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape

CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape  Travelers Survey: Distracted Drivers Making US Roads More Dangerous

Travelers Survey: Distracted Drivers Making US Roads More Dangerous  Supreme Court Allows More Transport Workers to Bypass Arbitration and Sue Employers

Supreme Court Allows More Transport Workers to Bypass Arbitration and Sue Employers  Norfolk Southern to Pay $600 Million to Settle Ohio Spill Case

Norfolk Southern to Pay $600 Million to Settle Ohio Spill Case