CoreLogic Integrates Hover with Underwriting Platform

CoreLogic has integrated Hover’s three-dimensional property measurement tool into is Underwriting Center platform for insurance clients.

The use of Hover will allow carriers and inspection companies to better manage inspection expenses, while allowing policyholders to use Hover’s self-service app to take measurements of their properties, CoreLogic said in a press release.

CoreLogic, based in Irvine, Calif., provides property data to insurers, real estate agents and financial institutions. The company is best known to the insurance industry for its frequent reports on estimated losses caused by natural catastrophes, but it is equally well known in the real estate sector for its insight into the residential property market.

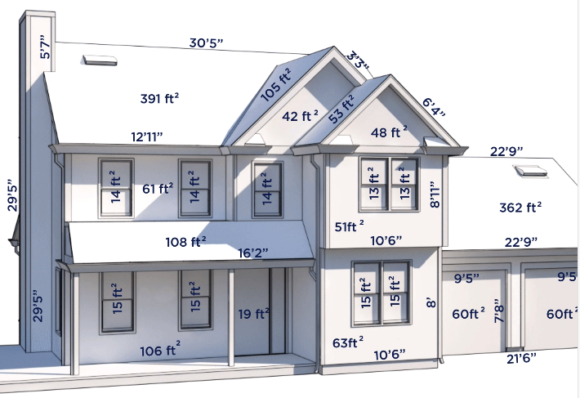

The Hover technology allows users to take smartphone images of properties that generate accurate measurements, including the total living area down to the inch, as well as a sketch of their home, CoreLogic said.

“The accurate sketch that Hover provides to homeowners serves as a single source of truth about a home’s vital data for all parties–from the homeowners themselves to the insurance carriers and inspection companies,” stated Hover Executive Vice President Kevin Reilley.

While CoreLogic’s services primarily serve underwriters by providing property data, Hover’s technology can be used by claims professionals as well.

The technology eliminates the need to hand-measure properties and provides a more complete property view, CoreLogic said. It also allows insurers to engage the homeowner as a part of the property insurance process, offering time savings and “an educational opportunity that enhances the customer experience,” CoreLogic said.

Hover, based in San Francisco, has its roots in a 2012 contract with the U.S. military. The company delivered 3-D maps derived from aerial photographs to give troops a better understanding of the lay of the land, according to the company’s website.

Hover has contracted with Travelers Companies, Pacesetter Claims Service and. U.S. Adjusting Services this year after receiving $87 million from investors in three funding rounds. Reilley told the Claims Journal in June that Hover counts among its customers six of the top 10 property and casualty carriers.

Jupiter Receives Grant to Deploy FireScore

Jupiter, a firm that provides data and analytics for climate risk and resilience, said it has received a $1 million grant from the Gordon and Betty Moore Foundation to accelerate deployment of its FireScore Operations service to California public safety officials.

Jupiter, based in San Mateo, Calif., said the grant will help make the FireScore Operations platform available to public safety organizations throughout California to increase readiness for the 2020 wildfire season.

Jupiter’s platform integrates real-time and forecast weather, fire spread modeling and satellite observations to allow emergency managers to put firefighting resources into position, monitor new ignitions and predict wildfire spread.

“By increasing lead time for emergency management, FireScore Operations will help optimize evacuation planning, utility de-energization and prepositioning of resources, enabling emergency managers to suppress fires in their early stages and protect public safety and property,” stated Jupiter Chief Executive Officer Rich Sorkin. “We expect all major utilities in fire prone areas worldwide will use this service.”

The Moore Foundation’s mission is to foster path-breaking scientific discovery, environmental conservation, patient care improvements and preservation of the special character of the San Francisco Bay Area. Gordon Moore founded Fairchild Semiconductor in 1957 and then Intel Corp., creator of the world’s first microprocessor, in 1968. He and his wife Betty created the foundation in 2000.

Friss Teams with NICB

Fraud-detection software provider Friss has formed a partnership with the National Insurance Crime Bureau that will incorporate NICB data into its automated fraud scoring process.

The data will help ensure that cases with ties to known fraudsters can be caught and investigated immediately, the NICB said in a press release.

Friss software is used to assess fraud risk in both underwriting and claims examinations. A “Friss score” expresses the level of risk. The company Dutch company has grown rapidly since in was founded in 2006. It now has offices in Chicago, Germany, France and Chile, as well as its headquarters in Utrecht, the Netherlands.

The NICB, headquartered in Des Plaines, Ill., is a nonprofit organization supported by member carriers that fights fraud and vehicle theft through data analytics, investigations, learning and development and public affairs.

“Our mission at Friss is to make insurance more honest and partnering with NICB brings us a giant step closer to helping carriers instantly identify claims that are likely to be fraudulent,” stated Chief Executive Officer Jeroen Morrehnof.

Photo courtesy of Hover.

Was this article valuable?

Here are more articles you may enjoy.

Report: Vehicle Complexity, Labor ‘Reshaping’ Auto Insurance and Collision Repair

Report: Vehicle Complexity, Labor ‘Reshaping’ Auto Insurance and Collision Repair  Hawaiian Electric Hits 40-Year Low Ahead of Maui Fire Report

Hawaiian Electric Hits 40-Year Low Ahead of Maui Fire Report  Texas Among Several States Facing New Fire Risks: Weather Watch

Texas Among Several States Facing New Fire Risks: Weather Watch  California Chiropractor Sentenced to 54 Years for $150M Workers’ Comp Scheme

California Chiropractor Sentenced to 54 Years for $150M Workers’ Comp Scheme