Sapa Extrusions purchased 28 insurance policies from eight carriers, but not one of them would reimburse the manufacturer for the cost of a settlement it paid after being sued for shoddy workmanship.

A federal appellate court, however, has cleared the way for Sapa — now known as Hydro Extrusions — to pursue damages from nine of those insurance policies. The Third Circuit Court of Appeals in Philadelphia on Friday overturned a portion of a district court’s decision that had granted all eight carriers summary judgment and dismissed all 28 of Saba’s claims.

The appellate court let stand the district judge’s decision to dismiss claims against the remaining 19 insurance policies.

The suit was spawned after Marvin Lumber and Cedar Co. and Marvin Windows of Tennessee started receiving complaints from customers about the quality of windows and doors that included parts manufactured by Saba, now Hydro. Marvin contracted with the manufacturer in 1996 and purchased 28 million extrusions, which were incorporated in 8.5 million windows and doors.

Marin said it received complaints from customers that the windows and doors corroded. Those claims were especially prevalent from customers who lived within one mile of the ocean. Marvin said it paid $75,000 to repair and replace the defective windows and doors. It sued Saba in 2010 and eventually Saba paid a settlement.

The manufacturer then sued the insurance carriers that refused to reimburse it.

The outcome of the case hinged on the exact language of each policy as interpreted using Pennsylvania insurance law. The 3rd Circuit said in 19 of Sapa’s policies defined an “occurrence” that would trigger coverage as an unforeseeable, “fortuitous event.”

Seven of the remaining policies — some of them written by National Union Fire Insurance — used a narrower definition of “accident” to provide coverage for conditions that are “neither expected nor intended from the standpoint of the insured.” The appellate court said that has a different meaning than “unforeseeable” or “fortuitous” and begged for a separate analysis by the court.

The remaining two policies, written by Liberty Mutual, also defined an “injurious exposure” to trigger coverage as events that are not expected or intended.

The appellate court ruled because the polices used different language, the district court judge should have examined them separately.

“To be clear, we take no position on whether Sapa may ultimately recover under any of the policies we are remanding to the District Court for more consideration,” the court said.

The appellate court the Pennsylvania Supreme Court spelled out clear rules on how to interpret policies that that provide for coverage for “accidents” in a 2006 decision. In Kvaerner Metals v. Commercial Union Insurance Co., the court said an accident is something that occurs unexpectedly or unintentionally. A failure caused by poor workmanship doesn’t meet that definition, the court said.

In other cases, Pennsylvania courts have ruled that policy language that provides for coverage for “occurrences” that are not expected or intended by the policyholder to includes conditions that the insured did not intend to cause. The district court should have interpreted the policy language in the seven policies to determine if faulty workmanship claims were covered.

“The District Court did not separately analyze these seven policies, grouping them instead with the cohort of Accident Definition policies,” the Third Circuit said. “That was error, since courts must review and enforce insurance policies according to their terms. And the operative term of these seven policies—the Expected/Intended Definition of ‘occurrence’—is materially unique.”

The court remanded the district court’s ruling on the remaining two policies that also used “expected/intended” language under the same reasoning.

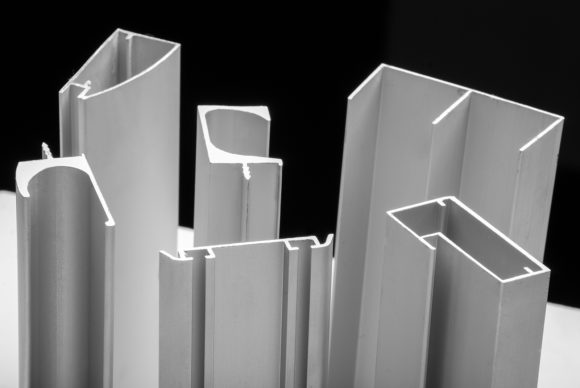

About the photo: Displayed are aluminum extrusions similar to those that spawned a dispute between Sapa Extrusions and its insurance carriers.

Was this article valuable?

Here are more articles you may enjoy.

CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape

CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape  Florida’s Home Insurance Industry May Be Worse Than Anyone Realizes

Florida’s Home Insurance Industry May Be Worse Than Anyone Realizes  J&J, Kenvue Told to Pay $45 Million to Baby Powder User’s Family

J&J, Kenvue Told to Pay $45 Million to Baby Powder User’s Family  Zurich, Philadelphia, Others Ordered to Pay $345M to Cover Abuse Charges at Georgia School

Zurich, Philadelphia, Others Ordered to Pay $345M to Cover Abuse Charges at Georgia School