It should not be a surprise that drones fly over disaster areas for property inspection, and some insurers use chatbots to answer policyholders’ claims questions. Claims applications and supporting documents are shared within seconds, and real-time monitoring sensors alert people exposed to preventable risks. Those are only a few examples of the ways technology is changing claims operations. The shift is ongoing, even at this very moment, and the wave of innovation and technological transformation is opening a new age for the claims function and the industry as a whole.

Accordingly, claims professionals of tomorrow are going to be different from those of today. In a tech-driven business environment, claims professionals need to be comfortable working closely with more technological assets to drive business initiatives. They must be able to use smartphones, laptops and other tech gadgets for daily operations. At the same time, futuristic claims professionals are expected to possess superior soft skills to successfully engage the human element of modernization and evolving claims operations. For example, adjusters have assumed the role of grief counselors to comfort customers during times of catastrophic loss.

Modernization presents a myriad of possibilities for the function. However, only those organizations with well-rounded claims professionals in place will be able to take full advantage of them.

How can claims departments ensure they have individuals with the right skill sets to thrive in the age of innovation?

Claims Operations of Tomorrow

While hiring is definitely important, it is essential for insurance organizations to develop and prepare their claims teams to successfully drive the claims operations of tomorrow. Even though the future of work is quickly changing the ways the function operates, claims is still claims. No one can take that away. Insurers still need the experience and expertise that traditional claims staff members possess to run their departments. By successfully retaining and engaging employees, claims can continue to reinforce its value to customers while maintaining its commitment to modernization.

Just as plants grow and prosper with enough sunlight and nutritious soil, claims teams need an environment and culture that allows them to thrive in the age of innovation. The goal is to create a workplace where employees are comfortable discussing modernization and feel genuinely excited about the future of work. To realize these changes, organizational leaders should revisit their management practices and adjust their corporate cultures to embrace modernization and technological advances. In essence, innovation must be part of the corporate DNA.

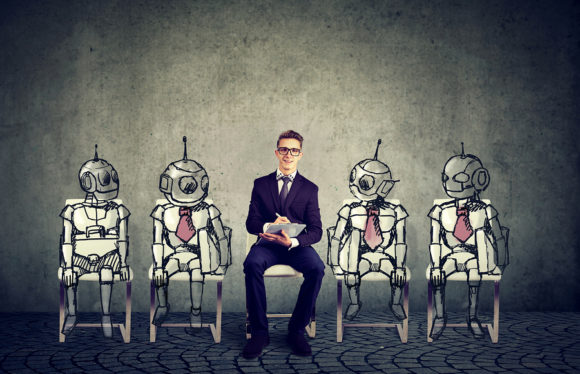

Yet some employees feel disconnected from modernization initiatives as they fear their roles may be replaced by robots and computers. They may be right; artificial intelligence, data analytics and digitalization can indeed replace some claims roles. However, these same advances can also generate new positions and career paths within the function, thereby putting more people to work. While positioning modernization in a positive light, insurance organizations should be transparent and regularly communicate upcoming changes and initiatives with their workforces. It is best to allow employees to express their concerns and ask questions.

The Right Attitude

Amplifying the right attitude toward modernization is a great place to start. However, it takes more than semantics to position employees to actively contribute to the wave of innovation. The future of work calls for the redefinition of work and simultaneously creates new roles to address evolving business demands. To boost departmental innovation efforts, leaders have to be ready to transition their staff members to different roles as needed.

To ensure a seamless transition, insurance organizations can proactively invest in employees’ professional growth by providing extensive, intentional training opportunities. Departments should put aside their employees’ defined roles or professions and focus on evaluating their individual skill-sets. With that information, leaders can offer personalized training modules that successfully augment individuals’ strengths and fortify weaknesses. Well-educated employees will be empowered to better transition into their newly defined roles within their future claims department.

Department leaders and executives should also consider promoting and sponsoring employees to attend industry, function-specific, technology or analytics events. Participating professionals can obtain critical knowledge and provide organizations a diversity of perspectives from which to launch continued innovation. They will also appreciate the fact that leaders are invested in their futures, which will motivate them to continue working in the claims function. Such intentional engagement is essential to building a solid foundation for competitiveness in tomorrow’s tech-driven business reality.

The realm of training must extend to managers, supervisors and department leaders. The future of work calls for leaders who can provide stability and show flexibility. The time has come for professionals to lead in the ways business schools do not teach. Companies should revisit their leadership training programs, incorporating change management, empathy, collaboration and motivation into their curriculums.

Embrace Innovation

As technology continues to change the claims function at an unprecedented pace, insurance organizations need to embrace innovation and focus on evolving their traditional teams into groups of well-rounded future-ready professionals. While realigning their corporate cultures and transparently interacting with employees, leaders must focus on providing ample training opportunities for employees of all levels. Special attention should be given to managers and supervisors, as the future of work calls for a different type of leadership. Those who proactively invest in the future of employees will be able to enjoy the limitless potential the wind of technological transformation presents to the claims function and the industry.

Was this article valuable?

Here are more articles you may enjoy.

California Chiropractor Sentenced to 54 Years for $150M Workers’ Comp Scheme

California Chiropractor Sentenced to 54 Years for $150M Workers’ Comp Scheme  Texas Among Several States Facing New Fire Risks: Weather Watch

Texas Among Several States Facing New Fire Risks: Weather Watch  Justice Department Preparing Ticketmaster Antitrust Lawsuit

Justice Department Preparing Ticketmaster Antitrust Lawsuit  CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape

CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape