Auto insurers are achieving high levels of customer satisfaction when handling claims, but still struggle to transition claimants to digital claims reporting solutions, according to the J.D. Power 2018 U.S. Auto Claims Satisfaction Study. These findings are noteworthy in light of claim severity outpacing the decline in claim frequency, which is putting enormous pressure on traditional customer service and claims processing operations to create a more effective way to handle auto claims.

“Insurers are doing a great job at the critical customer touch point of claims reporting, but the end-to-end claim process is still costly and not as fully integrated as it needs to be,” said David Pieffer, Property & Casualty Insurance Practice lead at J.D. Power. “The challenge for insurers is to seamlessly transition the claims reporting function to more cost-effective digital customer care solutions. For many insurance customers, reporting a claim is one of the few direct interactions they have with their insurer and it comes at a time when they are looking for a reassuring voice. That’s not the ideal time to introduce a new digital touch point.”

Following are key findings of the 2018 study:

- Record-high customer satisfaction with auto claims: Overall satisfaction with the auto insurance claim process increases to 861 (on a 1,000-point scale), up 3 points from last year’s study and setting a record-high. The performance improvement is driven primarily by a 5-point improvement in the first notice of loss (FNOL) factor.

Industry-wide improvement: Improvements in customer satisfaction are found across the board, with the gap between the highest- and lowest-ranking insurers shrinking to just 70 points, the smallest that gap has been since the study’s inception. - Few customers adopting digital FNOL offerings: Although customer use of technology has increased over the past five years, 65 percent of claimants have received a digital status update, with the majority of that done in combination with offline status updates. FNOL currently has the lowest technology utilization, with just 11 percent of claimants filing a FNOL via digital channels.

- Customer satisfaction lower when using digital FNOL channels: FNOL satisfaction is lower among customers who submit their claim digitally than among those who report via offline channels (860 vs. 869, respectively).

- Mobile app usage can be a double-edged sword: The use of mobile apps in the estimation process, which allows claimants to submit photos or videos of their damaged vehicle directly to their insurer, is growing in popularity, with 42 percent of claimants using the technology. When insurers use those photos or videos, overall satisfaction surges to 871. However, when they do not use the photos or videos and still need to send an adjuster, overall satisfaction falls 29 points to 842. Currently, insurers rely on claimant-submitted photos and videos 53 percent of the time they are submitted.

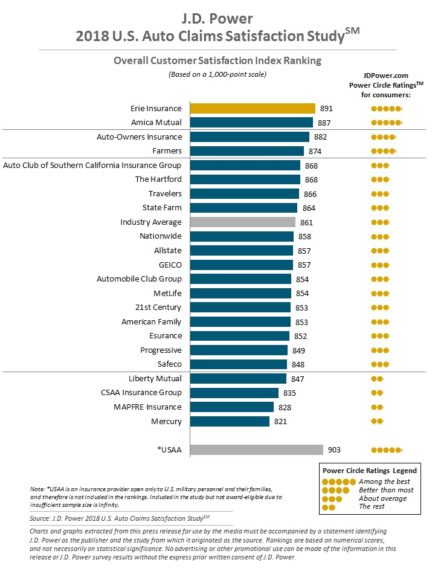

Insurer Rankings

Erie Insurance ranks highest in overall customer satisfaction with a score of 891. Amica Mutual (887) ranks second and Auto-Owners Insurance (882) ranks third.

The 2018 U.S. Auto Claims Satisfaction Study is based on responses from 10,896 auto insurance customers who settled a claim within the past six months prior to taking the survey. The study excludes claimants whose vehicle incurred only glass/windshield damage or was stolen, or who only filed a roadside assistance claim. Survey data was collected from November 2017 through August 2018.

For additional information about the U.S. Auto Claims Satisfaction Study, visit https://www.jdpower.com/resource/jd-power-us-auto-claims-satisfaction-study.

Source: J.D. Power

Was this article valuable?

Here are more articles you may enjoy.

Viewpoint: The Impact of Behavioral Health on Workers’ Comp

Viewpoint: The Impact of Behavioral Health on Workers’ Comp  Harvard Study Again Stirs the Pot on Demotech Ratings of Florida Carriers

Harvard Study Again Stirs the Pot on Demotech Ratings of Florida Carriers  CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape

CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape  Justice Department Preparing Ticketmaster Antitrust Lawsuit

Justice Department Preparing Ticketmaster Antitrust Lawsuit