Assurant, a provider of specialty protection products and related services, finalized its $1.3 billion 2015 Property Catastrophe Reinsurance Program, which reduces the Company’s financial exposure and ensures its ability to safeguard homeowners and renters suffering catastrophic losses caused by severe weather events.

Base reinsurance premiums for the catastrophe program are estimated to be $180 million in 2015, compared to $240 million in 2014. Reduced reinsurance costs reflect improved pricing, lower exposure from lender-placed insurance and the divestiture of American Reliable Insurance Company.

“While catastrophic events are unpredictable, Assurant’s comprehensive reinsurance program is put in place annually so we can weather the storm. This year’s program addresses a reduction in our overall U.S. property exposure and, at the same time, international growth,” said Gene Mergelmeyer, president and CEO of Assurant Specialty Property, a business segment of Assurant. “The program protects our financial ability to respond to our policyholders when they need us the most – after a catastrophic weather event.”

Assurant placed its traditional catastrophe program with more than 40 reinsurers rated A- or better by A.M. Best. To further diversify sources of reinsurance capacity, the Company supplements the traditional reinsurance with multi-year fully collateralized coverage, including catastrophe bonds.

2015 Catastrophe Program Risk Management Components

2015 Catastrophe Program Risk Management Components

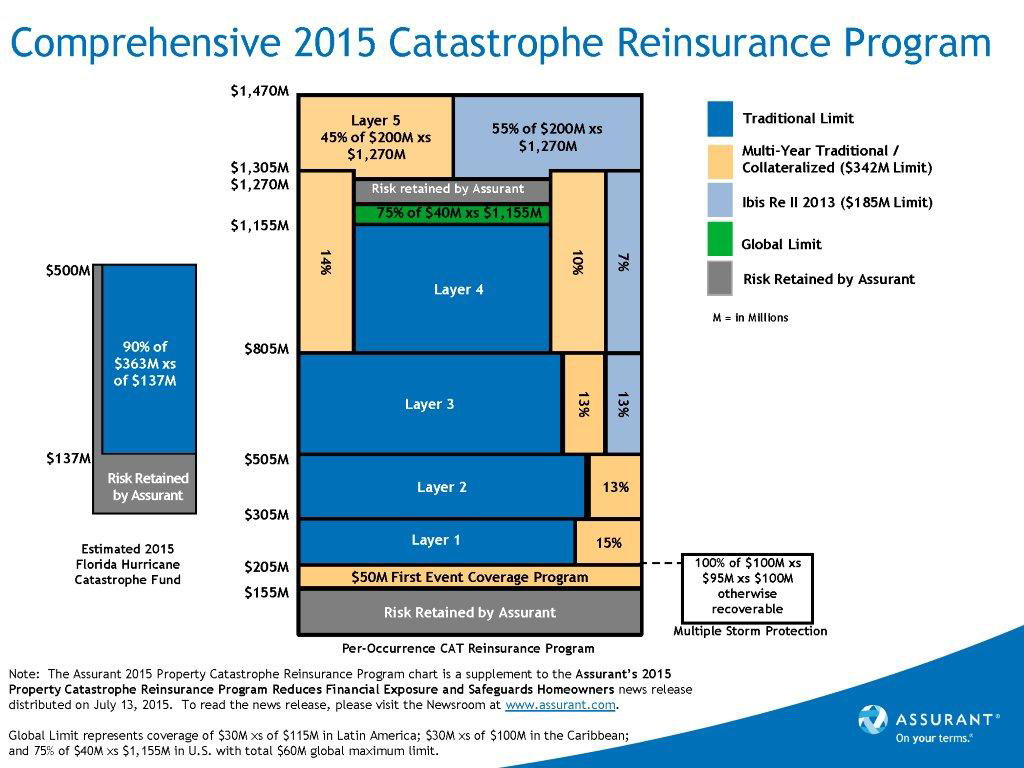

- Assurant’s retention declined nearly 20 percent from the prior year to $155 million for losses in excess of $205 million. This reflects reduced lender-placed exposure and the divestiture of American Reliable Insurance Company.

- Per-occurrence catastrophe coverage provides $1.3 billion of protection in excess of a $155 million retention for the United States. Protection in the Caribbean and Latin America markets were also increased as Assurant Specialty Property expanded in select property markets. Features include:

- Coverage in Latin America, mainly Mexico, of up to $136 million in excess of $9 million and in the Caribbean, protection up to $105 million in excess of $25 million. In these regions, Assurant Specialty Property’s product offerings include residential dwelling policies, covering the structure, contents and liability.

- Global protection consisting of $30 million per occurrence coverage per region in excess of $100 million, $115 million and $1.15 billion in the Caribbean, Latin America and U.S. respectively. In total, $60 million could be recovered from two different regions if one event impacted both areas.

- Multiple storm coverage provides up to $100 million of multiple storm protection for the United States, which lowers second event retention to $95 million following a $205 million first event. Multiple storm protection for the Caribbean, totaling $30 million, lowers the second event retention to $10 million following a $25 million first event.

Florida Hurricane Catastrophe Fund coverage encompasses 90 percent of losses up to $363 million in excess of a $137 million retention.

Source: Assurant

Was this article valuable?

Here are more articles you may enjoy.

DraftKings Sued Over ‘Risk-Free’ Bets That Were Anything But

DraftKings Sued Over ‘Risk-Free’ Bets That Were Anything But  Microsoft, Beset by Hacks, Grapples With Problem Years in the Making

Microsoft, Beset by Hacks, Grapples With Problem Years in the Making  Sanofi to Pay $100 Million to Settle Zantac Cancer Lawsuits

Sanofi to Pay $100 Million to Settle Zantac Cancer Lawsuits  MGM Resorts Sues US FTC to Stop Investigation of Casino Hack

MGM Resorts Sues US FTC to Stop Investigation of Casino Hack