A recent analysis by Xactware reveals that its claims assignment and management network processed more than 1.8 million estimates for roof repairs in 2012 — roughly 34 percent of the total number of estimates received for the year. The results of this study hold serious implications for property insurance professionals.

For insurers, it means a sizeable portion of their operating expenses goes to cover costs associated with onsite property inspections for roof losses. For field adjusters, it means much of their time is spent traveling to loss sites, climbing on roofs, and dimensioning structures before they can even begin to discuss repairs with the homeowner. However, advancing aerial data capabilities offer insurance professionals a new way to inspect roof damage claims more efficiently and cost effectively.

Aerial technology is no new phenomenon in the insurance industry. Insurance organizations have been using aerial imagery within their geographic information systems for years to view the location of homes in relation to potential hazards and to produce better risk management. Other property professionals have turned to third-party providers and do-it-yourself solutions that use aerial imagery to dimension structures, which is more efficient and cost-effective than conventional methods that involve a ladder, tape measure, pad of paper, and hours spent traipsing over roof tops.

The challenge with these approaches is that they rely on aerial imagery that’s less than optimal for use in the property insurance sector as it’s typically repurposed from other industries. That’s changing with the advent of aerial data that has been captured specifically for use in the property industry.

A key component of this data is aerial imagery that has a much higher resolution than most commercially available aerial images and provides a clear view of all details of individual structures, including chimneys, rain gutters, roof vents and even individual shingles. In an age where high-definition television and Blu-ray are becoming the norm, it’s easy to fixate on the clarity and lose sight of the real value of this resource. The additional level of detail makes possible the extraction of massive amounts of data that property professionals can use to improve their workflows.

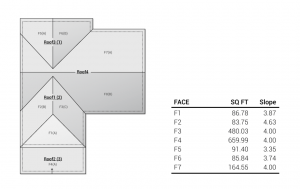

With these advances in aerial data capabilities, property professionals can understand all the crucial details they need to know about a structure’s exterior before even setting foot onsite. Perimeters, square footage of roof faces and slopes can all be calculated to a highly reliable degree of accuracy, and unique roof characteristics — such as eaves, valleys, hips and even type of roof material — can be identified well in advance of the initial site visit. Aerial data systems compile all this data into packets that include all dimensions and slopes, a digital rendering of the roof structure, and high-resolution images that can all be imported directly into the adjuster’s claims estimating system.

In the event of a roof loss, adjusters can use this data to streamline the roof dimensioning workflow and start estimating repair costs and discussing the claim with the homeowner within minutes of arriving onsite. Aerial data can also be a valuable asset in the CAT environment where weather and conditions make it difficult to visit sites immediately or if the structure is so badly damaged that there’s little left to measure.

By using this approach, adjusters can save hours of time that would be spent scoping and dimensioning the loss by hand. Increased efficiency allows insurers to reduce operating costs while improving customer relations with faster and more precise claims handling.

The amount and quality of data that can be harvested about individual properties through the use of aerial technology is significant, and it will only get better as the techniques and processes continue to evolve. These are just a few of the ways property professionals can employ aerial data to improve claims efficiency and cost effectiveness.

Jeffrey C. Taylor is vice president of Property InSight at Xactware. The Property InSight division oversees all data capture and process services to “learn about specific structures in a whole new way.” Website: Xactware.com.

Was this article valuable?

Here are more articles you may enjoy.

BNSF Says It Didn’t Know About Asbestos That’s Killed Hundreds in Montana Town

BNSF Says It Didn’t Know About Asbestos That’s Killed Hundreds in Montana Town  South Carolina Allows Out-of-State Adjusters After Massive Hail Storm

South Carolina Allows Out-of-State Adjusters After Massive Hail Storm  Report Using Aerial Imagery Keys in on Hailstorm Risks to Colorado Homes

Report Using Aerial Imagery Keys in on Hailstorm Risks to Colorado Homes  Zurich, Philadelphia, Others Ordered to Pay $345M to Cover Abuse Charges at Georgia School

Zurich, Philadelphia, Others Ordered to Pay $345M to Cover Abuse Charges at Georgia School