Illinois-based RLI Corp. second quarter net earnings of $34.4 million ($1.31 per diluted share) were 87% higher than the $18.4 million ($0.71 per diluted share) the company reported in the same quarter last year.

Through June 30, net earnings grew 80%, to $63.7 million ($2.43 per share) versus $35.3 million ($1.35 per share). All net earnings results set both quarterly and mid-year records.

Quarterly operating earnings of $31.5 million ($1.20 per share) were 84% better than last year’s $17.1 million ($0.66 per share) result. Through six months, operating earnings rose 81%, to $58.9 million ($2.25 per share) from $32.5 million ($1.25 per share). Both mid-year net and operating earnings set records.

The quarter and mid-year results include certain favorable developments from prior year loss reserves. During the quarter, positive development on prior accident year casualty loss reserves resulted in additional pretax underwriting earnings of $16.1 million, or $0.40 per share. Mid-year results also include positive first quarter development on prior accident year casualty loss reserves, which added earnings of $9.1 million, or $0.23 per share.

Additionally, as third quarter 2004 Southeast U.S. hurricane losses

did not develop as expected, first quarter 2005 results were improved by $3.8 million ($2.8 million in casualty and $1.0 million in property), or $0.10 per share. These developments include bonus-related accruals which affected other insurance and general corporate expenses.

RLI reported a second quarter underwriting profit of $29.6 million on a

76.1 net GAAP combined ratio versus the $11.8 million gain on a 90.7 combined ratio for the same period last year. Casualty recorded a 74.1 combined ratio. The property segment registered a 74.2 combined ratio. The surety segment recorded a 93.5 combined ratio.

Net premiums earned were down 3% in the quarter, to $123.7 million.

Consolidated revenue of $142.7 million and gross premiums written of

$199.4 million were both flat for the quarter.

RLI reported year-to-date underwriting profit of $56.0 million on a

77.4 net GAAP combined ratio versus the $22.6 million gain on a 91.1 combined ratio for the same period last year. Casualty recorded a 77.3 combined ratio. The property segment recorded a 68.0 combined ratio. The surety segment recorded a 94.0 combined ratio.

Net premiums earned were down 2% in the six months ended June 30, 2005, to $247.7 million. Consolidated revenue of $284.4 million was up slightly over last year and gross premiums written of $365.5 million were off 4%.

On July 10, Hurricane Dennis struck the Gulf Coast. Based on projections by the company’s catastrophe management systems and actual claim activity to date, the company does not expect its losses to be significant.

During the second quarter, A. M. Best Company reaffirmed the financial strength rating of A+ (Superior) of RLI Insurance Company, Mt. Hawley Insurance Company and RLI Indemnity Company. All of these ratings have a stable outlook. Standard & Poor’s continues to rate RLI’s insurance subsidiaries as A+ (Strong).

Was this article valuable?

Here are more articles you may enjoy.

CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape

CoreLogic Report Probes Evolving Severe Convective Storm Risk Landscape  Synopsys Sued by Private Equity Firm for Shopping $3 Billion Unit

Synopsys Sued by Private Equity Firm for Shopping $3 Billion Unit  Oregon Schools Sued for $9M After Young Girl Allegedly Raped

Oregon Schools Sued for $9M After Young Girl Allegedly Raped  National Crime Report Shows Vehicle Thefts Surged to More than 1 Million in 2023

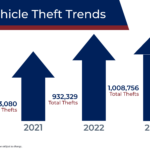

National Crime Report Shows Vehicle Thefts Surged to More than 1 Million in 2023