Standard & Poor’s Ratings Services has affirmed its ‘A-‘ long-term counterparty credit and insurer financial strength ratings on Norway’s non-life insurer Vesta Forsikring A/S (Vesta) with a stable outlook. S&P then announced that the ratings were withdrawn, reflecting the conversion of Vesta into a branch of TrygVesta Forsikring A/S (TrygVesta, formerly Tryg Forsikring A/S; A-/Stable/–). “As a branch, Vesta’s liabilities are ultimately those of TrygVesta,” S1P noted. “The ratings on Vesta prior to its withdrawal reflected its core status to TrygVesta.”

A.M. Best Co. has affirmed the financial strength rating of “B+” (Good) and the issuer credit rating of “bbb-” of Polskie Towarzystwo Reasekuracji S.A. (Polish Re) with a stable outlook. “The ratings reflect Polish Re’s improving risk-adjusted capitalization and business diversification,” said Best. However, it called the “the company’s reliance on investment income to generate profits” an offsetting factor.

Fitch Ratings has affirmed the ‘A-‘ issuer default rating (IDR) of Max Capital Group Ltd. and the ‘A’ insurer financial strength (IFS) ratings of its insurance subsidiaries, Max Bermuda Ltd., Max Re Europe Limited, Max Insurance Europe Limited and Max Specialty Insurance Company, as well as the ‘A-‘ IDR and ‘BBB+’ senior debt rating of Max USA Holdings Ltd., a direct, wholly-owned holding company subsidiary of Max Capital. The overall outlook on the ratings is stable. Fitch noted that the ratings “reflect the company’s disciplined and flexible approach to managing underwriting risk and investment risk, and recent favorable operating results. Partially offsetting these positives is the execution risk derived from Max Capital’s growing specialty product strategy and reserve risk associated with the long-tail casualty reinsurance/insurance lines that the company started writing in 2002/2003.”

A.M. Best Co. has assigned a financial strength rating (FSR) of “A-” (Excellent) and an issuer credit rating (ICR) of “a-” to Bermuda-based BNY Trade Insurance Ltd – a captive insurer of The Bank of New York Mellon Corporation – with a stable outlook. “The ratings reflect BNY Trade Insurance’s strong capitalization, consistent positive operating results and conservative operating strategy,” said Best.

Sources: A.M. Best, S&P, Fitch

Was this article valuable?

Here are more articles you may enjoy.

Report: Vehicle Complexity, Labor ‘Reshaping’ Auto Insurance and Collision Repair

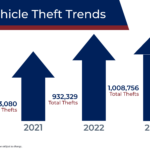

Report: Vehicle Complexity, Labor ‘Reshaping’ Auto Insurance and Collision Repair  National Crime Report Shows Vehicle Thefts Surged to More than 1 Million in 2023

National Crime Report Shows Vehicle Thefts Surged to More than 1 Million in 2023  Dog-Related Injury Claim Payouts Hit $1.12B in 2023, Report Shows

Dog-Related Injury Claim Payouts Hit $1.12B in 2023, Report Shows  Texas Among Several States Facing New Fire Risks: Weather Watch

Texas Among Several States Facing New Fire Risks: Weather Watch